UnitedHealthcare Insurance offers a wide variety of health insurance-related products and services to both individuals and employers. But does this insurance company take your health matters seriously, or will you be forced to pay through the nose for routine services or procedures? We take a closer look at United Healthcare, and share our findings with you here.

What is United Healthcare Insurance?

UnitedHealthare insurance was originally formed as Charter Med Incorporated back in 1974. It was formed by a group of physicians and healthcare professionals who wanted consumers to have more options for their health coverage needs.

UnitedHealthcare has been at the helm of many new healthcare innovations, starting the first network-based health plan for seniors, as well as programs to help coordinate care for those living in nursing homes, individuals needing transplants, individuals dealing with diabetes and cancer, and much more.

In addition to its comprehensive insurance programs and health plans, UnitedHealthcare is also highly involved in the development of technologies and platforms that helps physicians, caregivers and customers better manage and understand their conditions, and those of the patients they treat.

For the purposes of this guide, we'll be looking exclusively at the health insurance products and services offered by UnitedHealthcare Insurance.

What Products and Services are Offered by UnitedHealthcare Insurance?

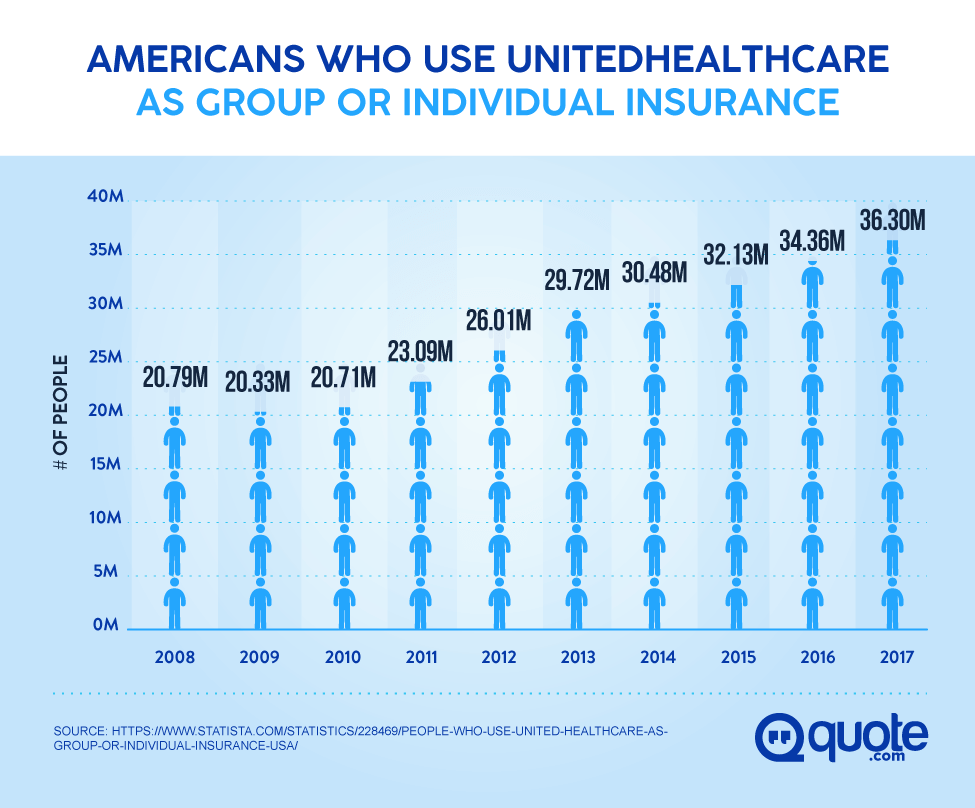

UnitedHealthcare Insurance offers a number of products and services covering over 70 million Americans. These include:

Plans for Individuals and Families

UnitedHealthcare offers a wide range of plans for individuals and families, including ACA (Affordable Care Act) plans.

Health Insurance Plans

Health insurance plans and rates differ depending on where you live. Fortunately, it's easy to get a quote and apply. In most cases, your coverage can start the very next day. For ACA plans from the Health Insurance Marketplace, you'll need to call and speak with a product advisor at 1-800-980-5213.

UnitedHealthcare also offers other types of insurance plans (more details on those below) that cover dental, vision, accident and much more.

Short Term Insurance

Short term insurance offered by UnitedHealthcare Insurance is underwritten by the Golden Rule Insurance Company. Most commonly, it affects people who cannot apply for the Affordable Care Act (also called Obamacare) because the enrollment period has expired and they don't qualify for a special extension, or they are waiting for their ACA coverage to begin.

Short term insurance can also help individuals who are looking for coverage to bridge the gap between their current insurance and Medicare, or those who are turning 26 and coming off of their parents' insurance plan. Individuals who are between jobs or who are waiting for benefits to kick in at their new job can also benefit from a short term insurance plan.

Dental Insurance

Dental insurance options offered through UnitedHealthcare Insurance help provide coverage for common dental issues, including preventative care (routine cleanings, fluoride treatments) as well as emergency services. Even major services such as root canals can be covered, depending on the plan's deductible and the waiting period. There are no age restrictions on UnitedHealthcare's dental insurance.

Supplemental Insurance

Supplemental insurance is any additional insurance not typically covered under normal health insurance. This can include things like:

- Hospital and doctor insurance – a type of fixed indemnity plan for major medical expenses. It offers limited benefits and is designed to supplement your regular health insurance. Rather than pay the provider directly, this type of supplemental insurance pays you a predetermined amount for certain expenses you incur related to your healthcare, and then you pay the remainder.

Indemnity insurance is often used to help apply payments toward your deductible, get money for unforeseen medical expenses, pay your share of x-rays or blood work, or get cash to help with prescription drug co-pays.

- Vision insurance – As you might expect, vision insurance helps cover routine vision expenses like eye exams, contact lenses and prescription glasses. It covers people of all ages and includes a national network of optometrists and eyewear providers. As a standalone supplemental insurance to your regular health insurance plan, vision insurance gives you the flexibility to choose the kind of coverage that's right for you. For example, you can choose a plan that covers glasses or contact lenses – or both.

- Term life insurance – Term life insurance helps provide financial peace of mind in the event of death. It pays a lump sum benefit to beneficiaries and coverage can extend up until the age of 75. There is no medical exam required. Term life insurance plans offered through UnitedHealthcare also feature an optional critical illness benefit that pays cash upon being diagnosed with a critical qualifying illness (or death).

- Critical illness insurance – Critical care insurance provides a lump sum of cash to help cover the expenses associated with a qualifying critical illness. While health insurance does cover some regular healthcare costs, in cases of critical illness, the individual affected is often out of work, which is where critical illness insurance can come into play. Some of the most common covered illnesses or conditions can include:

- Heart attack

- Life-threatening cancer

- Hearing, speech or vision loss

- Major organ transplant

- Paralysis

- Coma

- Renal failure

- Stroke

- Carcinoma in situ

- Coronary artery bypass graft

- Accident insurance – UnitedHealthcare Insurance offers two types of accident insurance –

- Accident SafeGuard – Pays a fixed amount for losses incurred as a result of a qualifying injury. It covers both inpatient and outpatient services and also includes an accidental death/accidental dismemberment benefit

- Accident SafeGuard Premier – Pays covered expenses resulting from a qualifying accidental injury. It also covers both inpatient and outpatient services and there are four benefit levels to choose from.

- Hospitalization Insurance – This type of supplemental insurance is also called Hospital Indemnity, because it helps to pay for unexpected hospital stays. With this type of insurance, there's no deductible to meet and no network. Coverage can extend to your entire family and is renewable up until age 65.

Like with accident insurance, UnitedHealthcare Insurance offers two types of hospitalization insurance:

- Hospital SafeGuard – This plan pays a fixed amount per day for hospital stays up to the calendar year maximum.

- Hospital SafeGuard Premier – This plan follows the same structure as the one above but also covers other qualified medical services such as emergency room visits, urgent care, inpatient/outpatient surgery, air/ground ambulance and anesthesia services.

- Disability Insurance – Temporary disability insurance is designed to help fill in the gaps if you can't work due to a qualifying disability. It acts as your paycheck while you recover from your disability. Monthly benefit amounts can range from $500-5,000 and benefit periods can extend up to 1 year, 2 years or 5 years. The insurance payments you receive can be put toward mortgage, rent, utilities, groceries and more.

As with accident and hospitalization insurance, UnitedHealthcare offers two types of disability insurance plans:

- Disability Income Protector – Provides basic coverage in the event of a total disability from an accident.

- Disability Income Protector Plus – Offers more coverage for total disability from both sickness and accidents.

- Travel medical insurance – SafeTrip international travel protection provide international travel medical insurance and travel assistance. In addition to helping you find a pre-screened, qualified medical provider, SafeTrip also helps with the costs for medical services, as it's common to pay up front at the time of service in other countries. Depending on the condition or need, you can also get help arranging for evacuation or transport or make travel arrangements for your family.

Health Insurance for Employers

Employers looking for comprehensive coverage for their employees will find a wide range of group coverage options at UnitedHealthcare.

Small Business, Large Business, National Accounts

Depending on the state you live in, and the number of employees you have, you can discover insurance plans that work for nearly every type of company. Other supplemental insurance plans, including dental, vision, life insurance, critical illness, disability and more are also available.

COBRA

COBRA, the Consolidated Omnibus Budget Reconciliation Act of 1985, requires employers to provide continuous healthcare coverage to employees and their dependents who would otherwise lose their coverage due to termination of their employment. COBRA requirements for employers with 20 or more employees are strict, and the rules governing its use are complex. Failure to comply can cost up to hundreds of thousands of dollars in penalties, fines and liability suits.

To help ensure compliance, UnitedHealthcare's administrative services work with a variety of qualified plans, carriers and coverages to handle the paperwork, administration and other requirements.

Public Sector

Government, labor, trust, and education sector employers can also customize health care plans for their employees and workers through public sector health insurance.

SBS

Rather than employers having to selectively choose between countless vision, dental and other types of plans, Specialty Benefits Solutions (SBS) is a packaged program that gives employees the freedom of using a single ID card and a single toll-free benefits number to access their dental, vision, life and accidental death and dismemberment benefits.

Retiree Solutions

For employers who want to help their retirees get on the right path to managing their Medicare benefits, UnitedHealthcare's Retiree Solutions can help them make an informed decision on whether to maintain traditional group benefits, subsidies or exchanges.

An Overview of UnitedHealthcare Insurance

When choosing a health insurance provider, it's important to know precisely what's covered, what the cost is, and how much you're responsible for. In addition to the details noted above, it's a good idea to have a clear, concise overview, so that you can more fully understand what's involved in making this very important decision – whether it's just for you, yourself and your family, or your employees.

Services Offered for Both Individuals and Employers

UnitedHealthcare Insurance provides both individual, family and employer health insurance as well as plans that fall under the requirements of the Affordable Care Act. In addition to healthcare plans, they also offer supplemental insurance plans for things like dental, vision, accident, disability and life insurance to name a few.

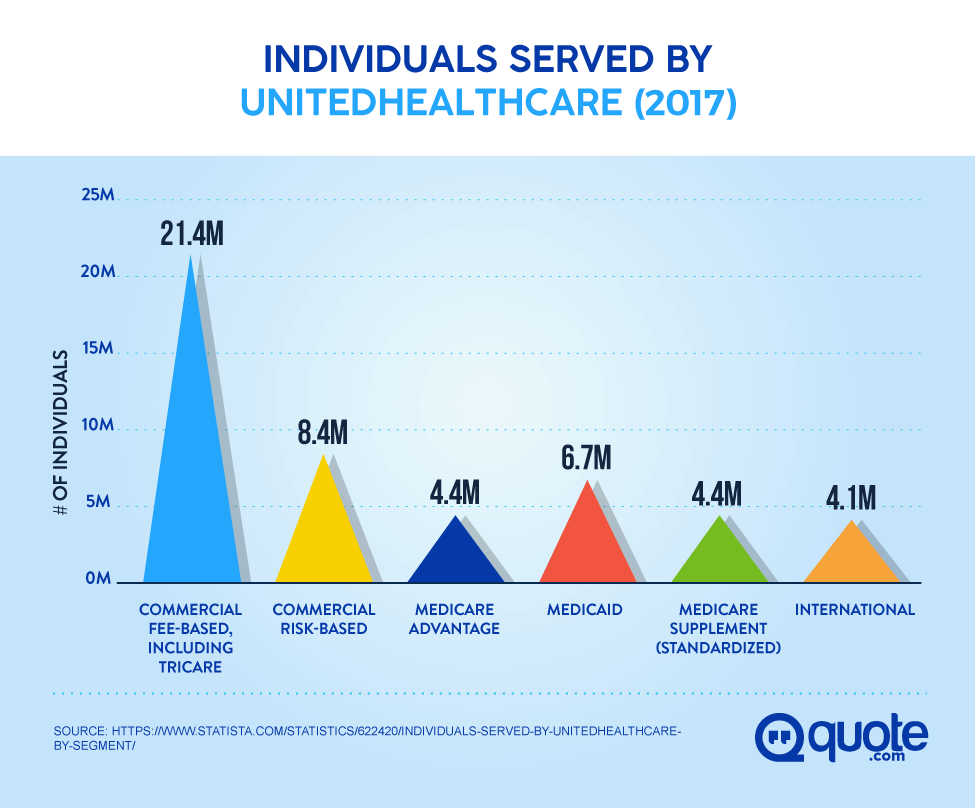

Dental Plans, Vision Plans, Medicare Plans, Medicaid Plans

Depending on where you live, you may have access to a variety of plans that cover things outside of the scope of normal health insurance, these may include dental and vision, as well as specific plans for individuals age 65 or older (Medicare) or low-income individuals (Medicaid).

What Does UnitedHealthcare Insurance Cover?

Health insurance plans from UnitedHealthcare cover a wide range of conditions and healthcare needs. For items that fall outside the normal coverage limits of health insurance, United also offers supplemental plans for things like travel, hospitalization, critical illness, accidents and more. The details of which plans are available and what's specifically covered will depend on where you live. The good news is that you can get a quote and it only takes a few seconds.

What Policies Does UnitedHeathcare Health Insurance Offer?

UnitedHealthcare offers policies that span a wide range of needs and budgets. From healthcare for those just coming off of their parents' insurance plans, or who are between jobs, to Medicare and Medicaid plans, to small business and self-employed plans, there are a variety of policies that can be adapted to suit your lifestyle and your budget. The specifics about which plans are available will depend on where you live.

How Do I Know Which Policy is Right for Me?

As with many things in life, there is no "one size fits all" health insurance policy. You will want to carefully weigh all the options and costs as well as the network of available doctors and specialists to determine a plan that best fits your needs and the needs of your family or employees. Read through this guide carefully to see some of the most common upsides and downsides of United Healthcare, and optionally get a quote as your first step to choosing the best health insurance for your needs.

UnitedHealthcare Insurance Strengths

UnitedHealthcare Insurance has a number of strengths that help consumers enjoy greater confidence and peace of mind in working with them as their chosen health insurance company. Their biggest strengths, beyond their history of innovations, include:

User-Friendly Online Platform

Because UnitedHealthcare Insurance is rooted in technology, they have a finger on the pulse of the changing, data-centered world we live in. Therefore, it's no surprise that their online platform would be straightforward and easy to use, even if you're not exactly "technologically inclined." It's easy to determine the status of your claim, find helpful resources and tools, and much more, all through a helpful consumer-geared website.

Extensive Physician Network

With over 70 million people insured, it should come as no surprise that UnitedHealthcare Insurance features a vast physician network. Through their website, you can find a physician, see a general directory of providers, or find physicians that accept Medicaid or Medicare.

Short-Term Health Insurance Plans Available

Many people who are in between jobs or are waiting for their health insurance coverage to kick in, find themselves worrying about what would happen if they were sick or injured in the meantime. Short term health insurance plans can help fill in the gaps while you're waiting, and aren't offered by many insurers – making UnitedHealthcare Insurance a must-see if you're concerned about coverage running out or not being there when you need it most.

UnitedHealthcare Insurance Weaknesses

Of course, not every insurance company is without its weaknesses. Here were the most common concerns we came across while looking into UnitedHealthcare as a viable health insurance provider.

One of the Most Expensive Insurance Options

In order to get a decent average of the cost of various plans and pricing, we looked at three different age groups in five different zip codes across the U.S. Compared to other insurance carriers, UnitedHealthcare's premiums were higher – up to $600 per year or more. And although this is just an average and your personal quote may be different depending on your individual health factors, it is absolutely worth shopping around at different health insurance providers to see which ones give the best benefits and the most affordable rate for your unique needs.

Certain Benefits are State Specific

Depending on where you live, you may have access to different benefits than someone who lives across the country, or even in a neighboring state. Here again, it's worth pricing out different insurance carriers within your state to determine the best route for your healthcare needs.

How to File an Insurance Claim with UnitedHealthcare

If you have an urgent, non-routine situation or have to pay for care because of an emergency when outside of UnitedHealthcare's network (or while traveling on vacation), you should send an itemized bill with the following details:

- The date of service

- The description of the service(s) obtained

- Procedure codes for the services obtained

- Diagnosis codes for the services obtained

- The provider's name, address and tax ID number

Then simply mail your claim to the address on the other side of your benefits card. If you don't have your card with you or you're uncertain of the address, you can send it to:

UnitedHealthcare of the River Valley= P.O. Box 5230 Kingston, NY 12401-5230

Include your name, member ID and a phone number where you can be reached.

UnitedHealthcare also has a reimbursement form that you can print, fill out and mail to the address above. This form is optional and not required in order to receive reimbursement.

What Do Customers Have to Say About UnitedHealthcare's Services?

Many people, particularly those who are members of AARP and use UnitedHealthcare as their insurance provider have horror stories about working with UnitedHealthcare. By far, customers are unhappy with the customer service they receive (or lack thereof), as well as getting the runaround from agents or finding that customer service is unavailable on weekends.

What Are Some of the Most Common Complaints About UnitedHealthcare's Services?

The most common complaints are that what would be viewed as ordinary and routine scans and procedures are potentially not covered, as well as certain injections and shots. Although every customer is different, it's worth noting that you should check your policy very carefully if you ultimately decide to sign up with UnitedHealthcare or if your employer has chosen them, since they are notorious for being the "lowest cost" bid among insurance companies.

Canceling Your UnitedHealthcare Insurance Policy?

If you'd like to cancel your UnitedHealthcare insurance policy, you'll need to contact customer service using the phone number on the back of your member ID card. You can also contact customer service through the website by clicking here.

Can I Cancel My Policy At Any Time?

Being able to cancel your policy will depend on your specific healthcare plan. Plans which fall under the Affordable Care Act have a special enrollment/cancellation period, as do Medicare plans. In order to know if your plan can be freely canceled at any time, and to initiate the cancellation process, you should contact UnitedHealthcare customer service using the number on the back of your ID card.

Common Questions about UnitedHealthcare Insurance

Choosing health insurance is a decision that should not be made lightly. That's why we've compiled the most common questions and answers about UnitedHealthcare Insurance here in one place, to help you find the solutions you're looking for, quickly and easily.

Can I Switch from One Policy to Another?

At certain times in your life, known as "Qualifying Life Events", you may be able to change insurance plans. Qualifying life events may include a marriage or a move, for example. What's more, moving may even entitle you to more benefits depending on where you live.

However, there are also open enrollment times to consider and other factors which may affect your ability to switch. It is recommended that you contact UnitedHealthcare's customer service directly by calling the number on the back of your member card for information on switching from one policy to another.

Do Products and Services Differ from State to State?

They do. Depending on where you live, many factors about your UnitedHealthcare insurance may change, including the benefits you receive, which plans are offered and much more. Although some benefits are at the core of every health insurance plan, you may find that the plans you have access to differ dramatically from one state to the next. In some states, UnitedHealthcare Insurance may not even offer insurance services. See the full list further down in this article.

Does UnitedHalthcare Insurance Use Credit Scores?

Insurance companies do use credit scores, but not in the way that you might think. They evaluate your credit score differently than, for example, a lender who is evaluating your creditworthiness in getting a loan. As part of your credit report, you also have an "insurance score". This is a set of attributes and ratings that are different from the FICO score that most credit score companies provide you with.

However, your FICO score and your insurance score are closely related, so if you have a low FICO score, you may be charged a higher insurance premium that someone with a higher FICO score. If you are concerned about a low credit score affecting the cost of your health insurance, it's a good idea to shop around and compare the best rates for your particular situation. For your own personal health, as well as your financial health, it's a good idea to take steps to improve your credit by paying down credit account balances, minimizing your spending and taking other common sense steps to promote better personal financial responsibility.

What Are UnitedHealthcare Insurance's Financial Strengths?

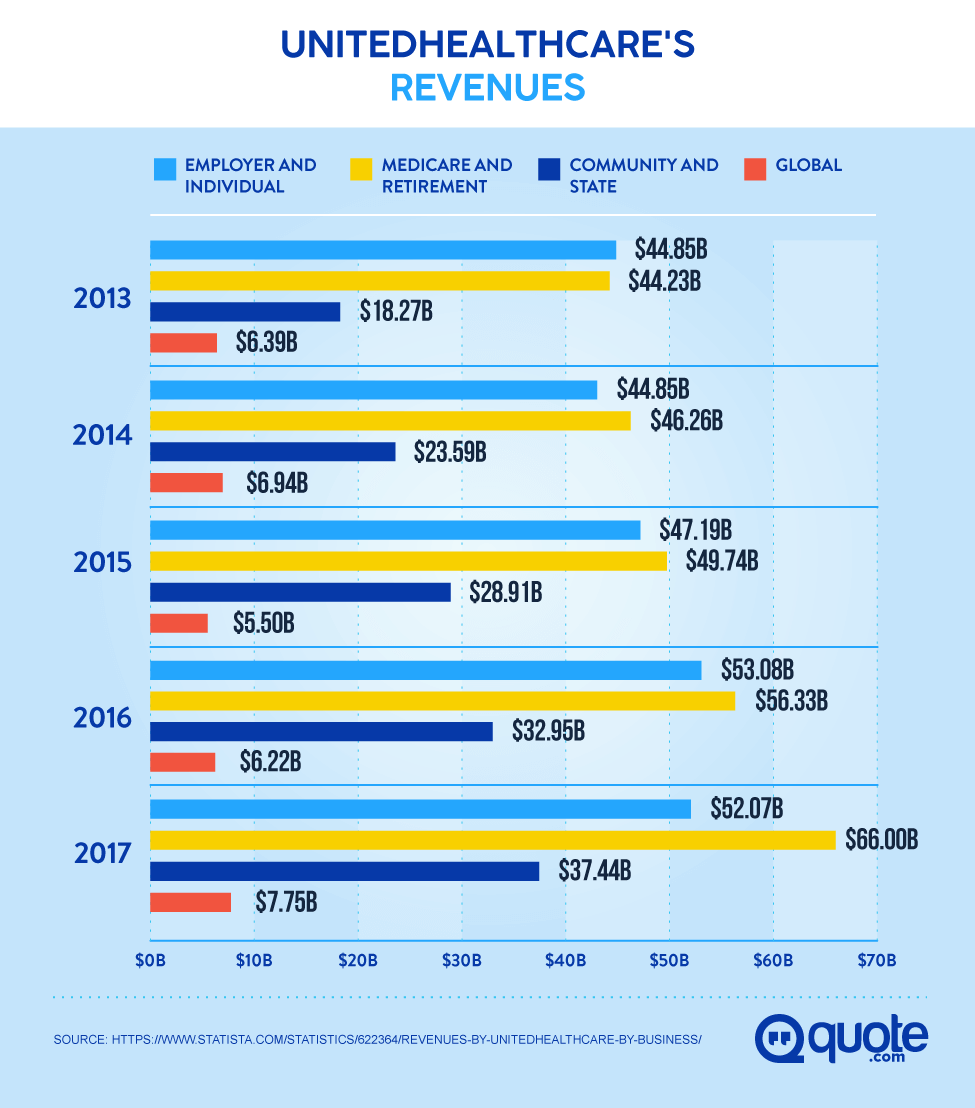

UnitedHealthcare is part of the family of companies that make up the United Health Group – the largest health insurer in the U.S. UnitedHealthcare Life Insurance company and Golden Rule Insurance Company, which typically underwrite a wide range of UnitedHealthcare plans, are rated "A" Excellent by A.M. Best.

A.M. Best is an independent organization that reviews insurance companies based on their financial strength and stability. UnitedHealthcare Insurance has helped provide insurance and related services for over 70 years – a testament to their history as well as their stability in providing millions of Americans with qualifying health insurance.

What is UnitedHealthcare's BBB Accreditation?

UnitedHealthcare is not currently BBB accredited. The Better Business Bureau is a third party ratings company, not an organization or governmental entity, and therefore resolutions to customer issues are handled independently by UnitedHealthcare's customer service.

What are Some of the Additional Plans and Products that UnitedHealthcare Offers?

UnitedHealthcare offers a number of supplemental insurance plans and products to complement your healthcare coverage through them, including:

- Dental

- Vision

- Accident

- Disability Insurance

- Critical Illness

- Life Insurance

- Hospitalization and much more

Can I Add More Family Members to My Policy?

Unlike with car insurance, where adding a new driver to your policy is a matter of making a quick phone call, health insurance is a bit more complicated. Being able to make changes to your health insurance will depend on whether or not you or someone in your immediate family has undergone a "qualifying life event".

These include:

- Getting married

- Getting divorced

- Death of a loved one

- Having a new baby, adoption or foster care

- Your dependent turning 26 and moving off of your health insurance.

The timeframe for being able to make changes to your health insurance plan is 60 days after the life event happens. If any of these events have happened, call the number on the back of your UnitedHealthcare insurance card to determine the next steps you should take.

Is There a Service Fee on Monthly Auto-Payments?

If you choose to have your health insurance premium deducted automatically from your checking account, there is no service fee associated with paperless billing. You can also use UnitedHealthcare's myClaimsManager, an online service launched in July of 2013 to allow plan participants to pay medical bills and manage claims directly online. This service can be found at www.myuhc.com.

What Should I Do if the Company Has Lost My Policy and is Not Willing to Compensate Me?

Specific events, such as needing to request a new ID card or change your policy should be handled directly with UnitedHealthcare's customer service by calling the number on the back of your member card. You can also go to www.myuhc.com to get a temporary ID card or a replacement ID. Policy-specific questions should be directed to customer service.

Can I Check the Progress of My Claim Online?

UnitedHealthcare Insurance operates the myClaimsManager website, which allows you to check the progress of your claim online and also pay bills directly to your provider using electronic funds transfer.

What States Does UnitedHealthcare Insurance Operate In?

UnitedHealthcare Insurance is available in every state except for:

- Alabama

- Arkansas

- Connecticut

- Idaho

- Kentucky

- Louisiana

- Maine

- Mississippi

- Missouri

- Montana

- New Jersey

- North Carolina

- North Dakota

- Oklahoma

- Texas

- Vermont

Does UnitedHealthcare Insurance Cover Diabetic Supplies?

Certain diabetic testing supplies, including blood glucose meters, insulin pumps and test strips may be covered depending on the plan you have with UnitedHealthcare Insurance. You will want to consult your plan's specifics to determine if your diabetic testing supplies are covered.

Which Hospitals Accept UnitedHealthcare Insurance?

You can search for participating physicians, hospitals, dentists, eyecare providers and network pharmacies that accept UnitedHealthcare plans as well as Medicaid or Medicare by visiting the Find a Doctor link on UnitedHealthcare's website.

Does UnitedHealthcare Insurance Require Referrals?

If your doctor tells you that you need to see a specialist, what's your next step? Before you make an appointment, check to see if your plan requires a referral first. Certain UnitedHealthcare Insurance plans will require you to get a referral from your primary care physician first. Failing to do this may result in you being unable to make an appointment, or your insurance may not pay the claim.

Can I Add Additional Insurance Types to an Existing Plan?

Depending on your existing insurance plan, you may be able to add different types of supplemental insurance to it, but in some cases, such as with Medicare, you may have to wait until the open enrollment period in order to do so.

In order to determine if you need supplemental insurance, it's a good idea to add up the deductible and any out-of-pocket expenses you would incur during a typical hospital stay. The average major medical event will cost you over $10,000 – so it's best to figure out how much you would be responsible for, and then see if the result is more or less than adding on supplemental insurance.

You may also want to factor in costs such as lost wages, mortgage payments, utilities and so on.

What Does the Supplemental Health Insurance Include?

The supplemental insurance you choose from UnitedHealthcare Insurance will depend on many factors. For example, supplemental vision insurance covers routine eye exams and can optionally include coverage for eyewear (glasses and/or contacts) at participating providers. If you are considering supplemental insurance form UnitedHealthcare, look into the basics as to what's covered and get a quote online to see if the costs and deductibles are worth the extra benefits. As each supplemental insurance product is unique, there is no one size fits all "blanket" supplemental insurance policy, but getting a quote can help you take the first steps toward making sure that you and your loved ones are covered for life's unexpected surprises.

The Final Verdict

Your health insurance choice may be at the whim of your employer, in which case there's relatively little you can do but try to make the most of an unpleasant situation. If you have to choose, however, it may be worth comparison shopping before you decide to choose UnitedHealthcare Insurance.

We looked at the high cost of premiums compared to related plans. This, coupled with unresponsive or downright rude customer service in concerning and even dangerous medical emergencies gave the overall impression that UnitedHealthcare has its fingers in too many pies.

Considering just how many platforms, technologies, and services they offer, it's easy to see that the company is spread thin, despite its financial stability. And at what cost? The cost of providing accurate, compassionate care to its customers when they need it most.

To their credit, UnitedHealthcare does have a finger on the pulse of technological innovation, and their initiatives have helped to make getting access to care (and paying for it) much easier and faster. But again, this comes at a cost. Considering that United Health Group is a publicly traded company, one may wonder if UnitedHealthcare is more focused on pleasing its shareholders than its customers. Serving millions of consumers means nothing if they can't get the help they need when they need it the most.

Of course, no one can deny is denying that health insurance is an industry that's fraught with change and uncertainty – not to mention a delicate balancing act between risk and reward. It's not an easy or accommodating industry to break into. However, UnitedHealthcare seems to have forgotten its roots – founded on the premise of offering the customer more choices for their healthcare needs.

With all of this in mind, we strongly recommend that you compare plans from providers in your area to determine the best course of action in choosing a health plan for yourself as well as your family. UnitedHealthcare may offer a wide range of insurance products and a large coverage network, but you may find them inattentive - or worse - downright careless and abrupt in the event of an actual emergency should you need help.

Carefully consider any plan you choose and be sure you've read and fully understand the fine print before signing up with UnitedHealthcare or any health insurance provider.