The Verdict

It's a solid option for life or supplemental insurance

Insurance shopping is tough, no doubt about that.

At the very least, it forces us to confront some uncomfortable eventualities in life.

Maybe you're concerned about putting your kids through college or keeping your family in the house after you die.

Or maybe you're anticipating a lot of medical expenses in your retirement and you need a little more help than just Medicare.

Avoiding these questions won't make them go away.

Fortunately, there are tons of insurance options in the market to help prepare you, just in case.

Omaha offers a wide variety of insurance products in a range of terms and pricing.

The insurer also has a handy calculator on its website to make comparison-shopping a little easier.

A word of wisdom to those in the market for insurance: Choose an agent or broker carefully, because they will make a big difference in your experience.

We'll briefly explain how in this in-depth review of Mutual of Omaha.

Why You Should Consider This Company

Omaha is an established insurer with a sterling reputation

Its been at this for over 100 years now, which should offer some peace of mind for your family's security in the long term.

The Better Business Bureau has given Omaha an A+ rating for the stability of its business and the time in which it resolved customer complaints.

And unlike some of its larger competitors, you can also buy Omaha's products anywhere in the United States.

Here's what you should be asking yourself as you consider Omaha.

- Do you expect a lot of medical bills during your retirement?

- Do you want to take care of your family after you die?

- Are you nearing retirement and thinking about how best to manage your finances?

If yes, then Mutual of Omaha may have something to fit your needs.

Why People Love It

The company offers helpful customer service and competitive rates

It comes through for customers in tough times. The most favorable customer reviews praised Omaha for knowledgeable customer service.

They also praised Omaha for fast, seamless payouts when a family member died.

Omaha's most ardent fans say their policies were paid out anywhere from a couple of days to a month.

Good rates on life insurance policies. Customers also praised Omaha for the rates it offered on whole life and term life policies.

With this said, they noted they might sometimes like a little bit more flexibility on those rates and terms.

Coverage across America. Unlike some of its competitors (State Farm, for instance), Mutual of Omaha offers its products in all 50 states.

No medical exam needed. The company has done away with the medical exam requirement for term life insurance and whole life products.

Keep in mind its universal life insurance may still require one, depending on the individual.

Better rates for non-smokers. Mutual of Omaha is also known for offering good rates to people who've had heart attacks, strokes, or other medical problems.

The only thing it really frowns upon is tobacco use.

And get another discount if you're in good health. Depending on the broker you use, you may be able to complete a Mutual of Omaha Fit Program questionnaire for some more favorable points toward your evaluation.

Biggest Consumer Complaints

Some are frustrated with the company's late payments and its third-party insurance brokers

Slow payouts were a common refrain. Some people have complained online about the speed (or lack thereof) with which the company paid out their claims.

Customer service can vary. Mutual of Omaha does get good reviews for its customer service, but a few bad apples can sometimes spoil the bunch.

Notably, many who complained about customer service often had issues with particular brokers or agents.

Which brings us to …

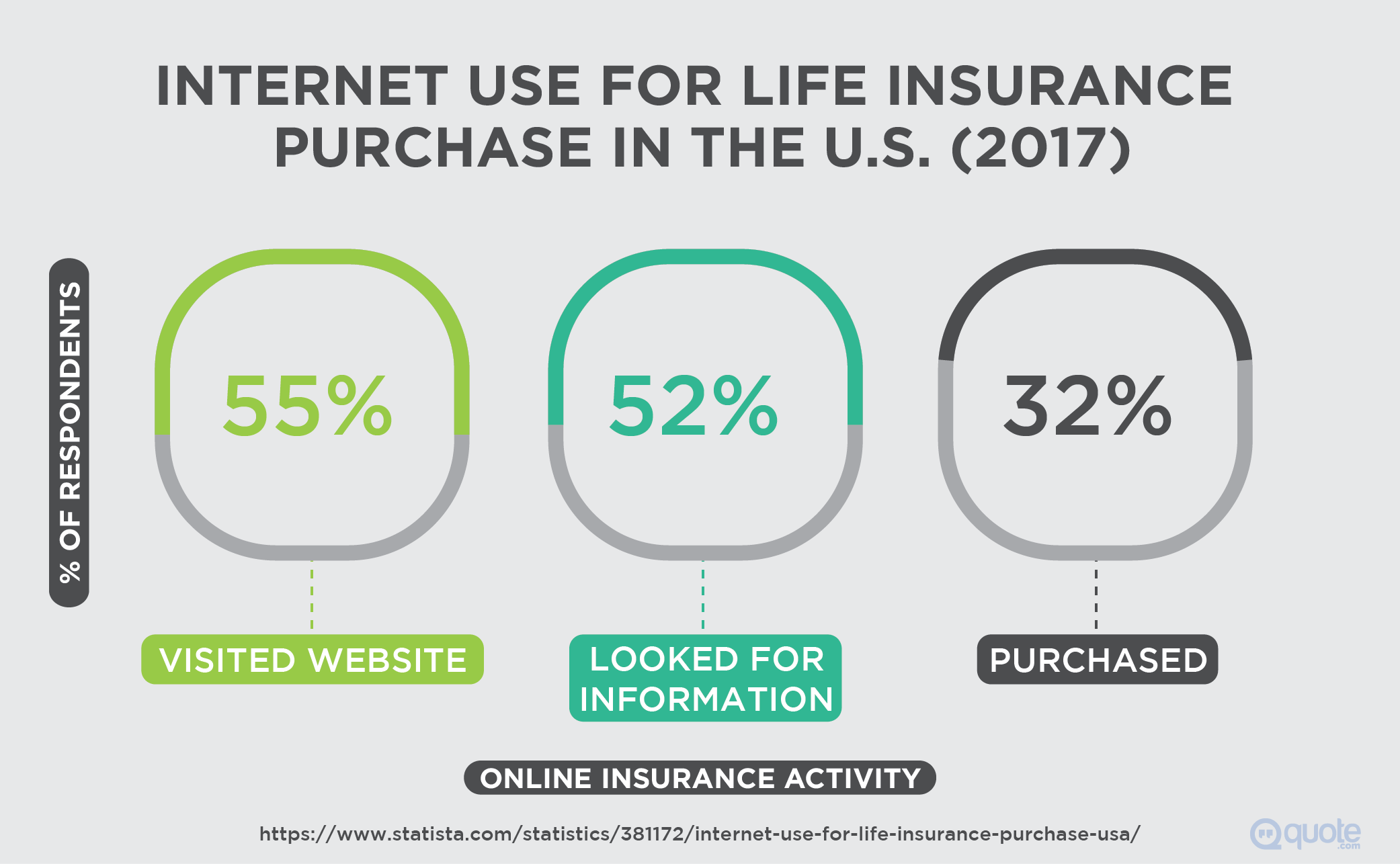

You also need to buy through an agent. You can start the application process online but will ultimately need to work through an agent to purchase a policy (unless you are getting a policy through your employer).

Too reliant on snail mail. Mutual of Omaha still does much of its business by mail and cannot accept some of your documentation or send you your policy electronically.

The Competition

State Farm is a good place to compare against offerings from Omaha

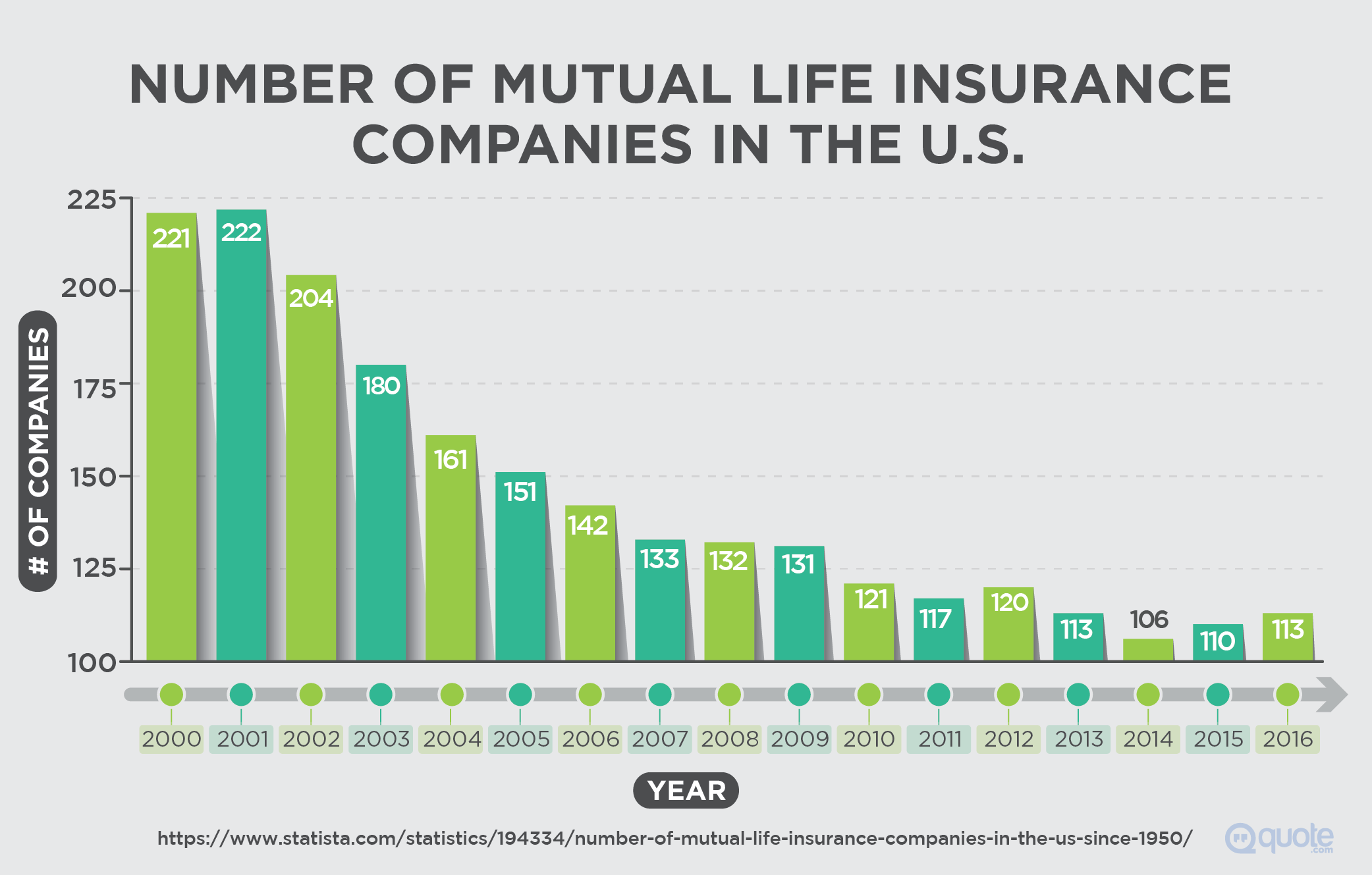

With about 0.69% of total U.S. market share in direction premiums, according to Investment News, Mutual of Omaha has no shortage of competition in the life insurance space.

Mutual of Omaha is a good company with a strong reputation, but that doesn't mean that it's necessarily the best option for your particular needs.

Mutual of Omaha is a solid choice, but it's still smart to shop around.

With a similar product suite and a somewhat larger market share, State Farm is a strong competitor in terms of life insurance.

It's hard to compare the two companies by the rates they offer because those can vary so much depending on your circumstances and where you live.

However, State Farm does top Mutual of Omaha in a few respects …

Superior customer service.

According to J.D. Power and Associates, State Farm ranked the highest of all life insurance companies on customer service measurements, showing that larger companies aren't necessarily out of touch.

By contrast, J.D. Power and Associates gave Mutual of Omaha middle-of-the-road marks, mostly three out of five stars for various customer satisfaction categories.

The American Customer Satisfaction Index ranked the two companies about equally on a number of customer satisfaction metrics.

A competitive suite of insurance products.

State Farm also offers life insurance products, beginning at $100,000 worth of coverage with terms running 10, 20, or 30 years, depending on your age.

State Farm also offers various other types of insurance products, including long-term care insurance, hospital indemnity insurance, and Medicare supplemental insurance.

But it's harder to get a quote.

One strike against State Farm: It doesn't have any kind of online quote tools on its website.

Instead, you have to call an agent or broker for a quote.

And they may not offer what you need in your state.

You can select your state from a drop-down menu on State Farm's website and check out your options while you're shopping around.

But State Farm doesn't offer its products and services across all 50 states.

For instance, State Farm doesn't offer Medicare supplemental insurance or any other supplemental insurance products in Massachusetts or New Jersey.

The Question Everyone's Asking Right Now

"How do I choose a life insurance company?"

You may very well have an idea of what insurance company you want to work with, but it's smart to shop around.

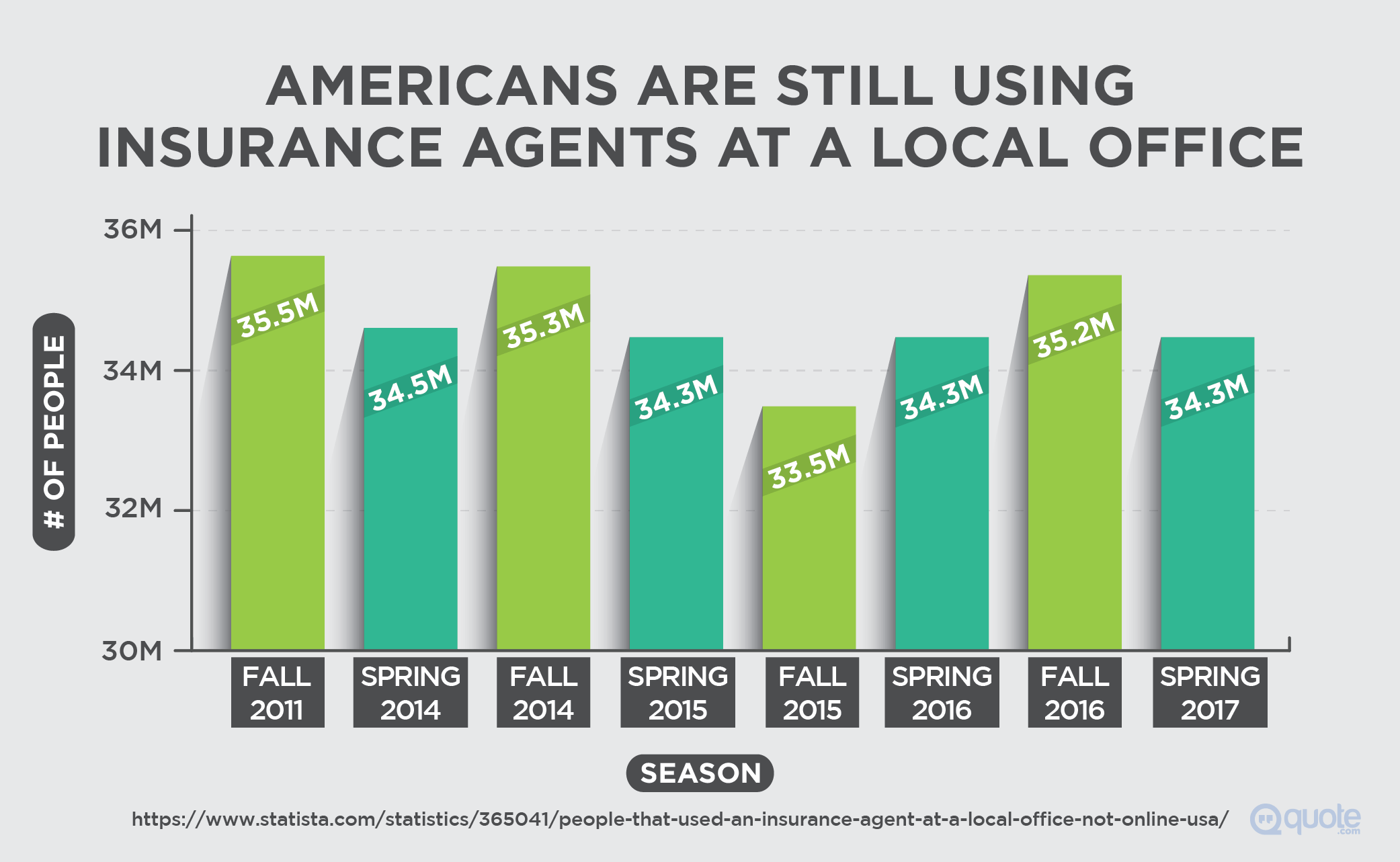

Don't go straight to the insurance company, but find a local, independent insurance agent who deals with several insurance companies.

In fact, you have to work through an insurance agent to purchase a Mutual of Omaha policy.

This can be tough because there are surprisingly few online resources not affiliated with specific companies to function as a database of independent insurance agents.

If you allow location-sharing on your internet browser, Mutual of Omaha will automatically show you the three closest agents or brokers who sell its products when you visit.

Another resource you may want to keep in mind is the National Association of Insurance Commissioners, an organization of state insurance regulators that is focused on consumer protection issues.

It has a primer on life insurance shopping and choosing an agent, as well as a map of state insurance regulators should you have a serious complaint or problem.

Your state insurance regulator may also have a list of insurance agents in your area.

Just as the average consumer shopping for a car may not know precisely how an engine works, the average consumer shopping for life insurance may also need some expert advice in this area.

Six things the right insurance agent will do for you

As you move forward with your insurance needs, you should know how to pick a life insurance agent.

Who you choose is almost as important as the company you end up buying insurance with.

One easy way to work with a reputable one is to ask your friends, family, and colleagues for advice on an agent.

If someone loves an agent and can tell you why, then Mutual of Omaha is a good company to consider as your provider.

A good agent will:

- Understand your financial situation, considering your family, income, and tax concerns. They'll take time to understand how you feel about risk.

- Explain, in terms you can easily understand (free of jargon), issues, options and planned uses of life insurance that are relevant to your financial situation.

- Work with you until you're ready and convinced that the policy you have selected is what is best for you. They will not make you feel pressured.

- Be licensed by your state insurance department.

- Tell you how long they've been in business.

- Not shy away if you ask for client references.

How the Insurance Company Works

Life and other insurance policies are available anywhere in the U.S. depending on your needs

The long-established Mutual of Omaha offers life insurance, long-term care insurance, supplemental insurance plans, and employer-based insurance plans, plus some banking and investment products, across all 50 states.

We're going to take a look at how these might work for you.

Life insurance if you want a simple application process.

Mutual of Omaha offers both whole life and term insurance options, as well as universal life insurance.

Its term life insurance is offered at lengths of 10, 15, 20, or 30 years with death benefits ranging from $25,000–$100,000.

You can apply for this between the ages of 30 and 74.

Whole life insurance policies, which you can apply for from the ages of 45–85, can cover $2,000–$25,000.

Mutual of Omaha also recently simplified the process for applying for life and disability insurance.

Notably, the company no longer requires a medical exam to apply for its term life and whole life plans.

Its universal life insurance may require an exam, depending on your individual circumstances.

Supplemental insurance if you expect a lot of expenses in your future.

For plenty of people, Medicare will cover most of their medical needs into their golden years.

Those who have to manage chronic conditions, however, might want to look into supplemental insurance.

Medicare supplemental insurance picks up the tab for whatever expenses you may have leftover after Medicare covers your bills.

Options if your employer has decided to go with Mutual of Omaha.

The company offers a variety of insurance and investment products for employers who want to give their employees group benefits options.

Because those rates will depend on the plan your employer has chosen, it's hard for us to evaluate here whether those plans will be a good deal for you.

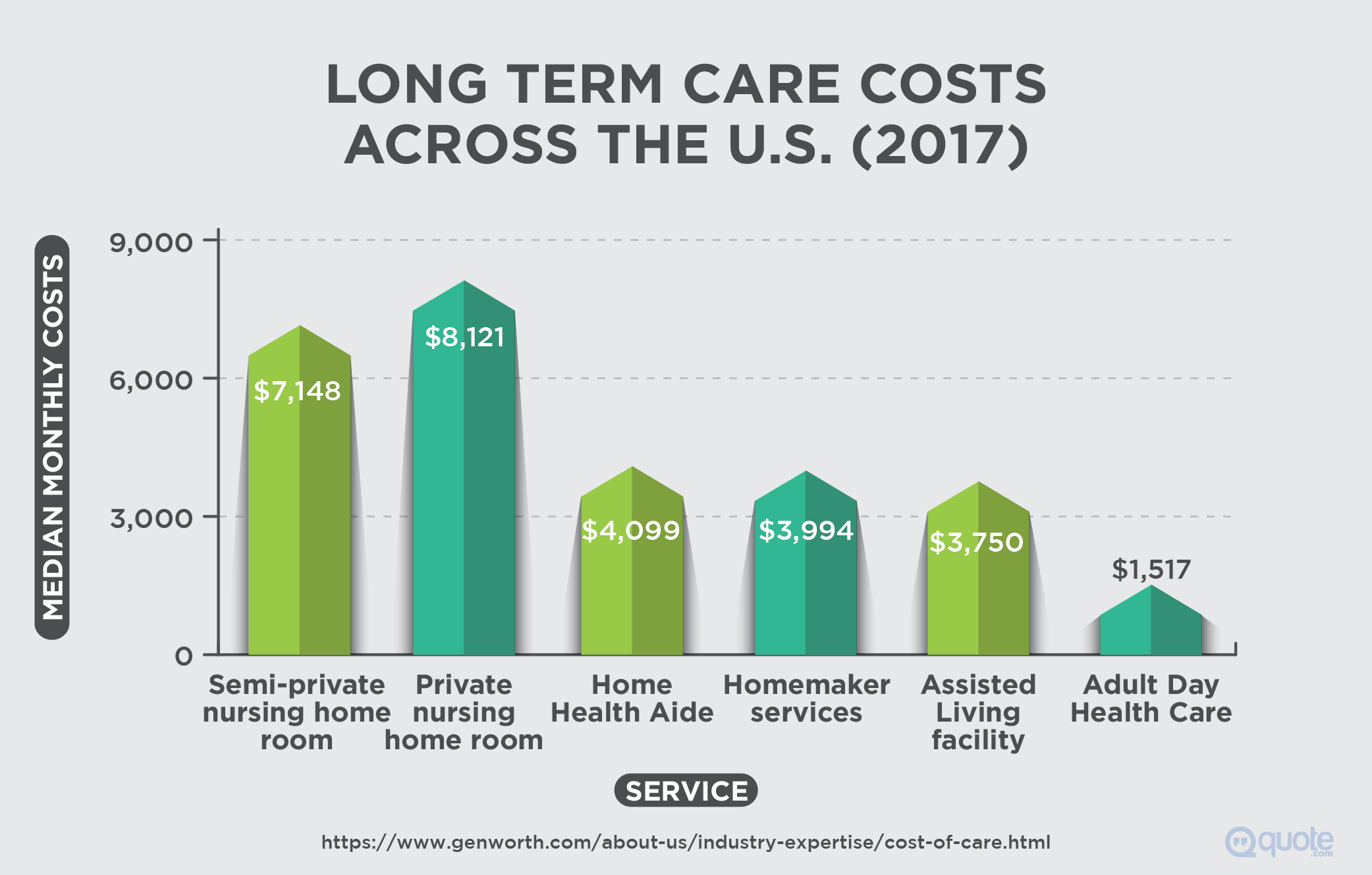

Long-term care insurance if you want to age in place.

This type of insurance will help you out with the cost of in-home care, like regular check-ins with a visiting nurse or aide.

Maybe bank elsewhere, though.

Mutual of Omaha also offers banking products and services for individuals, businesses, and community associations (for example, management companies and condo associations).

For individuals, Mutual of Omaha Bank offers between one and six checking account options, depending on your state.

Most of these accounts require a $100 minimum to open.

There's nothing especially bad about Mutual of Omaha's banking products, mind you.

But unless you're set on keeping your insurance and financial business under one roof, you can find competitive products elsewhere.

Key Digital Services

It's hard to evaluate Mutual's digital options

Mutual of Omaha has an online account interface which allows you to pay your bill, change your billing options, and view your Medicare supplement explanation of benefits.

They make comparison-shopping easy.

Mutual of Omaha has a sophisticated calculator on its website to help you figure out about how much insurance coverage you need and what it will cost you on a monthly basis.

You don't have to call up an agent to get a quote, which is super helpful and relatively rare.

Mutual of Omaha also automatically shows you the nearest independent agents and brokers when you visit it online.

Its app is OK for Android users.

Mutual of Omaha's mobile app has 3.7 out of 5 stars in the Google Play store and an average of three stars among nine ratings in the Apple store.

With the mobile app, you can check balances, deposit or transfer funds, and pay bills.

Frequently Asked Questions

Mutual of Omaha may be a good fit if you're seeking long-term insurance solutions

Mutual of Omaha isn't the biggest life insurer in the U.S., but it's a long-established company with a good reputation for customer service and therefore, worth your consideration.

It's hard to make direct comparisons between insurance companies here because rates can depend so much on an individual's location and needs.

But with a free online quoting tool and a network of independent agents and brokers nationwide, Mutual of Omaha does what it can to make comparison-shopping easy.

Additionally, choosing the right agent or broker to do business with seems to be the key to having a good experience with Mutual of Omaha.

How has the Mutual of Omaha worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.