Health insurance is dizzyingly complex.

We try to be smart about going to the doctor, only to find that a basic check-up costs $200 because the physician is out-of-network.

Visits to the emergency room result in mysterious bills.

Americans face higher healthcare costs than anywhere in the world and are often saddled with medical debt.

Prices vary widely between states and hospitals.

This confusion can cause financial ruin.

According to a 2013 study, about 20% of personal bankruptcies are caused by medical debt.

Those who file for bankruptcy have an average of $8,594 in medical debt.

The Affordable Care Act, also called Obamacare, tried to simplify things and get more people covered.

Among other things, it gave access to people with a pre-existing medical condition and covers mental health treatment.

But the clear financial benefit of having healthcare has been drowned out by the debate over how to provide it.

Congress constantly threatens to gut the law. Even child health insurance may be cut.

To filter through it all, consumers need to understand how health insurance works.

(And not get it confused with life insurance, long-term care insurance, and other types of insurance.)

Once you learn the basic terminology and pricing structures, health coverage will seem less daunting.

We'll cut through the complexity so you can find what plans are best for you and your family.

Health Insurance Coverage Basics

Health insurance helps you pay for doctors' appointments, prescriptions, blood tests, and any medical procedure.

A consumer pays a monthly insurance bill to buy access to certain doctors in the provider's health care network.

Each insurance plan specifies what is and is not covered.

Going without health insurance is risky.

You will have to pay cash for all medical services.

The median cost of a typical visit to the emergency room is $1,233, according to a 2013 study by the National Institute of Health.

Charges vary widely, but they're all expensive.

Many people don't buy health insurance because it's too expensive.

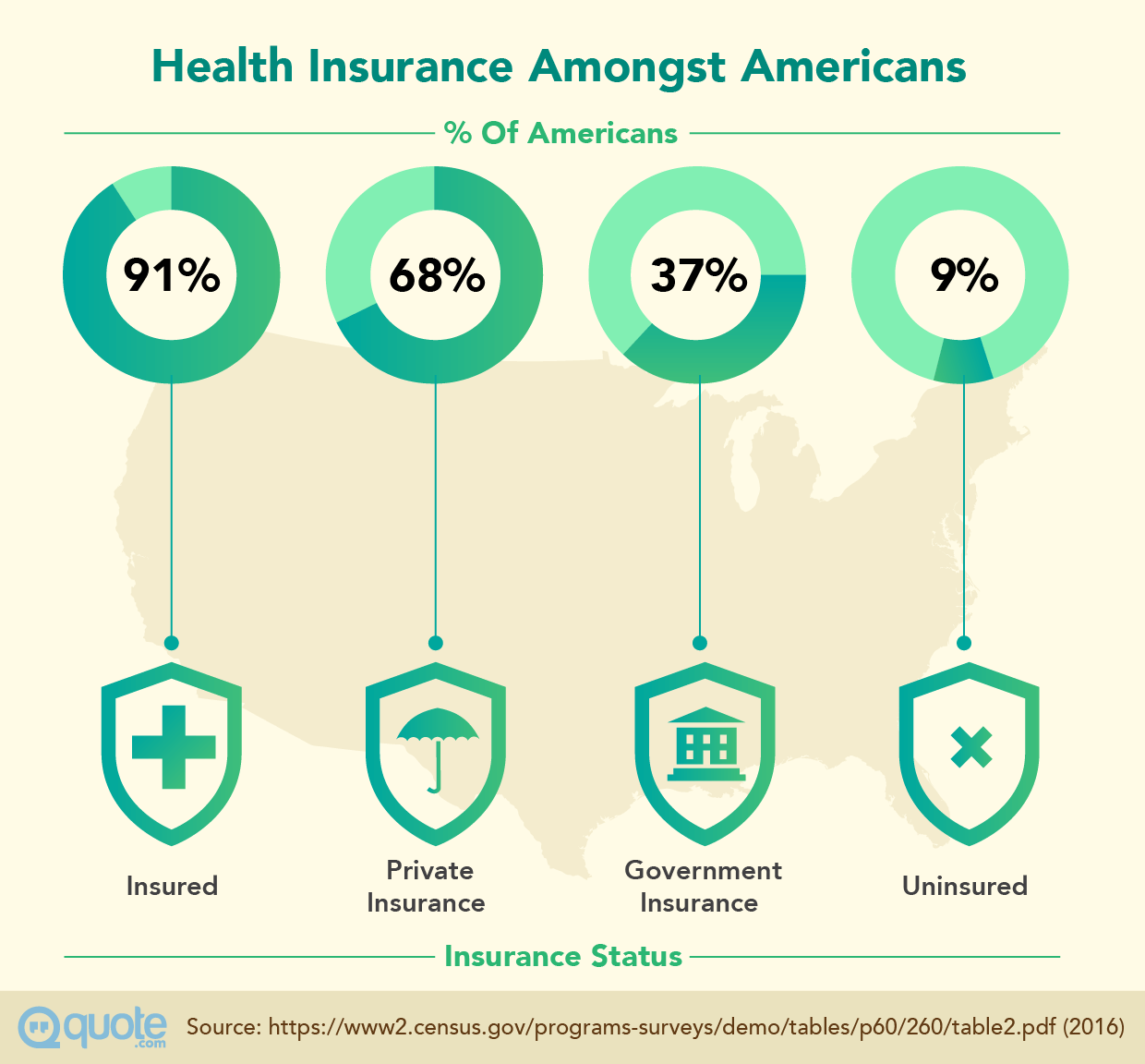

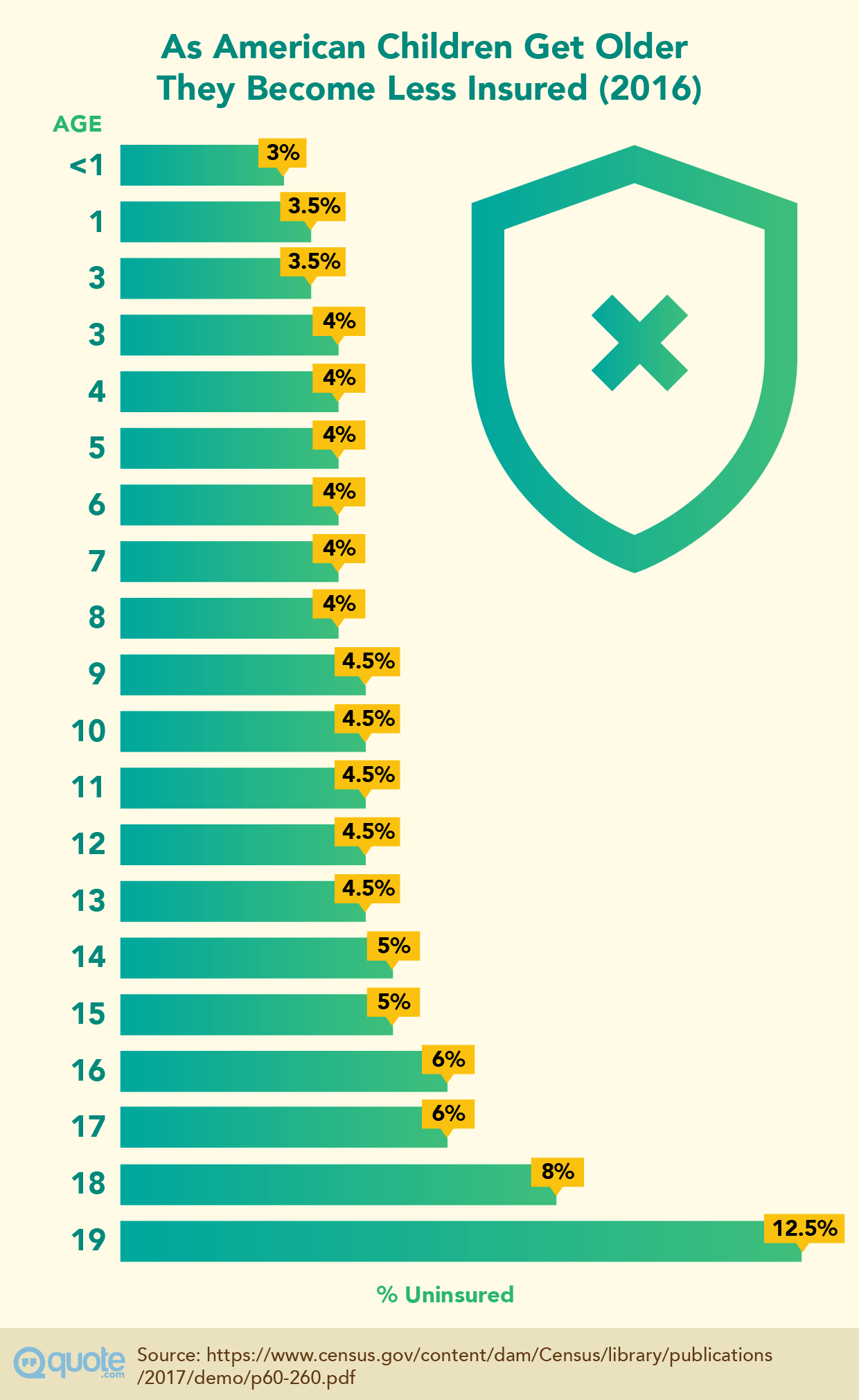

In 2016, 27.6 million Americans were uninsured.

Their health suffers: One in five uninsured adults skipped medical treatment due to cost.

They often forgo preventative care like blood tests or cancer screenings.

Insurance covers at least some of your hospital bills and protects you from surprise medical costs.

You never know when you will get sick or have an accident.

Yes, you need to have health insurance

All Americans must have health insurance. If not, you will probably pay a penalty fee.

The penalty fee is 2.5% of your household income or $695 per adult, whichever is higher. It rises annually with inflation.

It is also imposed when an insurance plan fails to cover certain benefits, like maternity treatment or prescription drugs.

Critics consider these to be excessive coverage mandates that raise the price of insurance, but advocates say Americans deserve to have basic needs covered.

There are some exceptions to the penalty. Americans who live abroad or are in jail do not have to pay it.

You can also file a financial hardship or religious exemption.

The cornerstone of the Affordable Care Act, this health-insurance mandate is under debate in Congress and may change.

For now, it remains law.

How to get health insurance

Under the Affordable Care Act, insurers can no longer deny coverage to people with pre-existing conditions.

All Americans can buy insurance regardless of their health.

There are many ways to get health insurance in the United States.

Options depend on your age, employment status, and income.

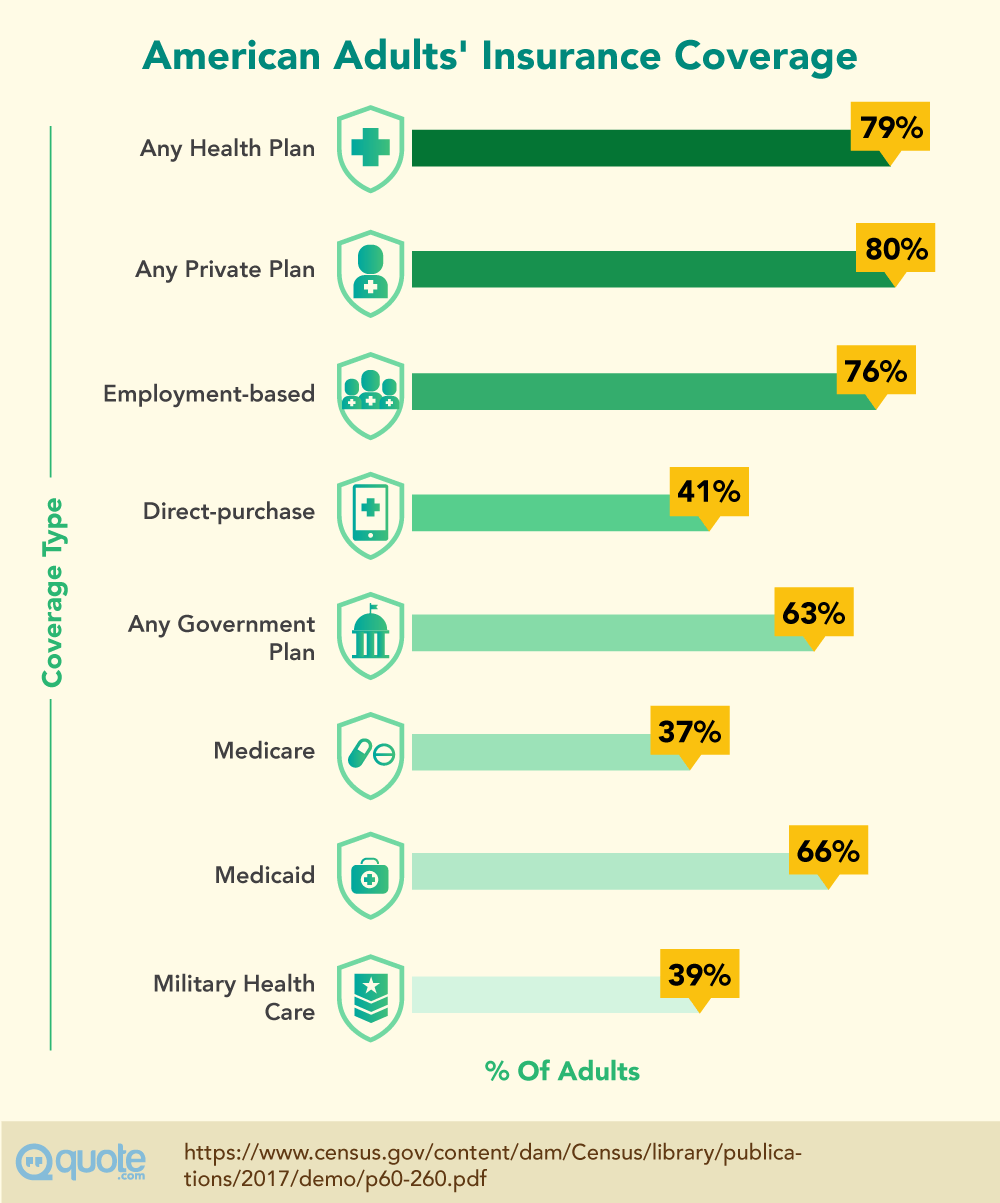

Half of Americans get health insurance through their job. Employer-sponsored insurance can cover spouses and children as well.

People who lose a job can still get coverage through COBRA.

People over 65 get health insurance through Medicare.

Low-income Americans can get coverage through Medicaid.

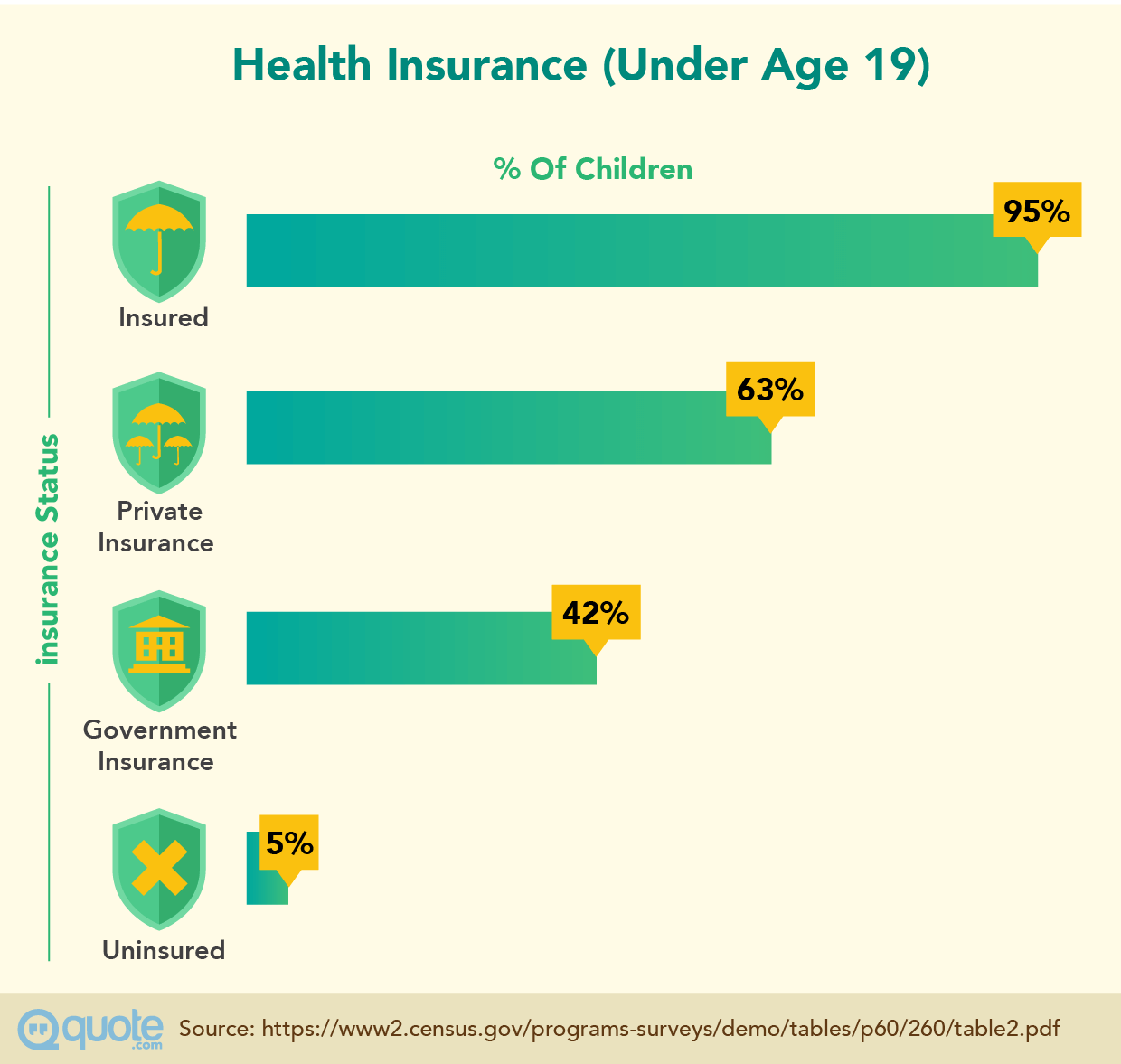

Kids whose parents don't qualify for Medicaid may get child health insurance coverage under the Children's Health Insurance Program.

Students can get it through their parents or school.

Everyone else, such those who are self-employed, has to buy it themselves, usually through a government Health Insurance Marketplace.

You can also buy it directly from the insurance company.

How to use the health insurance marketplace

Health insurance options vary by state.

You should buy insurance for the state where you live.

It is rare for insurers to offer coverage in multiple states.

If you live in one state and work in another, buy insurance based on your primary residence.

To start, go to HealthCare.gov during the open enrollment period at the end of each year.

In most states, this is where you will buy coverage.

You can also call the marketplace health center at 1-800-318-2596 or get in-person help in your community.

If you live in one of the following states, you will be redirected to your state marketplace.

Here are the states that have their own health insurance exchanges:

- California

- Colorado

- Connecticut

- District of Columbia

- Idaho, Maryland

- Massachusetts

- Minnesota

- Mississippi

- New Mexico

- New York

- Rhode Island

- Utah

- Vermont

- Washington

Before you log on, figure out whether you will qualify for a subsidy, or advanced premium tax credit.

This will lower the cost of health insurance.

If your household income is less than four times the poverty level, the government will help you pay for insurance.

In 2017, that's $48,240 for an individual and $98,400 for a family of four.

Note that you can only get an advanced premium tax credit if you purchase insurance through the Marketplace, not through employer-sponsored insurance.

What to look for in a marketplace health plan

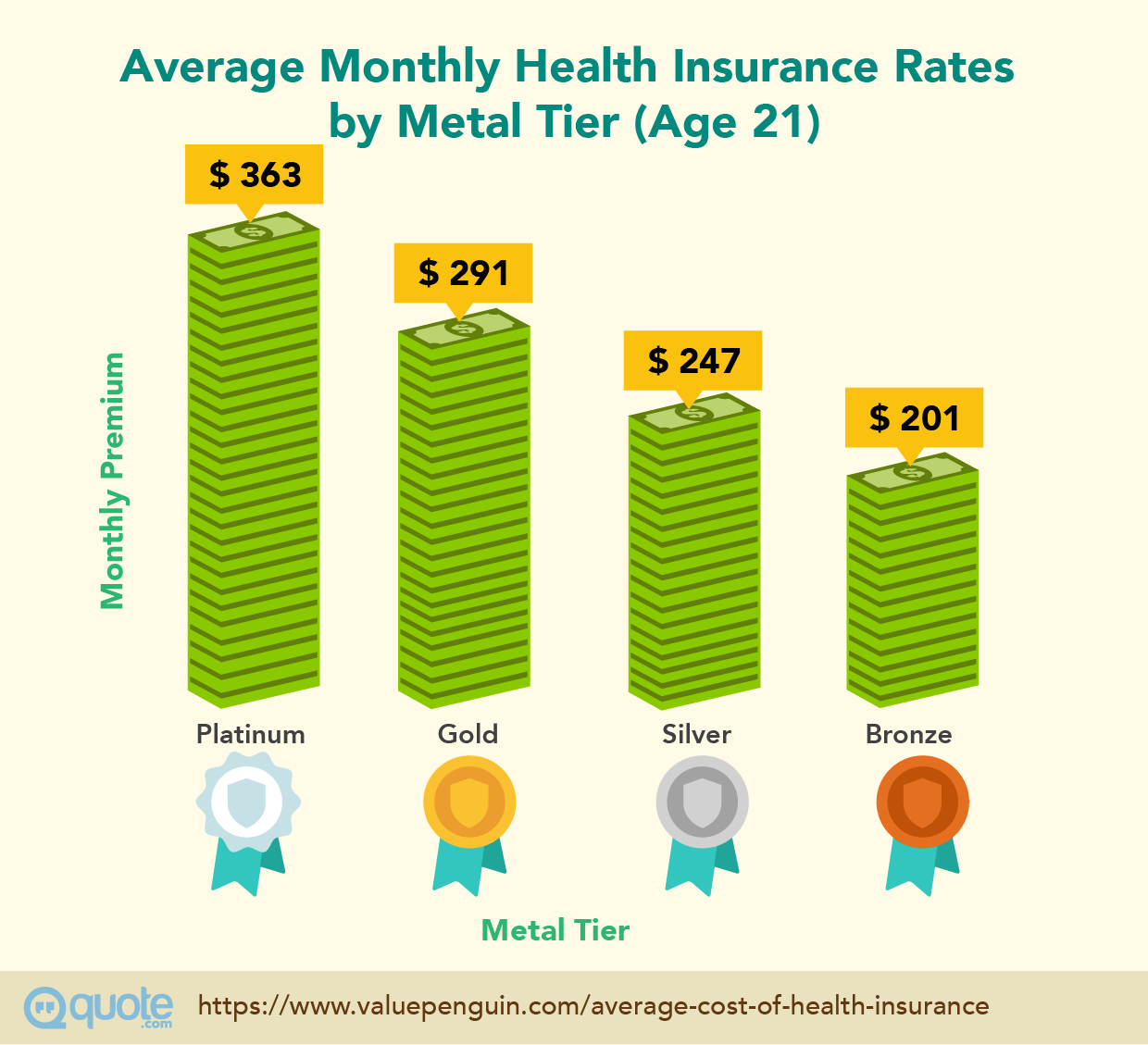

In the Health Insurance Marketplace, there are four metal categories:

- Platinum

- Gold

- Silver

- Bronze

The level of plan relates to how you and the insurer share costs.

In a Platinum plan, the insurer pays 90% of costs.

In a Bronze plan, it pays 60%. (These levels are not related to the quality of care.)

When comparing health plans, don't just consider the monthly cost.

Also weigh the maximum deductible, which is the limit of how much you will pay for medical services.

If you have a Bronze high-deductible health plan, you will pay more when you go to the doctor than if you had a low-deductible, Platinum plan.

Patients who see doctors regularly may want a Gold or Platinum plan.

Also pay attention to whether the health insurance plan only covers services in its network.

Insurers typically only help pay the cost of visits to an in-network provider.

Or they may charge you more when you visit an out-of-network provider.

Health Plan Details

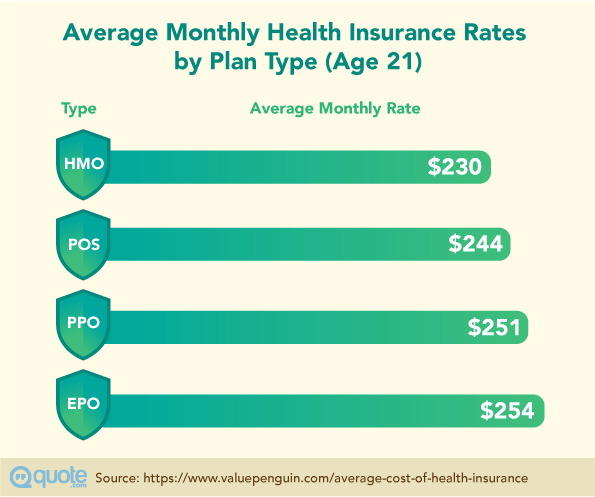

Health insurance plans vary widely based on price and flexibility.

In order to choose the right plan, it pays to understand how they differ.

The Affordable Care Act requires that all plans cover certain basic services, like hospitalization and preventative care, but not others, like adult dental care.

Yet just because a certain service is included doesn't mean it is covered at every hospital.

Most plans only help pay for treatment at doctors and hospitals in their network.

Different types of health insurance plans

When shopping for insurance on the Marketplace or comparing employer-sponsored plans, you will come across several types of insurance plans.

Health maintenance organization (HMO): Plans that only cover doctors who work for or contract with the network.

You pick a primary care physician who makes referrals to specialists.

HMO plans generally do not cover an out-of-network provider or service except emergencies.

Preferred provider organization (PPO): A flexible plan that allows visits to providers in and outside of its network.

Patients pay more to see out-of-network providers.

You don't need a primary care physician or a referral to see a specialist.

Exclusive provider organization (EPO): A plan that only covers doctors and hospitals within its network, except in emergencies.

You do not need a primary care physician or specialist referrals.

High deductible health plan (HDHP): Insurance with a lower monthly premium but higher deductible than most plans.

Individuals pay between $1,300 and $6,550 out of pocket before the insurer chips in.

These plans may be combined with a health savings account (HSA) to use tax-free money to pay costs.

Typically, plans with low premiums have little flexibility.

If you want more choice of doctors, you will have to pay extra.

Young people in good health should consider a high-deductible plan paired with a health savings account.

If you don't go to the doctor often and can save money tax-free, it may be a smart financial choice.

For most people, an HMO is probably an economical choice.

What health insurance plans cover

The Affordable Care Act requires that plans in the Health Insurance Marketplace cover certain essential benefits.

Although some employer-sponsored health insurance does not have to meet these criteria, most do.

Essential benefits include:

- Emergency services and hospitalization

- Outpatient care like doctors' appointments

- Pregnancy, maternity, and newborn care

- Birth control coverage

- Mental health treatment

- Blood tests

- Prescription drugs

- Preventative screening

- Rehabilitation services

- Child vision and dental

Adult vision and dental is not considered essential coverage, so not all plans help pay for visits to the ophthalmologist or dentist.

It is always covered for children, however.

By law, people with pre-existing conditions cannot be denied coverage or charged more for treatment.

Long-term care is usually not covered

Most health insurance plans, including Medicare, do not cover long-term care.

Medicare does cover:

- eligible home health services, like nursing or physical therapy

- hospice or respite care

- limited nursing-home stays

- care in skilled nursing facilities

For help with everyday tasks like bathing and eating, patients need to have long-term care insurance.

This is different from health insurance and should be bought in anticipation of future needs.

Who is covered in your plan

Insurance plans do not automatically cover spouses or children.

You need to add them to your plan.

When you get married, you have 60 days to add your spouse to your plan.

If you miss that deadline, you have to wait until the next open enrollment period to do so.

When a woman gives birth, the child is automatically covered for the first 48 to 96 hours in the hospital.

Some insurers allow coverage to extend for 30 days.

After that, you have 60 days to contact your provider and add the child to your health insurance plan.

If you are on an individual plan, you need to change it to a family or parent/child plan.

Children under 26 can stay on their parents' insurance, even if they are married.

After they turn 26, they have to buy their own coverage.

Insurance plans that qualify under the Affordable Care Act

The Affordable Care Act requires that all Americans have health insurance coverage or pay a penalty.

Yet not all health plans count as sufficient coverage.

Programs that help pay for only certain medical conditions or services do not qualify.

If you have only workers' compensation, a prescription discount, or dental care, for instance, you still have to pay the penalty.

If you have one of the following health insurance plans, you have qualified coverage and do not need to pay a penalty.

- Employer-sponsored health insurance

- COBRA insurance, for continuing benefits after you leave a job

- Most types of Medicare and Medicaid plans

- Children's Health Insurance Program (CHIP)

- Most student health plans

- Any health insurance plan bought through the government Health Insurance Marketplace (HealthGare.gov)

The IRS website has a detailed list of what qualifies as the minimum health insurance coverage to avoid the penalty.

What are premiums, deductibles, and copays?

When shopping for health insurance, you will come across many specialized terms.

They all denote different aspects of health insurance costs.

Understanding them is key to decoding a health insurance plan.

Premiums are what you pay each month

A health insurance premium is the amount you pay every month.

On average, annual premiums cost $6,690 for an individual ($558 a month) and $18,764 ($1,564 a month) for a family.

People on employer-sponsored plans don't pay that entire sum.

In 2017, workers contributed an average of $1,213 annually for individual coverage and $5,714 for a family.

Premiums vary widely on either side of the average.

They depend on many factors, such as the location and size of the employer.

Families in the Northeast, for example, pay more than in other parts of the country.

People in small firms pay lower average costs than those at large firms.

Deductibles and copays are out-of-pocket costs

In addition to the premium, consumers also pay a deductible.

This is the amount you pay for certain services before insurance kicks in.

After you reach the deductible, you will only make copayments (or "copays").

A copayment is a fixed price for covered health services, like $40 for a specialist appointment.

The Affordable Care Act sets an out-of-pocket maximum each year (outside of premiums).

In 2017, it was $7,150.

That's the most you will spend on deductibles and copays.

How to get a financial break on health insurance

The Affordable Care Act increased access to subsidized health insurance through the government Marketplace, the expansion of Medicaid in certain states, and the Children's Health Insurance Program (CHIP), sometimes referred to as, the child health care program.

Subsidies. If you purchase your health insurance on the Marketplace and qualify for a subsidy, your premium could be significantly less.

Subsidies are available to people whose household income is below 400% of the poverty line.

In 2017, that's $48,240 for an individual and $98,400 for a family of four.

The less you make, the higher your subsidy. For instance, a 35-year-old nonsmoker in Virginia who makes $40,000 per year could get a $142 subsidy in 2018.

If he made $30,000, he would get $260.

Medicaid and CHIP. Free health insurance is available through Medicaid and the Children's Health Insurance Program (CHIP).

If you live in one of the 33 states that has expanded Medicaid, anyone whose income is below 133% of the poverty level is eligible for free healthcare.

Your annual income needs to be about $16,000 for an individual and $32,700 for a family of four to qualify.

If your state has chosen not to expand Medicaid—this includes Texas, Mississippi, Kansas, and Florida—it will be harder to qualify for healthcare savings.

In Texas, for instance, adults are only eligible for Medicaid if they have disabilities, care for children, or are over 65.

The child health insurance program, CHIP, is available to low-income families who do not qualify for Medicaid.

For now, at least: Congress is currently threatening to cut the program's funding.

Other healthcare savings. There are many overlooked ways that you can save money on healthcare.

Many plans offer incentives for you to stay healthy.

They may reimburse you for a gym membership or give a discount if you quit smoking.

Major drugstores and supermarkets offer discounted prescriptions on common medications like antibiotics.

Sometimes it's cheaper to order prescriptions by mail when you buy large quantities.

However, the best way to stave off medical costs is to stay healthy.

Eating well, maintaining a healthy weight, limiting alcohol, and exercising reduce the risk of some diseases.

Private versus public health insurance

In the United States, health insurance is sold through private companies like Blue Cross Blue Shield or Aetna.

Whether you get insurance through your employer or on the government Marketplace, you will be purchasing private health insurance.

Medicaid, Medicare, and the Children's Health Insurance Program are the only forms of public health insurance in the United States.

Where to buy health insurance

Under the Affordable Care Act, anyone can sign up for health insurance on the Marketplace during the annual open enrollment period at the end of the year.

Dates vary by state. Go to HealthCare.gov to sign up.

People on employer-sponsored plans also have to choose a plan during a certain time every year.

Individuals and families who are not on an employer-sponsored plan can also purchase coverage directly from health insurance companies or through a labor group like the Freelancers Union.

You still have to sign up during the open enrollment period.

You can purchase insurance outside the open enrollment period if you have a qualifying life event such as marriage, birth of a child, or job loss.

Health Insurance Companies

Health insurance is not like other consumer products that allow you to shop around.

Your choices depend on where you live and vary from state to state.

All of the topics above should factor into your health insurance choice.

Even if you don't have many options, you want to understand what you're signing up for.

How to read health insurance plans

Health insurance plans are complicated, with hidden costs and fine print. Drink some caffeine before you start shopping—and keep a calculator handy.

This involves a bit of math.

What type of health insurance plan is it? Is it an HMO or a high-deductible health plan?

These plans will determine how much flexibility you will have to visit doctors outside of the plan's network and whether you will need referrals to see a specialist.

Who's in the provider network? What hospitals and doctors are in the insurer network?

If you have a primary physician, see if she is part of the network.

Otherwise, you'll end up shelling out extra for out-of-network doctors.

Some low-cost plans are limited to public hospitals and nonprofit clinics.

These typically require more planning, since you may have to wait a long time to get an appointment.

What are the premiums and deductibles? Many people think a low monthly premium sounds good.

But what if it's a high deductible?

You may end up spending more than you bargained for.

Low deductibles are best if:

- you go to the doctor often

- have a chronic or pre-existing medical condition

- take expensive medications

- plan to have a baby

- are likely to need surgery soon

High deductibles are best if: you are healthy and rarely see a doctor.

What are the benefits? Read the health plan benefits carefully to see if it will cover your needs.

For instance, what maternity care does it cover?

Does it include free health clinics?

Are your prescriptions covered?

Major insurance companies

There are dozens of healthcare companies nationwide.

Major companies include:

- Aetna

- Blue Cross Blue Shield

- United Healthcare

- Kaiser Permanente

- Cigna

- Humana

Some states have limited options.

Wyoming, Oklahoma, and Nebraska have only one health insurance issuer on the 2018 Marketplace.

Aetna is one of the biggest. Aetna's nationwide network includes nearly 6,000 hospitals and over a million healthcare professionals.

With 47 million patients, it is one of the country's largest insurers.

It's getting bigger, since CVS Health recently acquired Aetna.

While the merger is still being worked out, Aetna members will likely find discounted services at one of CVS' hundreds of local clincs.

Aetna receives strong ratings from the National Committee for Quality Assurance, especially its plans in Pennsylvania, New Jersey, and Connecticut.

Blue Cross Blue Shield affiliates get good reviews. Blue Cross Blue Shield insures one in three Americans, including federal employees. In the United States, 96 percent of hospitals and 93 percent of doctors contract with Blue Cross Blue Shield (BCBS) companies.

It is an association of 36 independent local companies that operate in all 50 states, plus Washington, DC and Puerto Rico.

However, if your insurance is a from a BCBS company, you do not automatically get access to that entire network.

Each of company is independent, with its own local network of hospitals and doctors.

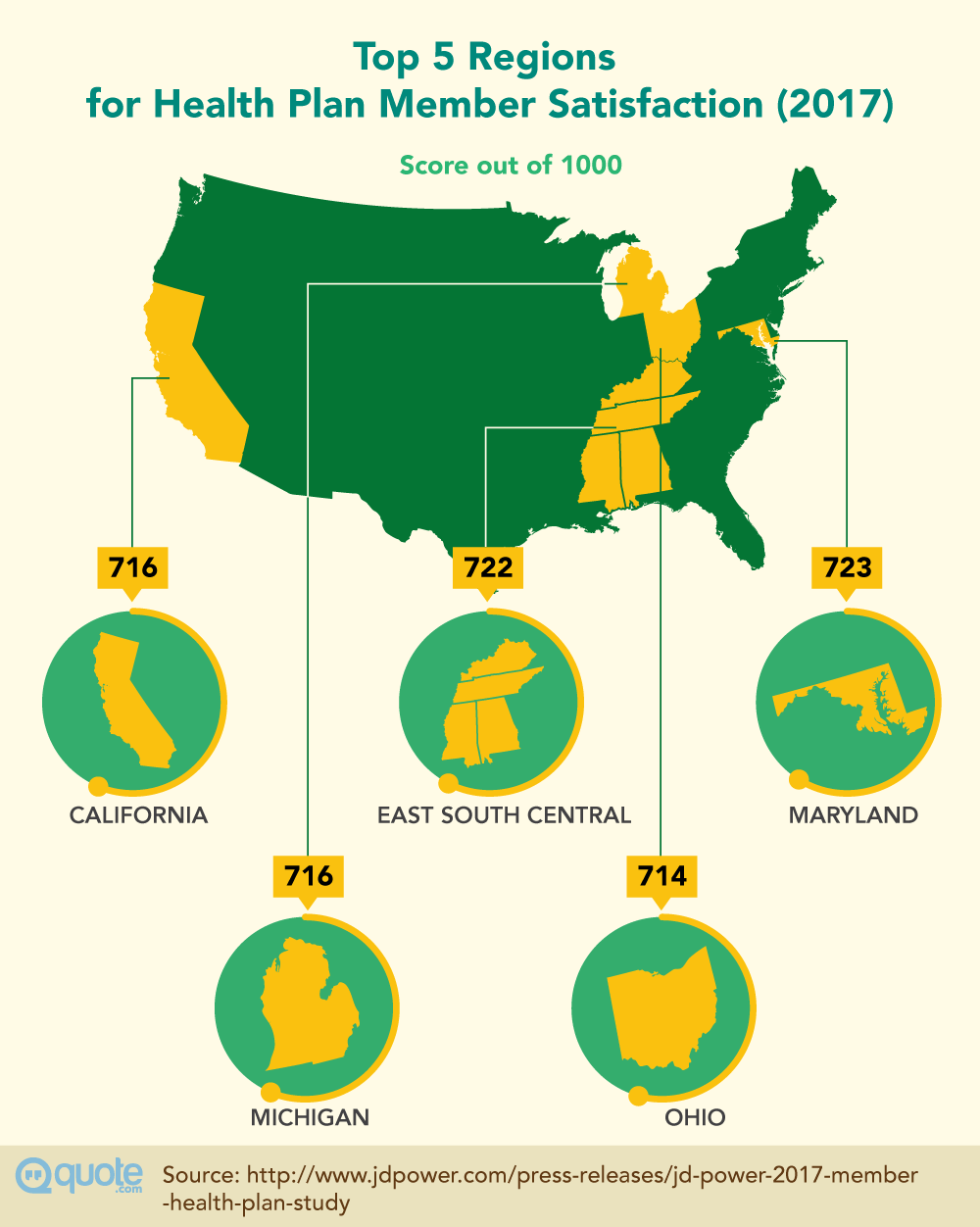

Its companies ranked the highest in several regions in the 2017 J.D. Power Member Health Plan Study, which measures customer satisfaction (based on premiums, benefits, network, communication). These include:

- Highmark BlueCross BlueShield of Delaware

- BlueCross BlueShield of Tennessee

- BlueCross BlueShield of Arizona

The National Committee for Quality Assurance gives Anthem, another BCBS company, high rankings in Maine, New Hampshire, and Connecticut.

Kaiser Permanente is a highly-rated nonprofit. Kaiser Permanente (also called Kaiser Foundation Health Plan) is a health insurance plan with 11.7 million members.

Based in California, it has a strong West Coast presence and also operates in Colorado, Georgia, and the Mid-Atlantic region. Its network includes 39 hospitals, 680 medical offices, and 75,000 physicians and nurses.

It regularly gets top consumer-satisfaction ratings in the annual J.D. Power Member Health Plan Study. In 2017, it ranked highest in the Maryland, South Atlantic, California, Virginia, Northwest, and Colorado regions.

United Healthcare is big and gets mixed reviews. A major insurance company with a presence in all 50 states, United Healthcare's network includes 6,000 hospitals and a million physicians and healthcare professionals.

The UnitedHealth Group invests over $3 billion a year in technology and is noted for its commitment to innovation.

It's plans have middle to low rankings in the National Committee for Quality Assurance's 2016-2017 ratings. NCQA compared plans based on clinical quality and member satisfaction.

You can find the right health care plan

Healthcare in America will never be simple, but it's more approachable when you understand how the system works.

The right insurance plan will keep you healthy, financially secure, and protect you from surprise medical bills.

Now find the plan that works for you and get covered!

Have you ever struggled to buy health insurance?

What worked and what didn't?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.