MassMutual Life is a great choice for a life insurance, investment, and retirement planning company

MassMutual goes above and beyond in providing for its customers with great customer service, a host of life insurance options including guaranteed acceptance, retirement planning resources, and investment choices that range from mutual funds to section 529 plans.

Life insurance is one of the most important investments you'll make in your life. It's about more than covering funeral costs.

Given that the average funeral costs between $7,000-$10,000, a lower-cost policy could cover that—but can it cover any outstanding debts you may have?

Will your family be financially sound on only a single income if those left behind still have to pay for mortgage costs or auto payments?

Choosing the right life insurance policy ensures your family is protected if something happens to you.

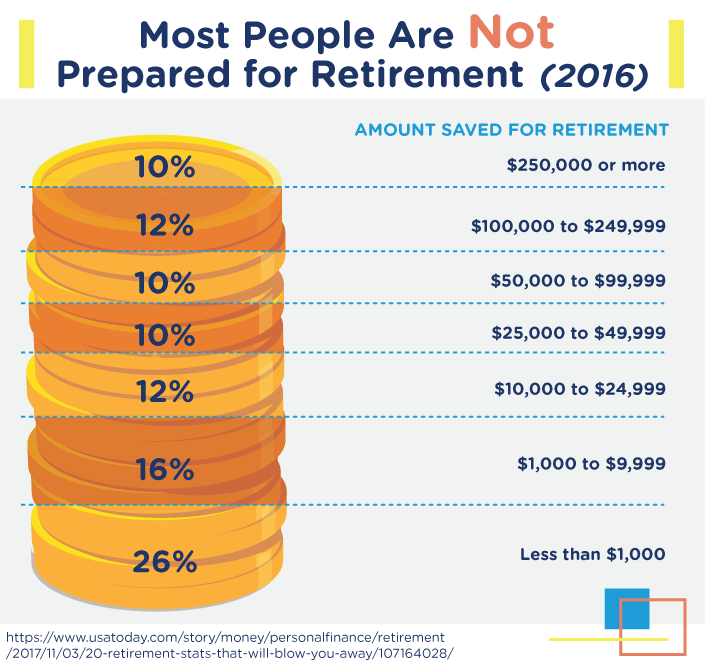

Choosing the right investments and annuities ensures you and your spouse will have the necessary funds to survive and thrive in your final years when you've retired and are enjoying a much-earned rest.

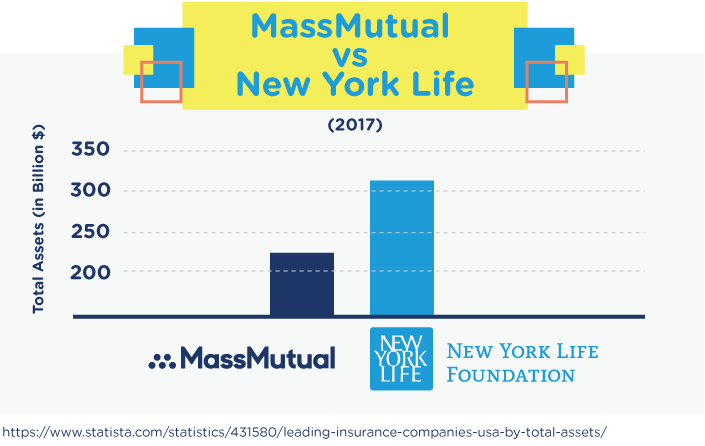

Main Competition: New York Life Insurance Company

One of MassMutual's main competitors is New York Life Insurance Company.

The two are geographically close—Massachusetts and New York—but also economically close.

As far as company size goes, MassMutual is 76th on the Fortune 500 list while New York Life is 61st.

Though New York Life's slogan is "Insure, Invest, Retire," MassMutual provides those same services. New York Life has special policies for families that have unique needs, but MassMutual has a bevy of educational resources to help anyone learn how to better manage their finances.

Ultimately, MassMutual seems like the better option of the two because of the outstanding customer service.

Although both companies provide information pertaining to the final years of life, MassMutual has a team of representatives standing by to help you understand how to put this information into practice.

Does it make sense to buy term and whole life insurance?

Term life insurance and whole life insurance serve two different purposes. While whole life insurance is by far the most common—and most recommended—type of life insurance, it is for end-of-life expenses.

On the other hand, term life insurance only lasts for a set amount of time but provides higher coverage amounts for lower cost.

Learn more about the difference between whole and term here.

Term life insurance is a great option when you have a lot of expenses. For example, until a mortgage, auto loan, or student loans are paid off, it is a good idea to supplement whole life insurance with term life insurance.

Once those debts are covered and you have no outstanding balances that might place a financial burden on your family, whole life can provide the necessary coverage for funeral costs.

Still not sure if you should get life insurance?This one quote might change your mind.

Strength: A wide range of policy riders

Policy riders allow you to customize your policy to fit your personal needs. An example would be a term conversion rider, which allows you to convert your term life policy into a whole life policy after a set number of years.

Where some life insurance companies offer policies that are inflexible and allow for little customization, MassMutual provides a full selection of riders for its whole life, universal life, and term life insurance policies.

These riders include an accidental death rider, which provides additional payment in the event of a deadly accident; a terminal illness rider, which lets you access your policy's monetary value early to handle end-of-life costs; and a disability rider, which provides funding to help cover the costs of sudden injury or illness.

Mass Mutual excels at high financial strength ratings. Almost every single financial rating agency has given top marks to MassMutual. The company earned a rating of A++ from A.M. Best. Moody's and S&P also give high ratings.

What this means for consumers is that MassMutual has the financial backing to honor its policies no matter the situation.

A high customer satisfaction ratings is a crucial perk. If you've ever dealt with an insurance company before, you know how important customer service is. When you've suffered a loss, you don't want to spend hours on hold trying to reach your agent.

MassMutual has implemented changes to speed up the purchasing process, as well as added more staff to the company sales force. Whether you have a question about a policy rider or you want to speak with a financial advisor about your annuities, MassMutual has you covered.

Weakness: No ability to get an online quote

One of the first steps of evaluating an insurance company is getting a quote.

After all, what's the point of learning the ins and outs of a company if you know from the start you can't afford their rates?

MassMutual does not offer online quotes, which comes as a bit of a surprise when you consider that most of the competition does.

On the other hand, life insurance can vary wildly based on a number of factors, so it isn't overly surprising—an online quote likely wouldn't be that accurate to begin with.

In order to get a quote, you'll need to contact a representative and they will walk you through the quote process.

There is one exception to this: guaranteed acceptance whole life insurance.

You can obtain an online quote for this type of insurance, but it's the only one.

MassMutual also lacks a mobile app. While this isn't a deal-breaker, it is a curious oversight when most insurance companies have them.

A mobile app would allow you to access your policy information quickly and easily without going to the mobile version of the site.

That said, MassMutual has a mobile site that is easy to navigate from your smartphone.

Good for you if: You want true flexibility in your insurance policy

At this point, we've mentioned it so much that it's approaching ad nauseum—but the benefit of MassMutual's many riders cannot be overstated.

MassMutual gives you the ability to purchase an insurance policy and then customize it to fit your specific needs.

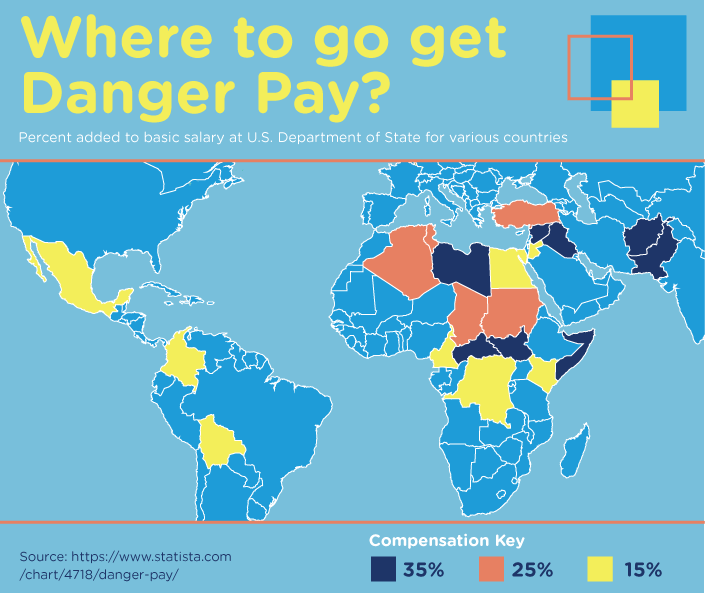

Are you a post-graduate student with $50,000 in student loans working in a dangerous field?

A whole life policy with an accidental death and dismemberment rider can ensure your family has enough money to cover your final expenses and to pay off any outstanding student loans.

Another benefit of the flexibility is knowing long-term care expenses are covered. Many people grow up genetically predisposed to certain illnesses, but it can be hard to plan for the healthcare costs you may face in the future.

MassMutual has a Long-Term Care Rider you can add to your policy that helps you pay for expenses like home health care, nursing homes, and other potential eventualities.

About the Company

MassMutual delivered more than $5 billion in benefits in 2016

MassMutual has provided coverage to its customers since 1851.

There is more than $560 billion in life insurance coverage at the present time, and MassMutual boasts an "Advisor Force" of more than 9,500 employees.

The company was founded on the idea that people need other people—"living mutual," they call it. MassMutual has taken pains to express this throughout the company's lifespan, and the standout customer service is one of the ways they do so.

MassMutual also expresses their core beliefs through their diversity programs. The company received a score of 100 on the Human Rights Campaign Corporate Equality Index—a perfect score.

And this is the eighth time since 2008 that the company has achieved this score. MassMutual also receives high ratings by the National Association for Female Executives.

MassMutual works for customers anywhere in the United States

MassMutual provides coverage to customers across the entirety of the United States, including Alaska and Hawaii.

There are locations in Honolulu, Kahalui, and Wailuku in Hawaii, but currently no advisors in Alaska. However, coverage can still be had in Alaska.

How MassMutual works for you

MassMutual is more than just an insurance company.

They procide life insurance services, but also investments, retirement options, and planning services to ensure you are financially sound during your twilight years.

Life Insurance

MassMutual provides six different types of life insurance to help fit every possible need: participating whole life insurance, guaranteed acceptance whole life insurance, term life insurance, MassMutual direct term, universal life insurance, and variable universal life insurance.

Participating whole life insurance is the industry standard. This is the most common type of life insurance. This type of life insurance builds cash value over time, and policyholders also have the ability to earn dividends.

These dividends can be used to increase either the cash value of the policy or the value of the death benefits.

Guaranteed acceptance whole life insurance is for the unsure. This plan is a solid choice for people who aren't sure if they still qualify for life insurance or not. You can't be denied coverage because of health reasons.

You can get coverage from $2,000 to $25,000, and some rates are less than $10 per month.

This type of policy is designed for people between the ages of 50 and 75 years of age.

Term life insurance is short-term, higher-payout insurance. Term life provides lower rates for a set period of time—usually 10 or 20 years.

While term life insurance isn't the recommended choice for end-of-life expenses, it works as a great supplement when you have high expenses like a mortgage or student loans.

MassMutual allows you to add a rider to your policy that converts your term life policy into a whole life policy without any medical exams or questions.

MassMutual Direct term life insurance is a wide-ranging plan. This plan is designed for people between 18 and 64 years of age and offers coverage amount from $100,000 and $200,000.

You can apply for MassMutual Direct Term life insurance through an online form. This policy is designed to help you get life insurance quickly.

Universal life insurance is a variation of whole life insurance. It provides permanent coverage for you and your family with one major difference: you can control the amount of the premiums you pay each month.

As long as there is sufficient value in your policy to cover administrative costs, you can pay less if you need to—but it's a good idea to pay more sometimes to make up for the lean periods.

Universal life insurance policies also build cash value that you can borrow against.

Variable universal life insurance allows for premium allocation. This plan is almost identical to universal life insurance except that it allows you to allocate part of your premium toward investment options or to the Guaranteed Principal Account.

The GPA is a fixed account that is guaranteed to earn interest daily, although it may not be as much as other investment options may earn.

Retirement

After you spend the majority of your adult life working, you want to kick back and take it easy.

Annuities can help you do just that.

They can provide you with income for the remaining years of your life, but it's important to get a strong start early on.

MassMutual provides deferred fixed annuities, variable annuities, fixed index annuities, immediate income annuities, and deferred income annuities.

Deferred fixed annuities restrict earning income for a set period of time. During this period, the money in your account is given a fixed rate of interest. You also pay no taxes on this amount until you begin withdrawing it as income.

The benefit of an annuity like this is the predictability.

You know how much the account will earn, allowing you to plan for your future.

This also allows you to withdraw a certain amount free of surrender charges each year, and if you die during the accumulation phase of the contract, it yields a death benefit to your beneficiary.

Variable annuities give you the option to grow your investments faster. The reason being, you can choose how much risk you want to take. Like deferred fix annuities, you do not have to pay taxes on anything you earn until you withdraw it as income.

You are also guaranteed a death benefit if you die during the accumulation phase of the annuity contract.

Fixed index annuities help you earn income safely. That's because these annuities protect you from fluctuations in the market.

Fixed index accounts can be credited with interest daily, and they offer income through annuitization or through a guaranteed lifetime withdrawal benefit rider, if you choose it when you apply.

If your account earns no interest or negative interest, nothing will be credited to your account, protecting you from loss.

Immediate income annuities begin generating income within 13 months of purchase, with only a single payment on sign-up.

However, these tend to have limited options for liquidating your investment.

Deferred income annuities provide flexible purchase payments and help plan for your future income needs. You'll begin receiving income after 13 months, but there is no liquidity except on certain products.

This type of annuity will return amounts paid if you die before the income payments begin.

If you die after payments begin, the death benefit received will depend on the type of annuity you choose.

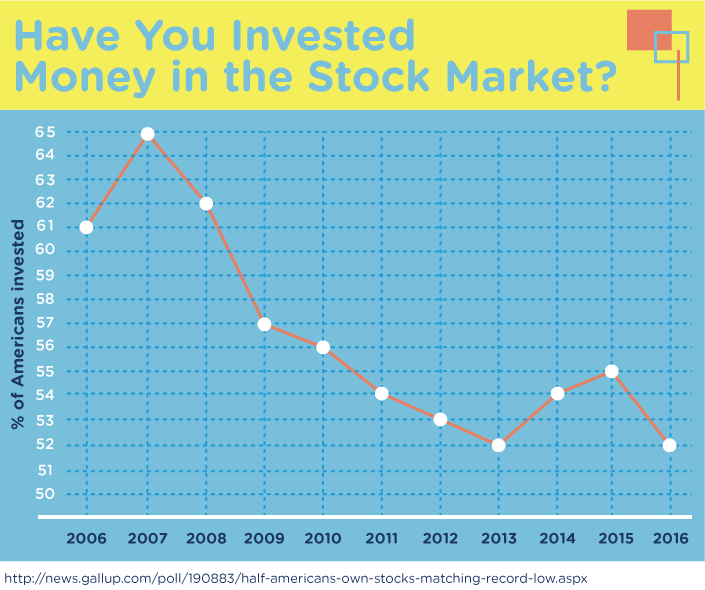

Investments

For many people, investments might well be another language.

MassMutual works to make that language easy to understand and navigate by providing explanations of the types of investments out there (mutual funds, exchange-traded funds, unit investment trusts, section 529 plans, and individual retirement accounts).

Mutual funds are one of the most common types of investments. These spread money across a wide range of potential investments to safeguard against market fluctuation while providing the ability to buy or sell shares at any time.

If you don't really understand investments, mutual funds are your best choice because you are provided with a professional portfolio manager.

Exchange traded funds are traded across the 500 Index. This means the investment is spread across all 500 companies within the index. While diversification can provide a layer of protection, it's no guarantee against loss or a promise of gain.

The amount you earn via one of these funds is determined when you sell the shares within it.

These tend to be less expensive investments because they are not actively managed, but there may be a commission when a share is purchased.

Unit investment trusts are smart no-risk investments. UITs, as they're called, rarely change over the life of the investment. There is an initial sales charge at the time of purchase, but UITs are passively managed and do not require any administrative fees.

When the investment matures, you can reinvest into another UIT for a reduced sales charge. If any proceeds have been earned, you may receive a cash distribution.

Section 529 plans are future higher education investments. These state-sponsored plans are tax-deferred and come in one of two forms: a college savings plan, which lets you vary your contributions, and a prepaid plan, which lets you pay monthly or in a lump sum.

One benefit is that even if the person you purchased the plan for doesn't go to college, it can be transferred to another child or even used for yourself.

Individual retirement accounts help you prepare for retirement. IRAs are generally funded through payroll contributions from your employer. There are two primary types of IRAs: traditional and Roth IRAs.

These allow you to choose from mutual funds, annuities, and individual securities. IRAs are something everyone should plan for, but it is a good idea to discuss your options with a financial advisor.

What people love most: Great customer service

MassMutual has earned the love of its customers with stand-out customer service. A quick look at Consumer Affairs will show how many customers are satisfied with the personalized care they received.

Even the negative reviews often mention customer service agents that helped them.

Payout options are another area where customers are extremely satisfied. The various options that MassMutual provides not only for life insurance payouts but for annuities and investments make it easy for customers to receive their money.

Several customers mentioned how MassMutual helped them understand the tax implications of a certain type of payout and how to avoid additional fees.

Biggest complaint: Slow communications

One of the main complaints we discovered revolved around snail-mail communications with MassMutual.

When customers needed forms mailed to them for hardship verification or other types of authorizations that needed signatures, the forms took far longer to arrive than customers felt was necessary.

Other customers had multiple payments withdrawn from their account after authorizing only one payment. Despite these complaints, these seem like isolated incidents.

Digital Services

MassMutual has a "Planning" tab that provides access to life insurance, retirement income, disability income, and college savings calculators.

The company also provides educational videos on budgeting, disability insurance, life insurance, 401(k), college, and several other topics.

MassMutual has a blog and several pages full of advice on planning for your future.

If you're just getting started with your plans for fifty years down the road, MassMutual has enough resources to help you understand nearly every step you're going to encounter.

There are terminology definitions, tips for putting these ideas into practice, and much more.

How to start

Contact 1-800-272-2166 if you want to speak with someone about life insurance, annuities, or disability income insurance, or to receive a quote.

Few MassMutual policies provide the ability to get a quote online, so you will have to call this number or visit a physical location for more information.

If you want to speak with someone about long-term care, you'll need to call 1-888-505-8952 between 10 AM and 8 PM ET, Monday through Friday.

If you want to speak to someone about a 401(k) or pension plan, call 1-800-743-5274 between 8 AM and 8 PM ET during the week.

If you wan to speak to someone about a pension annuity plan, call 1-800-775-4331 between Monday and Friday, 8 AM to 8 PM ET.

How to cancel

Contacting customer service is the fastest way to cancel your policy, although you may have to visit a physical location and sign paperwork to verify the process. If you are unable to go to one of the physical locations, you can have the paperwork mailed to you.

Cancelling your life insurance policy is not a great idea, as the older you are, the more expensive premiums become. Before you cancel, make sure your reasoning is solid and you have a guaranteed way of covering any end-of-life expenses.

If you are struggling to pay, speak with a customer care representative to try and work out a payment plan.

Frequently Asked Questions

What is the income tax-free death benefit?

Upon the death of the insured, a life insurance policy pays out a death benefit. This benefit is not taxed as income, so the beneficiary will receive 100% of the payout.

However, if the death benefit is paid in installments instead of a lump sum, any interest earned on the benefit is taxable.

What is the tax-deferred cash value growth?

If a life insurance policy earns cash value, that increase in value is not taxed until you withdraw the money. This means taxes will be applied to the amount from the moment you begin to withdraw it, but not before.

How do the dividends work with MassMutual?

Dividends are the amount paid out per share you own. For example, if you own $100 worth of a stock that yields 2%, you will receive $2 per year simply for owning the stock.

What is the underwriting process with MassMutual?

"Underwriting" is the process of determining whether someone qualifies for an insurance policy, and if so, what their rates will be.

The first step of the process is to determine the "insurance age" of the applicant. This means the closest birthday to the policy date, offset by a period of six months. The next step is to determine the amount of money at risk.

The third step is to determine the underwriting requirements, followed by an application package. Finally, the underwriter will order any specific medical tests or examinations that may be required to issue the policy.

Am I considered as "high-risk" because I have a pre-existing medical condition? If so, will my premium be more expensive than others?

Certain pre-existing conditions make a person high-risk, and this can result in higher premiums. Whether you are considered high risk or not will be determined by the underwriter.

Can I switch from one policy to another?

You can attach riders to some policies that will allow you to convert your existing policy to another. In addition, you can also purchase new policies if your current policy no longer fits your needs.

Does MassMutual Insurance use credit scores?

Insurance companies do not use credit scores to determine whether you qualify or not, but some may use "insurance scores" which are calculated in part with your credit score.

What are MassMutual Insurance's financial strengths?

MassMutual has been given a financial strength of "superior" from A.M. Best, a Moody's rating of Aa2, and a Standard & Poor's rating of AA+.

How can I claim my annuity once I retire? How many days will it take for my annuity request to get approved?

Once you retire, you should reach out to your agent with the relevant information and file a request for your annuity. Once filed, this request can take several weeks to be approved.

Can I withdraw cash amounts on my policy?

If your life insurance accumulates cash value, then you can withdraw against that amount.

What is MassMutual BBB accreditation?

MassMutual received a rating of A+ from the BBB.

What is the maximum loan amount that I can take out on my policy?

You can borrow up to the full cash value of your policy.

Where can I edit the beneficiaries to my policy?

You can edit the beneficiaries of your policy online or by contacting your customer service agent.

Is there a service fee on monthly auto-payments?

There may be a service fee depending on your policy if you pay your annual premium in installments.

How long does it take to payout life insurance?

The vast majority of death claims are paid within 30 days.

How can I claim funeral services if I am the beneficiary?

Contact MassMutual and provide them with the relevant information, and make sure you have the death certificate on hand to answer any questions MassMutual may have for you.

Can I borrow against my MassMutual's life insurance policy?

You can borrow against the cash value of a whole life insurance policy.

How to surrender a MassMutual insurance policy?

To surrender your insurance policy, you will need to contact MassMutual and provide them with your reason for surrendering. You will be provided with the surrender form, which you will need to fill out and submit.

Confirm with the company after a certain amount of time that they have received your request, and then you should receive the cash surrender value in a short period of time.

What should I do if the company has lost my policy and is not willing to compensate me?

Should a company lose your policy and refuses to compensate you, gather proof of the existence of your policy and speak to a legal representative for further information.

Why are my payments still being withdrawn when my policy has lapsed?

Insurance companies will attempt to bring your policy up to date by withdrawing payments from your account.

Can I check the progress of my claim online? What should I do if MassMutual does not acknowledge the claim I make as a beneficiary?

You can check the status of a claim by contacting the customer service department.

If MassMutual does not acknowledge your beneficiary claim, you may need to provide more information as proof that you are the stated beneficiary or that the person in question has passed.

Is MassMutual insurance deductible?

Some types of insurance, in some situations, are tax deductible. Whether yours is or not depends on your given circumstances.

Does my MassMutual insurance expire?

Term life insurance has a maturation date after which it no longer provides coverage, but whole life insurance does not expire. It is considered permanent life insurance.

Conclusion

MassMutual is one of the oldest life insurance firms in the country, and certainly one of the most popular. The excellent customer service makes the company stand out from the competition.

In a time of crises following the death of a loved one, the last thing you want to deal with is the logistics of filing a claim. Having a customer service team that can help streamline the process is invaluable.

MassMutual would be one of our top choices for a life insurance company, not only because of the policy options but also because of the investment and retirement options.

When it comes to preparing for the final years of your life, MassMutual understands what customers need.

Do you use MassMutual Life Insurance Company?

How has the company worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.