Choosing the right health insurance plan for you or your family can be daunting.

Health insurance plans seem complicated because, well, they are complicated.

There are different tiers and different types of plans, all of which mean different realities for you as the consumer.

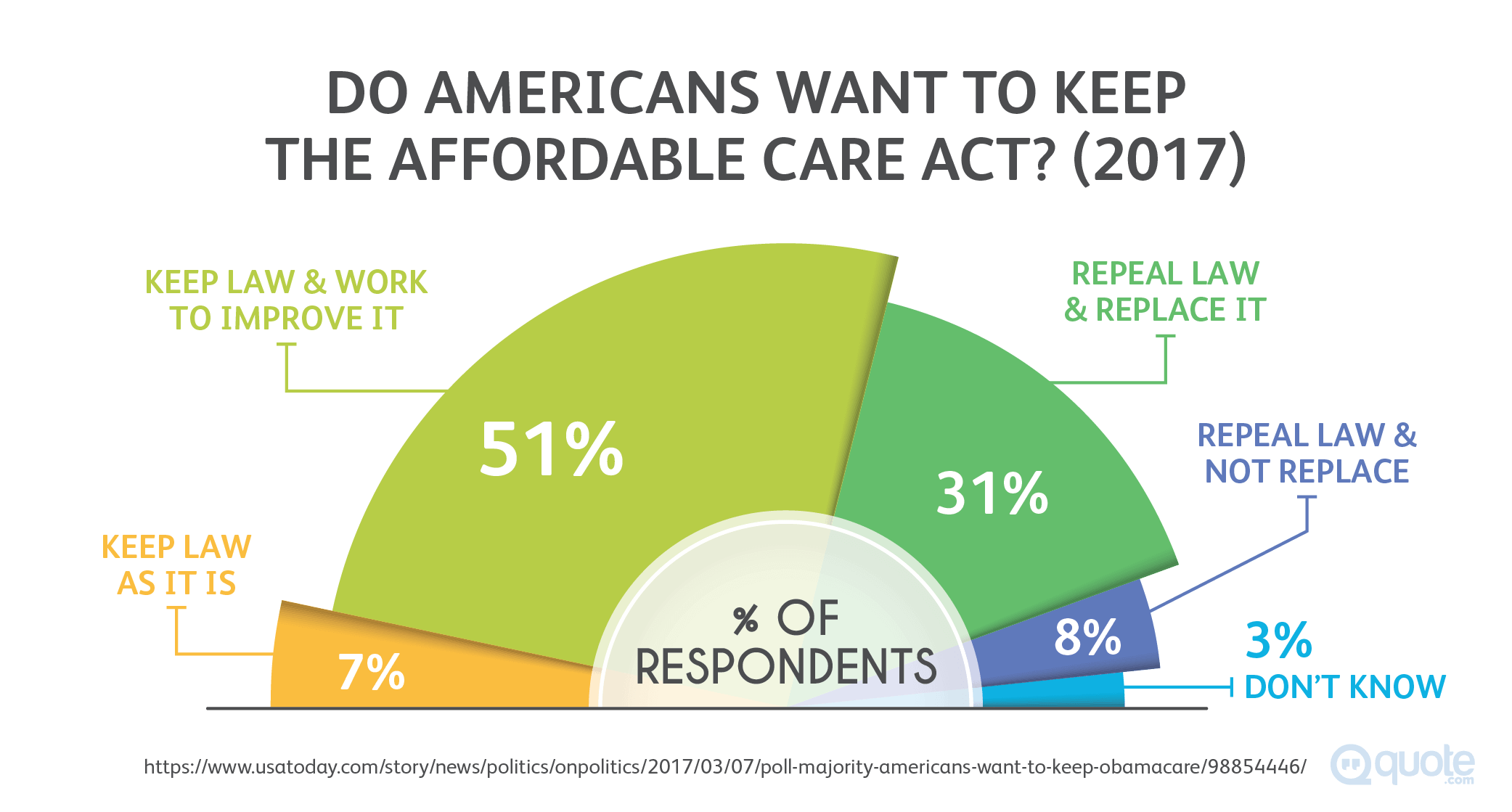

Previously, under the Affordable Care Act, everyone was required to have health insurance.

Those who didn't have an employer-sponsored health plan, or who don't qualify for Medicaid or Medicare, needed to choose some form of individual health care plan.

Insurance coverage was made mandatory because it's important.

Today, the requirement for all Americans to have some form of health care coverage has been repealed.

Although it might not be the law anymore, it's still incredibly important to choose the right coverage for you and your family.

There's a lot of confusion about health insurance right now.

One thing stays the same: You want to make sure your family is covered for health-related costs. Especially expensive ones.

You'd also like to know you didn't pay more than you had to for the coverage you need.

When you lack the knowledge and information you need to make the right choice, you can end up losing thousands of dollars.

Nearly 75% of Americans who purchase insurance are "illiterate" when it comes to the terms they see on the plans they're comparing.

A recent study revealed 71% of health insurance consumers couldn't define basic plan terms like "deductible," "copay," and "out-of-pocket maximum."

If you're not sure what those terms mean, don't worry—you're in good company.

You're also in the right place to gain the knowledge and information necessary to choose a health insurance plan to best meet your situation and needs.

The same study found people who don't know how health insurance works choose plans that are not right for them, and they tend to pay more than necessary.

I understand why people overpay.

They want to make sure there will be coverage for them and their family if a worst-case scenario happens.

They believe paying more means better care and coverage.

Unfortunately, health insurance plans don't really work that way.

I've learned a lot about health insurance and it frustrates me to see people needlessly overpaying.

Another problem I see a lot is people who only look at the bottom line of the monthly payments (premiums) instead of considering the total cost of healthcare coverage and insurance.

My job is to empower people with the knowledge they need to make informed decisions in the best interests of their family's health, as well as their budget.

I get it—the stakes are super-high.

The most important thing in my life is my family.

I wouldn't want my family to lack coverage for any kind of medical need, especially a serious and expensive one.

Another huge source of frustration for me is the fact that the number-one reason for bankruptcy in America today is due to medical bills.

People need to take out personal loans to cover their healthcare costs.

Even with the most basic coverage, people should be able to avoid getting completely swamped by healthcare costs.

I'm personally motivated to help you prevent such a situation.

The good news is, you can customize an insurance plan to meet your needs whether you are a regular user of healthcare services or someone who never goes to the doctor.

I want you to know everything you need to know to get the best value for your health insurance plan.

You'll sleep well at night knowing your family is covered to your satisfaction and you didn't pay too much.

I'm going to help you learn how to choose plans by understanding the benefits that work best for you.

There is a plan out there perfectly suited to your needs and preferences, so let's find it!

How Individual Plans Work

Individual health plans cover all basic treatments and services

The reality is, since Obamacare came completely into effect in 2014, the different health plans available today don't vary a whole lot when it comes to what actual healthcare services they cover.

The difference is the level and cost of coverage.

No matter what healthcare plan you choose, it should include basic coverage benefits.

Health care plans all cover a broad range of preventative and emergency benefits

There is a very broad spectrum when it comes to the healthcare treatments and services people need.

Health insurance plans all cover the basics.

Outpatient care happens in the doctor's office. When you get treatment at the office of your physician, it's covered.

Emergency room visits are essential. You wouldn't want concerns over costs to stop anyone from going to an emergency room for treatment in a crisis.

Hospital-based treatment is a core service. If you have to spend time in the hospital, the bills can really start to rack up. Inpatient hospital treatment is covered.

Maternity and newborn care support families as they grow. Having a baby usually requires some service support from the healthcare sector.

Insurance will cover the costs.

Prescription drugs are important tools for treatment. Drugs can also cost a lot of money, so health care plans include some coverage for medications.

Rehabilitation services provide therapy for a full recovery. Occupational therapy, speech therapy, and physical therapy are all programs to help people achieve healthy functioning.

Health insurance plans cover these important services.

Substance use and mental health services should not be stigmatized. It's a human right to access mental health services and programs for addiction recovery.

Thanks to health insurance plans, cost isn't a barrier.

Laboratory tests are expensive but necessary. Blood work, x-rays, urinalysis, and other tests need to be analyzed in a lab.

The costs are high, so insurance covers lab work.

Preventative treatment saves money downstream. Preventing illness is a lot less to pay for compared to treating it.

It makes sense for health insurance plans to all cover screenings, regular check-ups and physicals, and other preventative services.

With the Affordable Care Act (aka Obamacare) preventive care, vaccinations and screenings can't be charged additional fees like co-pays, deductibles or coinsurance (keep reading to find out what those terms mean).

Chronic disease management is a long-term concern. Basic benefits include coverage for services and treatments for diseases like COPD, diabetes, and heart conditions.

Pediatric services keep kids healthy. Insurance plans all include basic coverage for kids' health care, including oral and vision care.

Paying more in insurance for better care is a myth. No matter what health insurance plan you choose, all these basic services are going to be covered.

The difference will not be the services themselves, but rather the level to which the insurance covers them.

For example, what happens when a person breaks their leg?

Two people show up in the emergency room, both needing treatment for a broken leg.

One has a health insurance plan with a high deductible and a low premium.

The other has a health insurance plan with a low premium and a high deductible.

They're both going to get the exact same level of care.

The only difference will be the final cost to each of them.

Insurance Plan Factors

Are you illiterate when it comes to the terms and conditions you find on healthcare insurance plans?

Get familiar with health insurance plan payment terms before you start trying to choose the right one

The next step is to get to know the meanings of the terms you see when you get a health insurance quote.

Then you'll have the knowledge you need to accurately compare different quotes.

There are five factors you need to understand when you're picking the right plan for you

Different quotes are going to have different numbers for each of these terms. By understanding what they mean, you can make an informed decision when it comes to comparing the cost of coverage.

"Premium amount" is the upfront cost. It's the monthly or yearly bill you get for enrolling in the insurance plan.

Even if you don't use any medical services, you pay this amount.

"Copay" is a fee you pay for a service or treatment. Depending on the plan you choose, a standard fee for various services could be charged.

For example, you might be charged a $30 copay every time you visit the doctor's office.

"Coinsurance" determines how much of a bill you pay. Your insurance plan could cover 80% of a particular medical service, meaning you'd have to pay the remaining 20% of the bill.

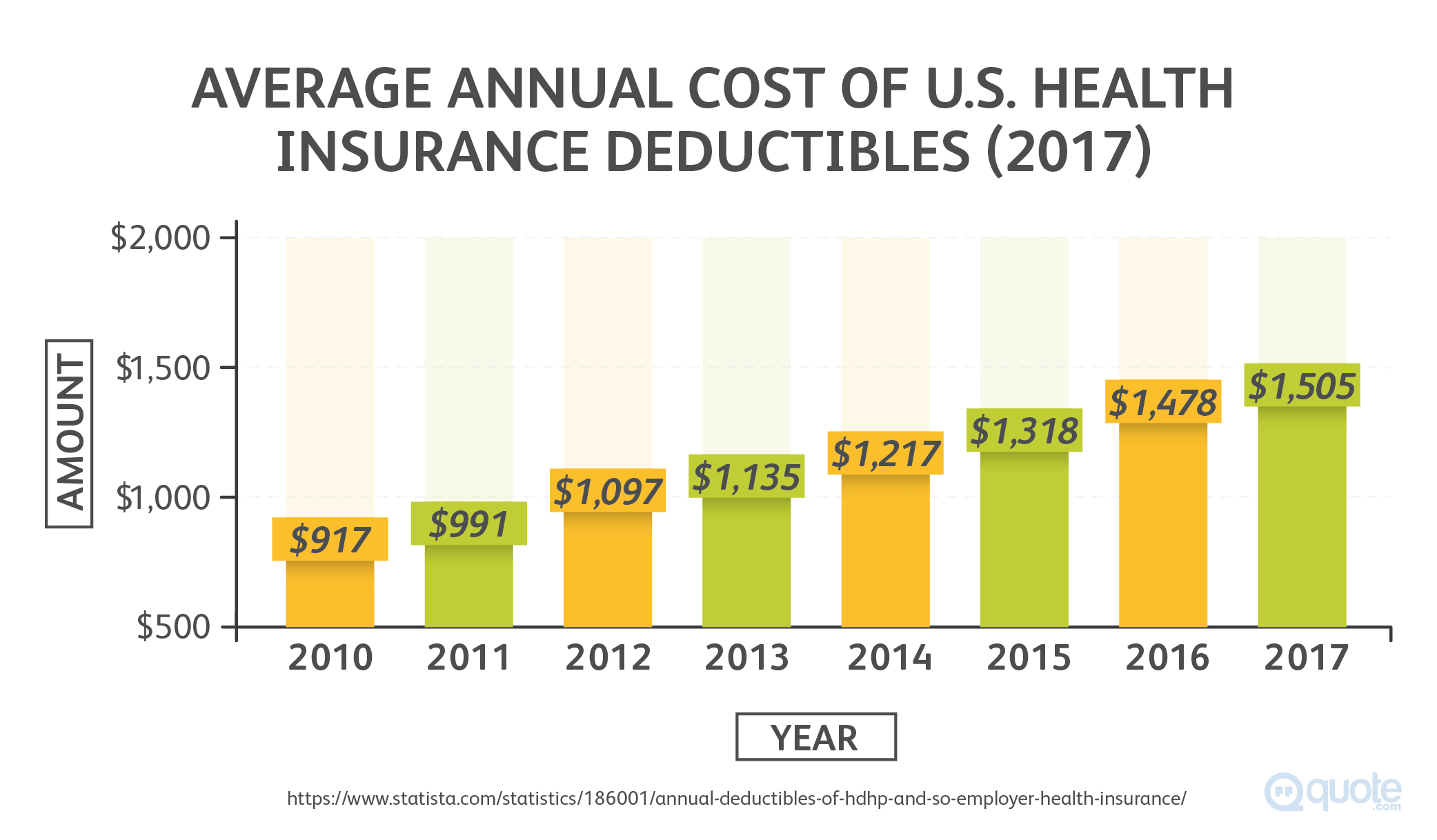

"Deductible" is what you pay before the insurance kicks in. Health insurance benefits are applied after your payments reach the agreed-upon deductible.

A higher deductible usually means a lower premium.

Our friends at The Motley Fool give a good explanation on the pros and cons of high deductible plans.

"Maximum out-of-pocket expenses" protect you from out-of-control medical bills. Your health insurance quote will include a dollar value for the maximum you can pay each year on deductibles, copays, and coinsurance.

When you've reached the agreed-upon maximum, the insurer is responsible for paying the rest of the costs.

The "MOOP" became a mandatory element of health plans when Obamacare was passed.

Quotes include a dollar value or percentage for all five of these factors.

Here's an example of the costs and coverages for an individual private health insurance plan

The monthly premium payment is fixed. A health insurance plan client pays a monthly premium of $400 a month (or $4,800 annually).

Copays are charged at $25 a visit. The quote will specify the amounts and the services requiring copays.

Medical tests, office visits, and other services are charged this flat user fee. Some plans don't include copays.

The deductible is set at $5,000. The insurance plan doesn't start paying until the client has paid the full costs up to $5,000.

Co-insurance is 20% to the client. Once the deductible is hit and insurance kicks in, the customer still has to pay 20% (up to the out-of-pocket maximum).

The annual out-of-pocket maximum is $6,000. Once the client has paid $6,000 in deductibles, copays, and coinsurance in one year, the insurance company pays 100%.

How it works if you are in a car accident and need care

Let's say you had a car accident and with a cost of $60,000 in medical bills for one year.

You would pay the first $5,000 in the medical costs yourself.

Another $1,000 would be spent as $25 copays for appointments and 20% co-insurance towards the costs of hospitalization.

The insurance company would pay $44,000, and you'd pay the maximum out-of-pocket amount of $6,000.

Just be aware, next year your $400 monthly premiums are definitely going to go up!

The Differences Between Plans

Different types of health insurance plans determine who cares for you

Depending on the type of health insurance plan you choose, the coverage you receive could be restricted to services delivered by members of a particular network.

The differences between the plans influence who an insurer will pay for services.

Plans also differ when it comes to how the insurer pays and how much the insurer pays.

Evaluate your current health before you pick a plan

The key to making the most of your health insurance plan is to pick the one with benefits most suitable for your own health status and usage.

Perform a self exam. To match yourself with an ideal plan, do a bit of a self evaluation to determine how healthy you are.

How to Proceed

Take an inventory of all the healthcare services you use

Make a bit of a list measuring how much you actually access healthcare services and resources.

Seen a doctor lately? Estimating how many times a year you typically visit the doctor is a good start.

Do you find yourself in the doctor's office every month?

Or have you forgotten who your family doctor is because it has been so long since you saw them?

Got meds? If you take prescription medications regularly it's going to cost big.

Do you need care from specialists and medical facilities? If so, you need to pick a health insurance plan with coverage for accessing a specialist.

Some types cover only local and in-state services, while others cover out-of-state.

Pick your plan based on your health. If you're the type of person who only sees your doctor once a year for a check-up, you'll be looking for a plan with a low monthly premium and very basic coverage.

If you go to the doctor a lot and are living with a chronic illness, look for a plan with a lot of benefits.

It will cost you a higher monthly payment with the advantage of more affordable trips to the doctor.

Types of Health Insurance Providers

Most types of health insurance plans come with a network of healthcare providers

With most health insurance plans, there is no need to search around for a family physician.

You choose a Primary Care Provider from within the plan's network.

The different types of individual health insurance plans all give preference to specific care providers in their network.

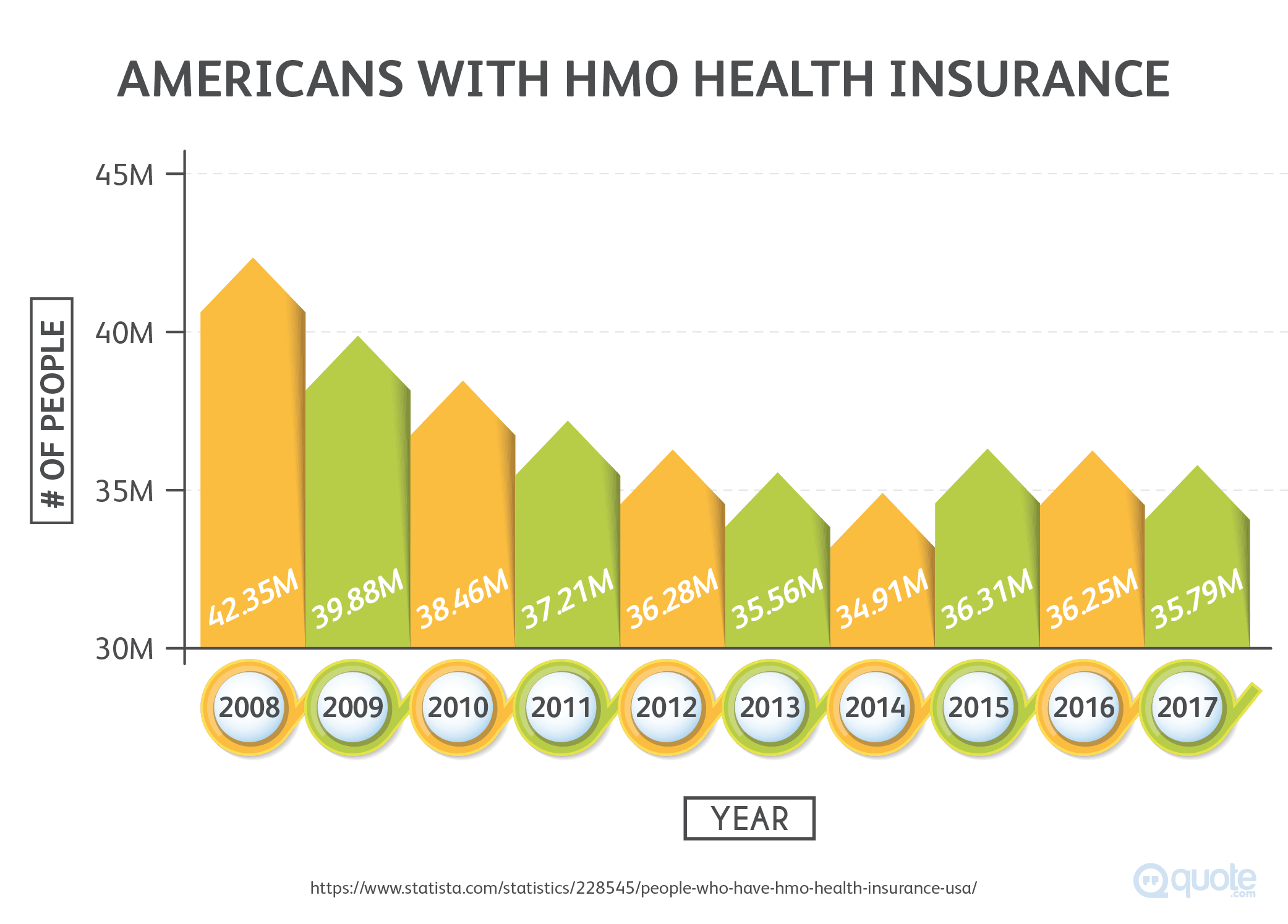

Health Maintenance Organizations (HMOs) provide comprehensive care

When you choose an HMO health insurance plan you first choose a Primary Care Provider.

Access to diverse healthcare providers. Customers are then able to access other healthcare providers in the HMO's network.

Since these plans are focused on prevention and wellness, coverage includes multiple practitioners within the network like dietitians and chiropractors.

Healthcare experts like those at Dignity Health recognize the importance of approaching health via different factors such as diet and lifestyle.

No out-of-network benefits. Coverage is available for out-of-network care services if it's an urgent, medically necessary emergency.

However, if it's not an emergency, the plan's coverage is restricted to the HMO network of care service providers.

Strictly local. HMOs are also locally based, which means the coverage doesn't include out-of-state healthcare services.

For example, the Meritage Medical Network is an HMO only serving members in Marin, Napa, and Sonoma Counties in California.

Referrals required. With an HMO, you need a physician referral for a healthcare service to be covered.

Preferred Provider Organizations (PPOs) cover out-of-network

Unlike HMOs, out-of-network care coverage is covered by PPOs, only the percentages are different.

It will cover a higher percentage of an in-network service than an out-of-network healthcare service.

Discount for in-network services. Customers pay less for services provided by members of the PPO network.

It's much more expensive to utilize other providers.

Unlike HMOs, PPOs can cover services accessed outside of the state as long as they are members of the PPO network.

You can also get covered care from a specialist without a referral.

Point of Service (POS) plans are a combination of HMOs and PPOs. These plans are similar to HMOs since you need a referral from your primary physician to get coverage for specialists.

The similarity POS plans share with PPOs is the ability to get out-of-network coverage with lower prices for in-network providers.

High Deductible Health Plans (HDHPs) work with health savings accounts

HDHPs come with lower premium payments and a higher deductible compared to other plans.

An HDHP is a requirement for a health savings account, which is an account an employer sets up for tax-free contributions to be used only for medical expenses.

HDHPs are usually a form of employer insurance coupled with the health savings account as an employee health benefit.

By the way, Belle News offers some great advice for employers who need to choose the right healthcare for their employees.

Catastrophic coverage plans provide coverage for major health crises

Catastrophic coverage is a low-cost plan option with a low monthly premium and a high deductible.

This type of plan could save money and still be there in the case of a serious (and expensive) health issue like a car accident or cancer.

Catastrophic coverage is considered a suitable health insurance option for people under 30.

Three Health Plan Tiers

Customize your plan by choosing the tier most fitting to you and your health

Within any of the types of health insurance plans listed above, the customer has the option of picking the Bronze, Silver, Gold, or Platinum package.

Bronze is for healthy people only

If you are looking for coverage at the lowest price and still want to know you're protected in a worst-case scenario, pick the Bronze tier.

You'll pay a low monthly premium. Bronze plans are the most affordable when it comes to paying upfront costs.

The deductible will be high. The trade-off is you will often pay thousands in medical bills before you hit your deductible and the coverage kicks in.

Go with Silver if you're not comfortable with the basic minimum

Silver coverage offers moderately higher premiums and lower deductibles compared to the Bronze package.

Silver is the tier for discounts. If you'd like to have more of your routine care covered, Silver is a good choice.

If you qualify for special discounts known as "cost-sharing reductions" you need to choose the Silver tier to receive the extra savings.

Care costs you less with a Gold tier package

Gold tier plans are high premium and low deductible packages.

With a low deductible, the insurance kicks in earlier and the costs of care are less to you.

Good for frequent care users. If your self-evaluation indicated you access healthcare a lot, Gold is a good option to keep costs down.

Pay a lot for Platinum's big coverage

Choosing a Platinum tier option for your health insurance plan means you'll be paying the highest possible premium.

It also means you'll be paying the lowest deductible.

If you're a heavy healthcare user, it makes more sense to pick a Platinum package and pay a higher premium yet pay less for each individual visit.

Here's how the cost-splitting works for each tier

One of the most important differences between the different metal tiers is their respective splitting of costs between the customer and insurance company.

Bronze is a 60/40 split. If you paid your full deductible and there was a $1,000 hospital bill, you'd pay $600 and the insurer would pay $400.

Silver pays 70%. You must pay 30% for medical services beyond the deductible and under the out-of-pocket expense max.

Pay less than a quarter of the costs with Gold. Gold tier packages see the insurer paying 80% of costs over the deductible and under the max out-of-pocket spend.

Platinum almost pays for it all. With a 90% payment from the insurance company, all you're left to cover is 10% of the bill with a Platinum tier plan.

Remember, the rankings have nothing to do with the quality of care. I mentioned this at the beginning, and I'm going to mention it again because nothing makes me more frustrated than seeing people pay more for insurance than necessary.

Choosing the "Platinum" option doesn't mean you're paying for the best healthcare possible for you and your family.

It does mean when it comes to splitting healthcare costs, you've picked the option where the insurance company pays the majority of the expenses.

Compare quotes and choose the health insurance plan that works for you

You're now officially empowered with all you need to know to compare and choose between the various types and categories of health insurance plans.

Health insurance in the post-Obamacare era is even more confusing than ever and the changes are not over.

You can feel confident you will be able to choose the right coverage for you and your family by applying the tips and info you've learned here.

There are some next steps you can start right now.

When you are looking at a quote, try to estimate the total cost of care for you and your family members.

Don't just look at the premium.

Calculate out-of-pocket costs, copayments and coinsurance costs, and the deductible you'll have to pay based on the estimated healthcare usage for you or your family.

The savings could be in the thousands for a little bit of extra work.

I've helped many people match their health insurance plan with their circumstances.

The power is with the consumer to customize an option that works best for them.

The problem is very few people look at anything other than the price of the premium.

I hope what I've shown you here gives you everything you need to make an informed choice.

Choose the right price for the right coverage and feel secure your health needs will be met without paying too much.

Do you have any advice or tips for choosing the right healthcare insurance plan?

What's your experience?

Share with us in the comments below!