Introduction

Finding the right insurance coverage can be a difficult, time-consuming process.

That's why experience and industry-leading practices go a long way for companies to stand out to their potential and current members.

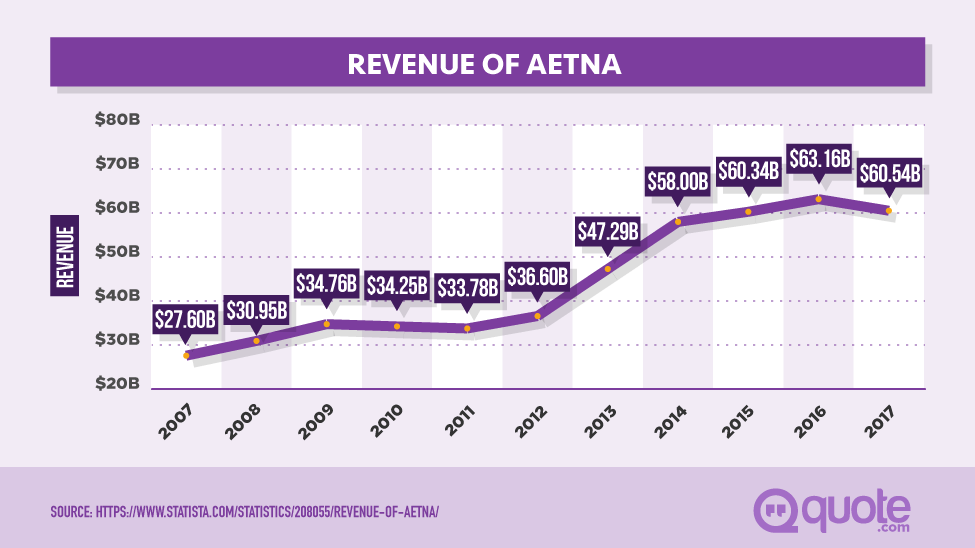

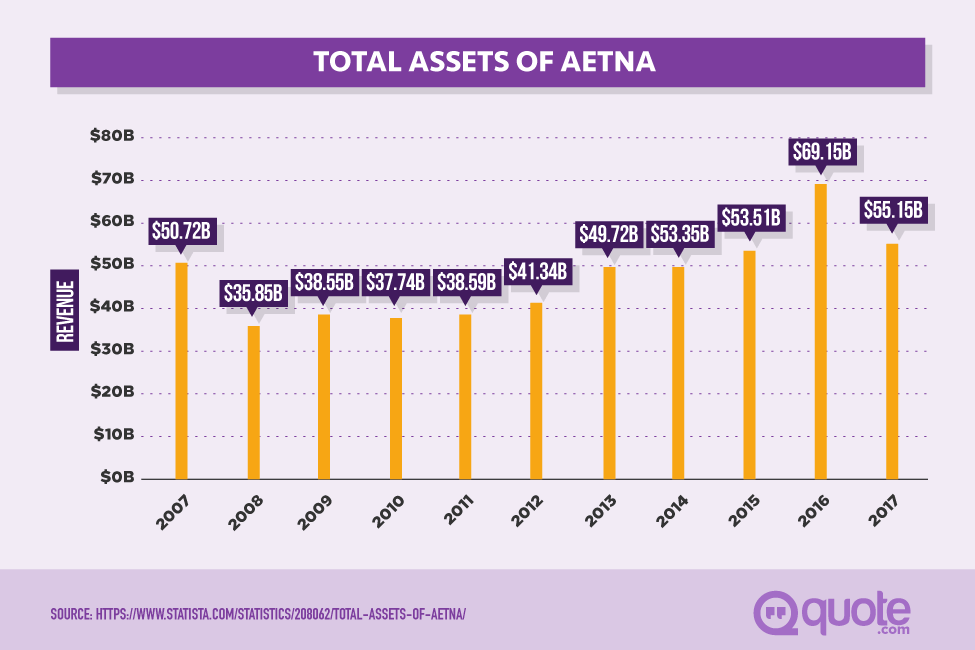

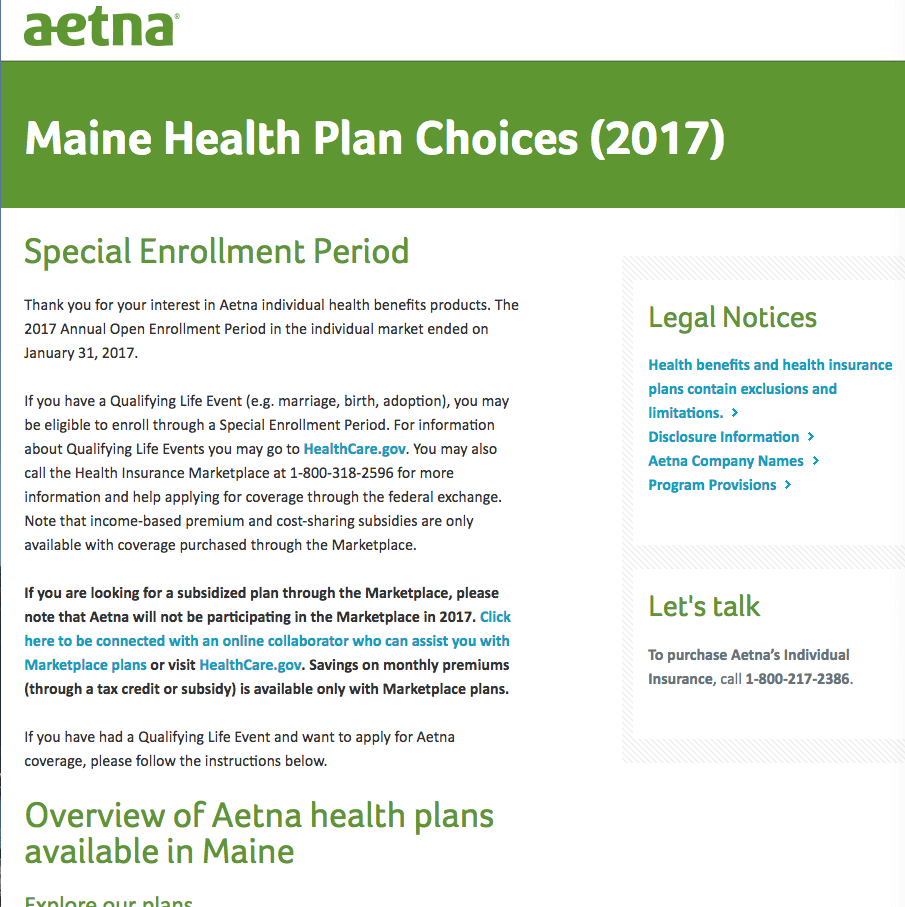

Aetna is the third largest health insurance provider in the United States, according to Forbes, and their revenues exceeded $60 billion as of December 2016.

Even though they've been around for over 160 years, they show no signs of slowing down their long-standing progress. They currently have:

- 23.1 million members insured through their health plans

- 14.5 million members insured through their dental plans

With stats like those, you may be wondering about switching providers to accommodate your health, dental, and wellness needs.

If that's the case, today's guide should provide you with everything you need to make an informed decision about Aetna's services.

Today we'll be covering Aetna's history and company background, discuss the specific types of coverage plans they offer, talk about their customer service reviews, and highlight their strengths and weaknesses.

We'll even answer some of the most commonly asked questions that pop up about their services.

When you're done with this guide, you'll have a better idea of what kind of company Aetna really is and if they might be the right coverage choice for you and your family.

So What is Aetna Anyway?

Before we dive into the specifics, let's talk about Aetna's unique 160-year history we just mentioned.

Initially, Aetna established its roots by selling life insurance way back in 1850.

Their new life insurance policies "paid dividends to policyholders similar to how mutuals did," their website explains, which attracted Americans looking to invest in life insurance policies after the devastation seen during the Civil War.

Aetna's competitively priced policies helped them grow by 600% and top $1 million in annual income by 1864.

In 1907, just one year before Ford's iconic Model T was mass-produced, Aetna started offering car coverage.

Aetna then focused its attention on selling group life insurance policies, becoming the first provider of such coverage in 1913. From there, Aetna offered group disability policies four years later.

During the next 30 years, Aetna "bonded the construction for" U.S. government projects such as:

- The Hoover Dam

- The National Archives Building (Washington, D.C.)

- The construction of seven U.S. Navy aircrafts

- The UN headquarters (New York, NY)

In 1944, Aetna was tasked with the responsibility of supplying "insurance coverage for the Manhattan Project, which produced the world's first atomic bomb."

Three years later, Aetna provided group coverage to the United Nations.

Aetna then went on to create a major medical policy that paved the way for employers to provide benefits to their employees in order to attract and retain hard workers.

This landmark became what Aetna is most commonly known for today.

In 1960, Aetna moved into the international insurance sector by acquiring Excelsior Life Insurance, a Canadian company. They then partnered with Italy's Assicurazioni Generali to create a network of insurance products available in over 70 countries.

By 1968, Aetna expanded its global reach by acquiring a Sydney, Australia-based company known as Producer's and Citizen's Cooperative Assurance Company.

Ten years after this move, Aetna created its HMO subsidiary, and by 1985, it had become the nation's largest private health insurer, offering not only HMOs, but also PPOs and other competitive products as well.

Aetna merged with U.S. Healthcare in 1996, and then Aetna acquired:

- NYLCare Health plans

- Prudential HealthCare

- Strategic Resource Company

- ActiveHealth Management

- HMS Healthcare

- Schaller Anderson

- Coventry Health Care, Inc.

- InterGlobal Group

Through these acquisitions, Aetna became the third-largest health care benefits company in America, according to their site. They continue to be a major powerhouse in this space today.

Aetna's current mission is to build a healthier world and a better health care system through the services they offer.

Let's take a look at those now.

3. What are the Services Offered by Aetna?

Aetna provides coverage options under the following categories:

- Medical

- Dental

- Life

- Disability

- Medicare

- Medicaid

We're going to explore each option in the next few sections.

Medical and Pharmacy Plans

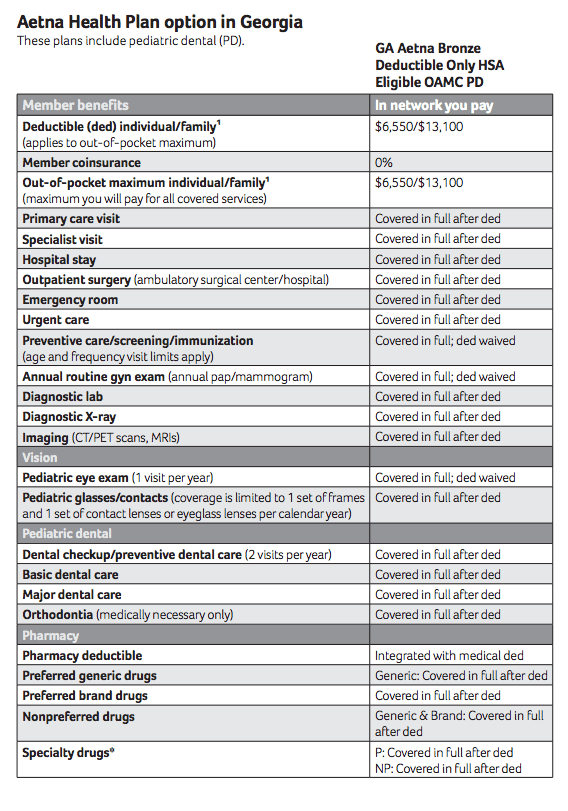

There are three different plan levels you can choose from when deciding an individual plan: Bronze, Silver, and Gold. The difference between each plan has to do with the monthly premium costs and your out-of-pocket expenses.

If you're looking to pay a lower premium, you're going to incur higher out-of-pocket costs. This is how the Bronze plans work.

Gold plans will cost you more each month, but their out-of-pocket expenses are the lowest of all three plans.

If you prefer a healthy balance between how much you pay for your monthly premium and your expected out-of-pocket costs, a Silver plan is your best bet.

However, these options are only available if you live in a state that Aetna provides coverage for.

And in some cases, Aetna may provide coverage in your state but not for your particular county. To find out if you're eligible, head over to Aetna's site.

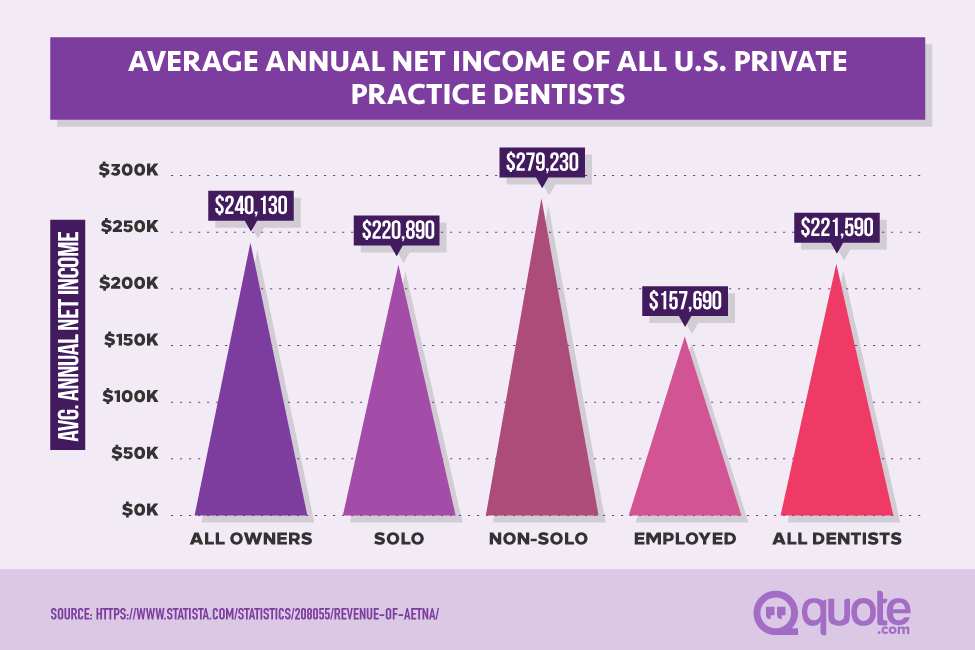

Dental Plans

Dental plans are also not available everywhere in the US.

In fact, only five states–—Alaska, Arizona, Delaware, Illinois, and Pennsylvania–—actually have dental coverage available through Aetna.

If you live in one of those states, you can choose between two different plans at this time:

- Aetna Individual Advantage PPO Plan

- Aetna Individual Advantage PPO Plus Plan

Check out the above image and you'll notice that they differ in your deductible amount and how much of the bill will be paid by your insurance.

With the PPO Plus plan, your plan covers more of the invoice up-front and has a lower deductible. But to enjoy these perks, your monthly premium is slightly higher than the regular PPO.

For a regular PPO plan, you'd be responsible for a higher portion of your bill each time and $50 more for your deductible. But this also comes with lower monthly payments.

Life Insurance Plans

According to their site, life insurance plans from Aetna are only available via employer-provided plans.

So individuals purchasing insurance on their own or through the Marketplace are not eligible for this type of coverage.

In addition, "not all benefit plans are available to all members."

So you'll need to do your homework here to see if you're eligible for life insurance coverage through Aetna. To do this, just follow this link.

If you learn that you're eligible, you can sign up for the following life insurance plan options:

Accelerated Death Benefit

With this life insurance coverage, you can request payments from Aetna as soon as you become terminally ill.

Conversion

When you stop working or are no longer eligible to work, you can exercise your conversion option on your current group term life insurance plan. Use this link to learn more.

Premium Waiver

A premium waiver provision means that you don't have to pay your monthly premiums should you become disabled before a pre-determined age.

This only becomes applicable if the disability lasts for a pre-determined amount of time as well.

Portability

Some plans also have the option of portability, which means you'll be able to take your coverage with you even if you leave your current role.

Accidental Death & Personal Loss (AD&PL) coverage

This type of coverage provides benefits to policyholders who have been injured (or killed) in an accident.

You can also add Supplemental AD&PL to receive additional coverage above your plan's basic foundation.

Keep in mind, the amount of money paid out for either of these options depends on factors such as the type of injury sustained, your coverage amount, and other similar details.

According to Aetna's site, "Not all injuries caused by an accident will qualify you to receive benefit payments."

Some common injuries that may qualify for this coverage include:

- Paralysis

- Loss of speech or hearing

- Loss of sight

- Third-degree burns

- Loss of limbs

- Death

In addition to life insurance plans, you can also opt for disability plans through your employer. Once again, these plans cannot be purchased via individual plans.

Disability Plans

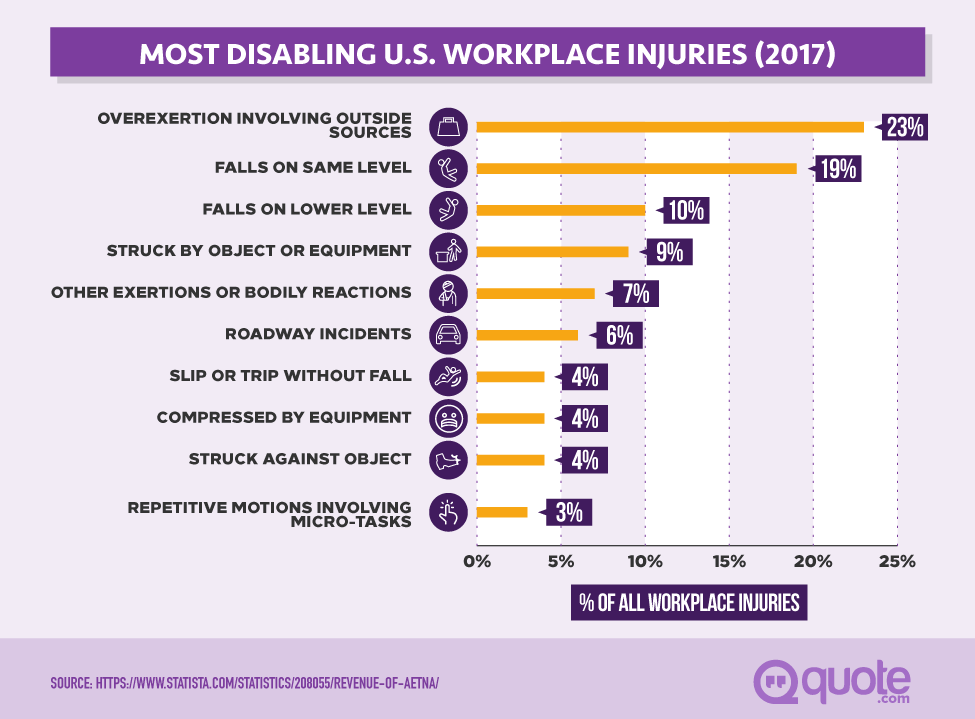

Disability plans cover periods lasting weeks or months when you cannot work due to reasons like:

- Illness

- Injury

- Pregnancy-related conditions (i.e., prescribed bedrest)

With this type of coverage, your income, housing, food, and other necessities are protected and paid for.

So while your medical insurance covers your doctor visits and medical expenses, disability takes care of the major everyday expenses, their site notes.

With disability coverage, you'll be given a portion of your income each week while you are out of work.

You'll be able to maintain your current standard of living and keep up with your monthly expenses despite being unable to work. This means you won't have to cut back or tap into your savings should something unexpected occur.

You have two options when it comes to Aetna's disability plans: short-term disability and long-term disability:

Short-term Disability

For this coverage to kick in, you must be out of work for a specific number of workdays. This is known as the elimination period.

On top of that, you're only covered during a pre-specified period of time. If your disability runs over this limit, you must opt for long-term disability to be covered (more on this next).

As for how much you receive each week, that depends on:

- Your annual salary

- Any commission you earn

- Any other forms of income

Long-term Disability

Long-term disability coverage also begins after an elimination period, but it lasts much longer than a short-term disability plan would, as the name suggests.

However, the benefits still only last for a pre-determined period of time, according to Aetna, and your age at the time you were injured is also taken into consideration when determining how long your benefits will last.

Just like with short-term disability:

- Only certain illnesses or injuries are covered

- Any income you receive is evaluated before your benefit payments are paid out

Medicare plans

Are you older than 65?

If so, you may be eligible for a Medicare plan, which is a type of health insurance that covers people 65 and older.

Medicare also covers certain disabilities in people under the age of 65. To find out if you're eligible for Medicare, use this link.

For those deemed eligible, there are four parts to Medicare you should know about:

- Original Medicare (Parts A and B)

- Medicare Advantage (Part C)

- Medicare Prescription Drug Plan (Part D)

Each one covers a different area so it's important to understand the differences between them all.

Part A (Original Medicare - Hospital Coverage)

Part A coverage is mainly concerned with:

- Inpatient care at a hospital or nursing facility (short-term care only)

- Hospice care

- Home health care services

Part B (Original Medicare - Medical Coverage)

Part B, on the other hand, covers your day-to-day medical care needs like:

- Doctor's services

- Outpatient services

- Home health aids

- Medical equipment

- Preventative services

Part C (Medicare Advantage)

Medicare Advantage plans usually cover Medicare Parts A and B as well as some of Part D.

These plans are typically run by private insurance companies such as Aetna.

Because of this, additional benefits may be available outside of your Medicare coverage and provided by the insurance company instead.

Part D

Part D coverage simply covers your prescription drug costs.

You can opt for this coverage on its own or you can bundle it through Medicare Advantage.

You can also add Part D coverage to:

- Supplemental Plans (more on this next)

- Medicare Cost Plans

- Medicare Medical Savings Account Plans

- Private Fee-for-Service Plans

Now, when it comes to Medicare's Part D coverage, there are four drug coverage phases you'll need to learn:

1. Deductible

As with normal insurance, you must fork over a deductible before Medicare picks up the bill.

This amount can vary from year-to-year, and in some cases, may not cost you a dime.

For those with a $0 deductible, your plan's coverage starts right away.

2. Initial Coverage

With initial coverage, you're responsible for a portion of the bill each time (your copay) and your insurance company (your plan) picks up the rest of the percentage on your behalf.

Once again, this figure can change with an annual renewal.

Coverage Gap

When you've exhausted your initial coverage limit, you move into a coverage gap, or a "donut hole", as Aetna puts it.

Find yourself in one of these and, "You may be responsible for paying a larger portion of your drug costs, depending on the plan," according to their site.

Medicare offers different tiers of coverage during gap periods so you can choose the right level to meet your needs.

If you end up exhausting this coverage, you move into catastrophic coverage.

Catastrophic Coverage

With Catastrophic Coverage, you pay a reduced copay and the coverage continues until the end of the policy year.

Medicare Supplement (Medigap)

When certain health care costs are not covered by Original Medicare, Medicare Supplement insurance (or Medigap) comes to the rescue by taking care of these expenses for you.

On top of that, you won't experience any network restrictions with this coverage.

So you can see any doctor or visit any hospital that accepts Medicare and you'll be covered.

Now that you understand a bit more about Medicare, let's move on to our next section about Medicaid. These two terms are often confused despite the fact that they are very different.

Medicaid Services

Medicaid is a super low-cost––and in some cases no cost––coverage option that's only available to individuals with special needs, disabilities, or low income.

To determine if you're eligible for Medicaid, you must visit Medicaid.gov.

Medical Management

Aetna also provides assistance for those needing Medicaid.

This is done through their Medical Management program, which, among many other services:

- Manages disease, care, and pharmacy needs for patients

- Profiles providers and medical services

- Develops disease management programs

- Monitors and reviews quality of care standards

If you're interested in learning more about Aetna's Medical Management, just visit their site and poke around.

Behavioral Health Programs

Aetna also offers behavioral programs as part of their Aetna Integrated Primary Care Behavioral Health Programs. These programs support individuals with mental health needs.

An integrated approach is used so both your primary care physician and your behavioral health clinician are on the same page about what's going on with you medically and psychologically.

To take advantage of this coverage, simply speak with your primary care physician for a referral to a behavioral health clinician.

When you're under this program, you'll start out with a minimum of three sessions with a licensed psychologist, licensed social worker, or a licensed professional counselor.

Your behavioral health clinician will then regularly report back to your primary care physician on your diagnosis, as well as with the solutions they're currently implementing.

This continues for as long as both your doctor and clinician see fit.

You can learn more about this program here.

Aetna's Most Popular Services

Now that you have a better idea of the types of plans Aetna offers, let's learn more about the specifics of their most popular services.

Aetna's Individual Health Plans

Aetna's Health Plans offer affordable coverage that doesn't sacrifice quality.

According to their 2017 health brochure, most of their health plans include:

- Flexibility to see doctors without needing referrals

- Coverage for doctor visits, prescription medicines, immunizations, and hospital stays

- No copays for preventive care when you see an in-network doctor

- No claim forms to fill out when you use an in-network doctor or provider

Additionally, you can use walk-in clinics for minor illnesses that don't require a trip to the ER.

To see if you're eligible for Aetna's health plans, visit their site here.

Aetna also offers dental plans. Since we already discussed the different plan options earlier, we're going to dish about what they cover.

Aetna's Dental Coverage

Aetna's Dental Plans offer coverage for both preventative care and big-ticket dental work, including:

- Cleanings

- X-rays

- Fillings

- Extractions (simple)

- Root canals

- Restorative work (basic)

- Bridges

- Crowns

- Dentures

To give you a complete picture, Aetna won't provide coverage for certain services such as:

- Treatment for jaw joint disorders (such as TMJ)

- Dental appliance replacements

- Experimental services

Sign up for dental coverage and you can see dentists from participating or nonparticipating practices.

Now, nonparticipating practices are not the same as out-of-network practices.

For dentists who participate in your plan, Aetna covers a portion of the bill and you'll be responsible for the rest.

Visit a dentist who does not participate in Aetna's program and you'll pay a pre-negotiated yet reduced rate off the full price of your bill.

That means you still get to see your favorite dentist and you don't have to pay their often hefty, full-priced rates.

On the other hand, dentists who are out-of-network and don't participate in Aetna's dental program don't give Aetna customers discounts or reduced office rates.

If you think an Aetna dental plan may be right for you, check out their site to learn more.

Aetna's Vision Plans

Similar to their dental plans, Aetna offers two options when it comes to vision coverage:

- Aetna Vision

- Aetna Vision Preferred

In both cases, you simply pay a reduced rate for vision services.

Technically speaking, these are not considered an insurance plan.

With these plans, you receive discounts on:

- Eye exams

- Contact lenses

- Glasses

- LASIK surgery

According to their site, some medical plans may have Aetna Vision already tacked on. This means eye exams are covered and glasses and contact lenses may also be paid for as well.

Furthermore, Aetna's Vision Preferred option can be purchased as stand-alone coverage from your employer.

So even if you're not using Aetna for your health insurance, you can still use Aetna's vision discounts by opting for this coverage only.

More details on their vision program can be found here.

Aetna's Group Plans

Aetna also offers affordable group health plans for businesses of all sizes.

Their small business plans help companies slash premiums for their employees by as much as 15%, according to Aetna's website.

Mid-sized businesses of 101–3,000 employees can enjoy a larger network nationwide, which translates to more savings for both employees and employers.

Plus, with Aetna's group plans, you'll find coverage for:

- Medical needs

- Prescription drugs

- Dental

- Vision

Aetna also gives you the option of using a Health Expense Fund.

This can help spread out the costs of expenses like high deductibles and also gives employees a tax break anytime they use part of their salary to contribute to this fund.

To learn more about their group plans, visit Aetna's website.

In our next section, we'll delve further into Aetna's Medicare coverage.

5. Aetna's Medicare Coverage

For individuals who do not have coverage from their job or a separate group health plan, you can opt for coverage through one of Aetna's Medicare programs.

Let's take a look at each one separately.

Medicare Advantage Plans (Part C or MA plans)

Medicare Advantage plans serve as a direct alternative to Original Medicare (or Parts A and B). This means you'll receive coverage for:

- Short-term hospital, hospice, or nursing home care

- Doctor's services

- Home health aids

- Preventative services

- Medical equipment

In addition, and according to Aetna's site, these plans may also cover extra services such as dental or wellness programs.

Some Advantage Plans also offer prescription drug coverage as well.

Medicare Prescription Drug Plans (Part D plans)

As we mentioned earlier, Medicare Prescription drug plans can be purchased alongside Original Medicare; this also holds true for Aetna's coverage.

So if your current health plan does not include Part D coverage, you can opt for it through Aetna.

Medicare Supplement Insurance Plans

Aetna provides Medicare Supplement Insurance, or Medigap.

To reiterate, this coverage pays for any expenses that are not picked up by Original Medicare.

Copays, deductibles, and coinsurance are covered under this plan, but prescription drugs are not. To add this type of coverage, you'll need to opt for a Prescription Drug Plan as well.

Remember, Aetna does not offer Medicare plans in every state. So you'll need to find out if you live in an eligible state and then determine if you meet the requirements for Medicare before being able to sign up.

You can do this online or by calling them directly at 1-800-345-6022.

Want to know what you'll be covered for when you choose an Aetna plan?

6. What Is My Coverage With Aetna?

Aetna members can view their health and prescription drug coverage anytime online.

To do this, simply log into your account and click ‘View Coverage' to see what you're eligible for.

To find out which prescription drugs you have coverage for, head over to their ‘Find a Medication' link instead.

You can also call Aetna's team directly at 1-800-US-AETNA (1-800-872-3862) to learn what's covered under your plan.

When prompted, you'll want to press the number ‘2' on your phone's keypad to reach their medical or dental plan departments.

And if you have a question about deductibles, stay tuned. We'll go over these next.

7. How Do Deductibles Work with Aetna Insurance?

According to Aetna's 2017 brochure, a deductible is "a set amount you must pay for your covered services before the health plan starts to pay."

This amount varies based upon the plan level you choose (Bronze, Silver, or Gold).

Remember, the Bronze plans are going to have a higher deductible in exchange for a lower premium; Gold plans are just the opposite (higher monthly premiums for a lower deductible).

In addition to plan levels, your rates also vary based on the state you live in.

We'll take a look at this in more detail in our next section, but to give you an idea, someone living in Palm Beach County, Florida, would have two plan options to choose from:

- FL Aetna Bronze Deductible Only plan

- FL Aetna Silver $15 Copay plan

With the Bronze plan, the in-network deductible (see example in next section) is $6,550. The same in-network deductible on the Silver plan is only $2,950.

Let's talk about what creates this mighty difference in price.

8. What are Aetna's Rates?

Your plan's specific rate depends on two factors:

- The plan level you choose (Bronze, Silver, or Gold)

- The state that you live in

We can see this in action when we compare two plans in two different states.

First, we'll use the Florida plan we discussed in the previous section.

With the FL Aetna Bronze Deductible Only plan, a $6,550 in-network deductible must be paid before benefits are given.

However, once that's taken care of, you don't pay a copay from there on out.

So the following services would be covered under that 0% copay:

- Primary care visits

- Specialists

- Hospital stays

- Outpatient surgery

- ER visits

- Preventative care services and screenings

- Diagnostic labs and x-rays

- Urgent Care

- Imaging (MRI, CT/PET scans, etc.)

This plan also includes vision coverage for kids, dental coverage for routine visits, and major dental work once the deductible is paid in full.

Someone opting for this plan also receives full prescription coverage after the deductible has been met.

Now if we compare this to the FL Aetna Silver $15 Copay plan, we see the following differences:

- A lower deductible: $2,950 as opposed to $6,550

- A higher copay (40% instead of 0%)

- The only services that are 100% covered without a copay are preventative care and annual gynecologist visits

- Pediatric vision and dental checkups are covered in full, but everyone else under this plan will be shelling out a copay

- Prescriptions also require a copay, which may be as low as $5

Next, let's take a look at similar plans in the neighboring state of Georgia.

After you check out the image above, you'll notice that in the state of Georgia, Aetna only offers a Bronze plan. That's it.

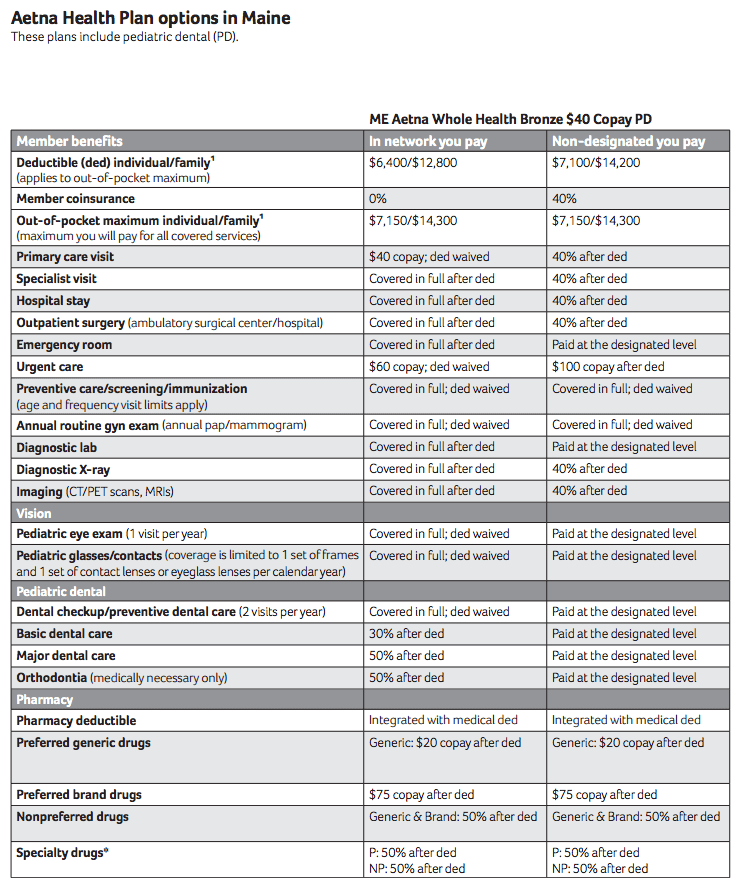

Though Georgia's Bronze plan is similar to Florida's, the Bronze plan in Maine is slightly different than both of them:

You can see that the deductible is slightly lower ($6,400 instead of $6,550) and not all services are free of a mandatory copay.

You'll also notice that a primary care visit will cost you a $40 copay in addition to meeting your deductible. And an Urgent Care visit will run you an additional $60 on top of your deductible.

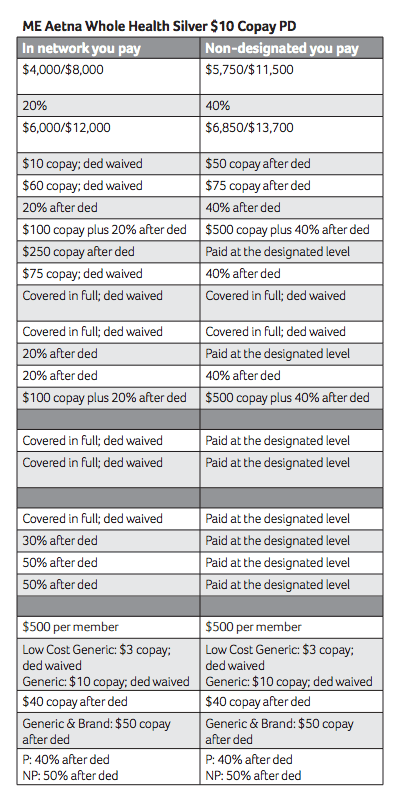

Let's see if the Silver plans offered in Maine are similar to those provided in Florida this time:

When we compare the two Silver plans, we see that the Maine deductible is $4,000 while the FL one is only $2,950.

As for the copays, Maine's comes in at 20%, or half of Florida's, which is 40%.

From comparing these three states, we can see that specific coverage options vary by location.

To find out what health coverage through Aetna is going to cost you, head over to their website and plug in your specific information.

But before you go, let us help you uncover any discounts offered by Aetna for choosing their coverage.

Discounts for Signing Up With Aetna and Using their Services

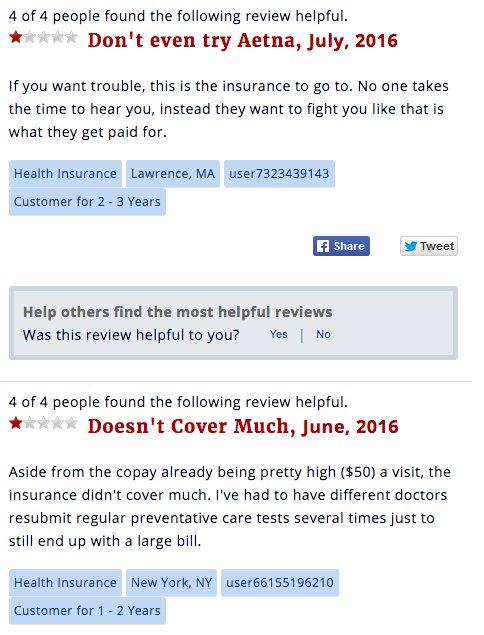

Aetna's insurance used to be part of the Marketplace.

Here, plans were offered at a reduced rate through tax credits and subsidiaries.

As of April 2017, Aetna is no longer participating in the Marketplace, which makes these discounts unavailable.

However, once enrolled with Aetna, you can find discounts on the following items simply for being a member:

- Gym memberships

- Home fitness products

- Nutrition products

- Chiropractic care

- Acupuncture

- Massage therapy

- Hearing exams and aids

- Weight-loss plans

- Travel

- Event tickets

- Electronics

- Gas

- Groceries

You can see that being an Aetna member does have its perks even though their premiums aren't available at a discounted rate.

Now that we know a little bit more about Aetna, let's take a look at what their customers think about their service.

9. How are Aetna's Customer Ratings?

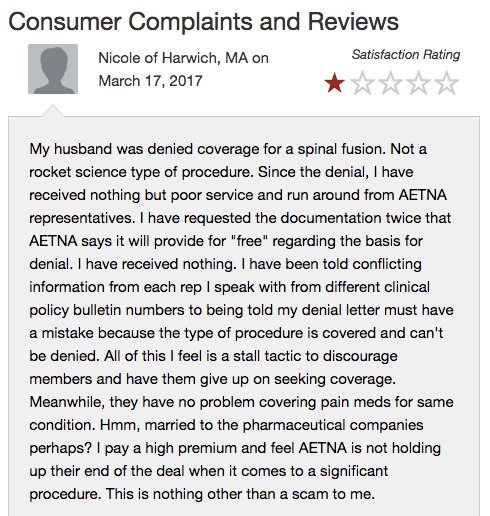

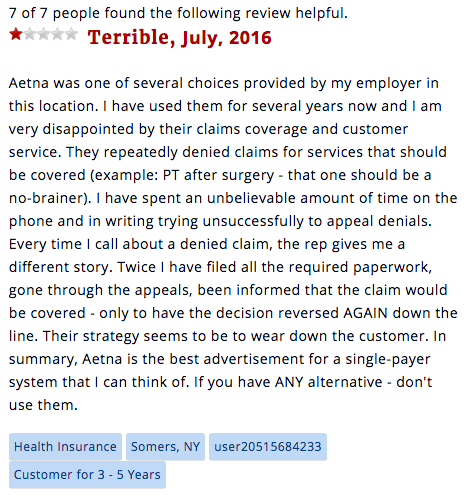

Unfortunately for Aetna, Consumer Affairs shows a 1 star (out of 5) rating for them based on 666 reviews.

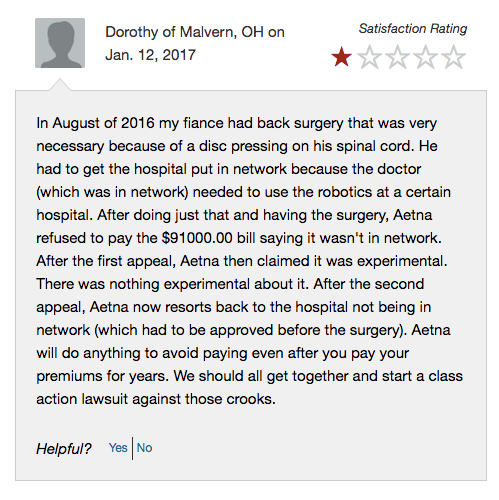

If we check out what a few of the most recent complaints entail, we see that one customer was denied coverage for a spinal fusion while another one fought for over five months for payment on a dental claim:

A third Aetna customer claims they used an in-network hospital and back surgeon and still received a bill for $91,000, which they had to dispute:

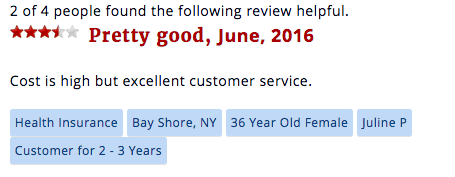

On the other hand, customers paint a slightly different picture when leaving reviews for US Insurance Agents.

This time, 233 reviewers gave Aetna's services a much higher rating of 3.7 stars.

This five star review from 2013 shows a friendlier and much more helpful side of Aetna than those one-star reviewers mentioned.

And a more recent review from 2016 depicts the customer service team as "excellent" despite their plan's high price tag:

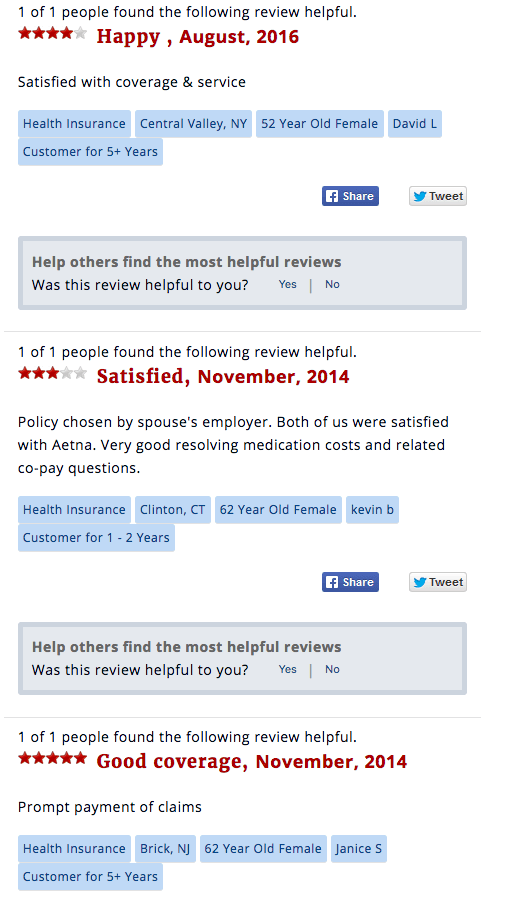

Let's not forget about these reviews from highly satisfied Aetna customers:

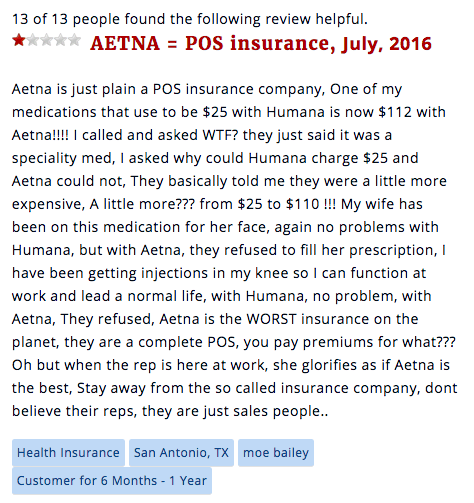

If you dig long enough, you'll also find plenty of one- and two-star reviews worth considering as well.

When this customer switched from Humana, for example, their prescription costs nearly tripled and some of their prescriptions were no longer covered:

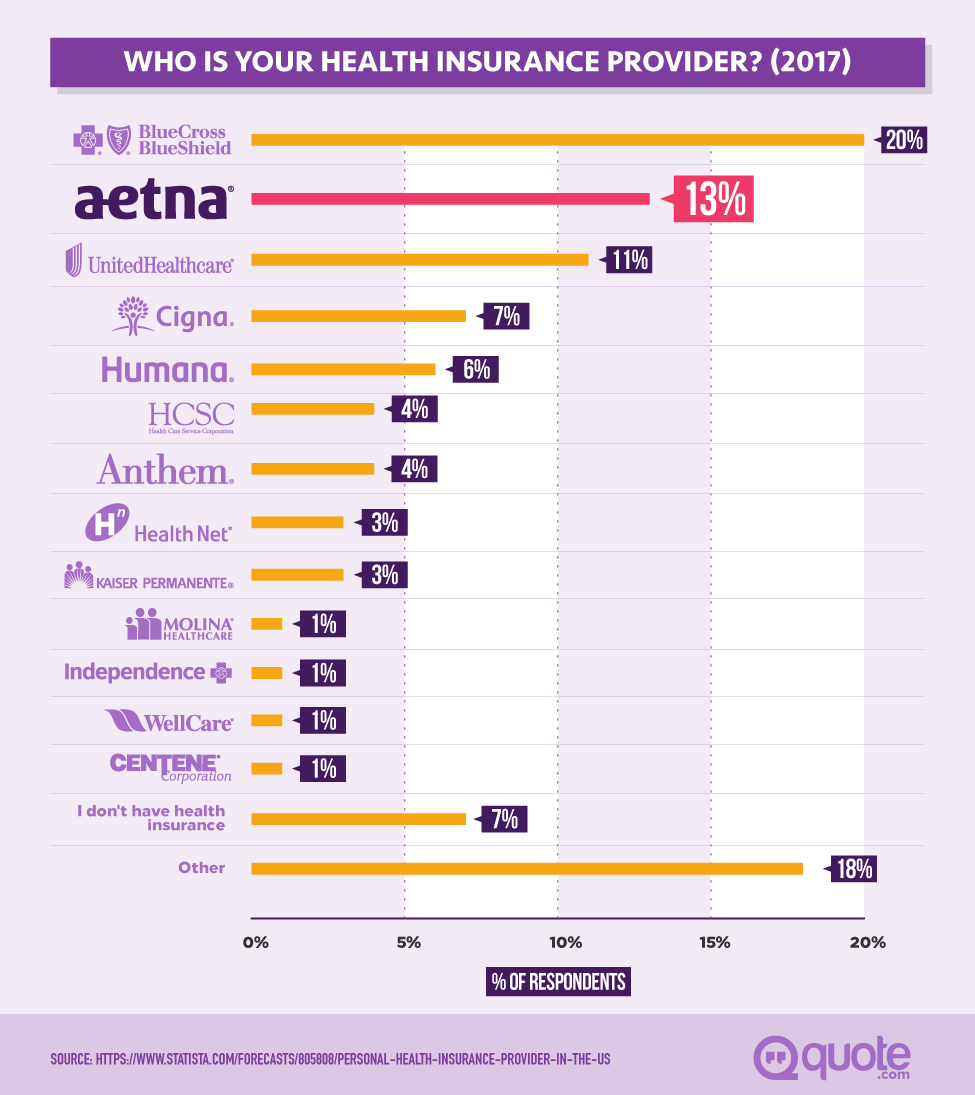

Another one-star reviewer mentioned that they've been using Aetna for several years, but they're "very disappointed by their claims coverage."

They continue that, "[Aetna] repeatedly denied claims for services that should be covered", which seems to be a problem reported by many low-star reviewers:

With over 800 reviews at your disposal, it pays to hear what current customers are really up against before you sign up for coverage and experience the same issues yourself.

Speaking of signing up, are you curious about how to get Aetna coverage in your area?

How to Use Aetna's Services

Aetna's comprehensive website allows you to access everything you need from anywhere in the world.

So if you're looking to apply online, learn more about the plans they offer, or read more about their interesting company history, simply head over to Aetna.com.

When you're ready to apply, we'll walk you through the application process next.

Application Process

For individual health plans, you must apply during an Open Enrollment Period or during a Special Enrollment Period.

Open Enrollment Periods are specific, predetermined days in the calendar year when you can add or switch insurance plans without penalty.

What's a Special Enrollment Period?

It's a window of time in which you experienced a life change, such as the following, within the last 60 days:

- Birth or adoption of a child

- Marriage

- Moving out of the country or your previous zip code

- Losing health coverage

If you meet any of the above criteria, you can click the link that says ‘Yes, at least one of these changes applies to me' from theirindividual health care page.

From there, a pop-up window appears asking you to select the type of plan you're looking for and your zip code.

If Aetna offers coverage in your state, you'll see this page with your state's name on the header like our example image below:

For states that Aetna doesn't service, you'll be directed to their partner site eHealth, which is still connected with Aetna.

When you're ready to apply for an Aetna plan, simply download the application form at the bottom of the health insurance page and mail it to:

Aetna Individual Plans

PO Box 14381

Lexington, KY 40512-4381

Want to know if you're even eligible for an Aetna plan? Stick around for our next section and find out.

Am I Eligible for an Aetna Plan?

In order to be eligible for Aetna's coverage, you must:

- Live in a state that Aetna services

- Apply during Open Enrollment, or

- Qualify for Special Enrollment

As previously mentioned, to qualify for a special enrollment period, you must have done one (or more) of the following in the last 60 days:

- Had or adopted a child

- Got married

- Moved out of the country or your previous zip code

- Lost health coverage

If you meet the above criteria, check out Aetna's health insurance plan page to find out what coverage is available for you.

We'll discuss how easy it is to use Aetna's website in our next section.

11. How User Friendly Is Aetna and Its Services?

When you first land on Aetna's homepage, everything is neatly organized and easy to spot.

Existing members can login using either the white button on the left or the blue one on the top right.

New members interested in registering their account can also use that same blue button.

If you're looking for an individual plan, just head over to the first link for ‘Individuals & Families.' Pretty intuitive, right?

There's also another box below the helpful member links that shows what makes Aetna the right choice for potential customers. For more information, just click the ‘See all the reasons' button.

You can literally navigate Aetna's homepage in a matter of seconds, which makes their site extremely user friendly and well designed.

It also means you don't have to spend forever searching for your policy number.

How Can I Find My Aetna Policy Number?

As an existing member, you can find your policy number by clicking the ‘View Coverage' link on the homepage.

From there, you'll be asked to login to verify your account. Once you do, you'll find your policy number in a jiffy.

You know what else you can take care of right from the customer-friendly Aetna website?

12. Making Payments and Filing a Claim

Aetna gives you a few options when it comes to paying your monthly premium.

To cover your portion of insurance, you can:

- Pay online using a debit or credit card

- Deduct your bills from your checking account using an Electronic Funds Transfer (EFT)

- Pay by phone at 1-866-350-7644

Aetna also offers an Easy Pay option that automatically deducts your monthly premium from your account every month.

Take this route and you can choose to deduct the funds on the 1st or 15th of each month, which gives you some flexibility to work around your paydays and other bills.

This option also ensures that you don't miss a payment and crosses off one more item from your already huge to-do list.

To sign up for Easy Pay, you must be enrolled in an Aetna individual health plan, have access to a checking account, and be in good standing with your monthly payments.

If this applies to you, head over to their site to complete their Easy Pay application form.

Speaking of forms, here's what you need to know about making a claim with Aetna.

How to File a Claim with Aetna

If your healthcare provider is in Aetna's network, they will automatically file a claim on your behalf.

For those not in-network, you must file a claim yourself.

To do this, you'll need to head to Aetna's website and download the claim form that pertains to the services you need covered:

- Medical Claim form

- Dental Claim form (English)

- Dental Claim form (Spanish)

- Vision Claim form

You can also find authorization forms and other important documents on that page as well.

Additionally, once you're logged in, you can submit a form directly online.

Once you're logged in, click on the ‘Claims Center' button.

You'll see a button to ‘Submit claims'. That link contains the documents you'll need to complete before you send your info electronically.

After you complete the forms, hit ‘Submit' to complete your end of the process.

Within a few minutes, you should receive an email confirmation letting you know that the form arrived safely.

How Long Does Filing a Claim Take?

Aetna does not specify how long a claim takes to process.

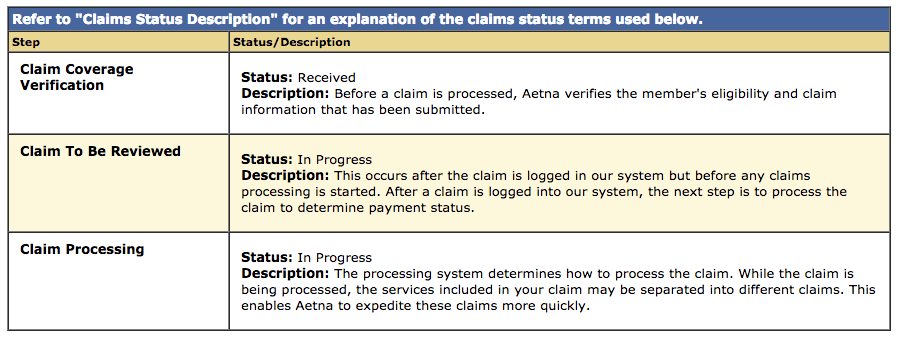

Their website explains that each claim must work its way through a series of stages before being processed, as you can see below:

To see where your claim stands, you'll need to login to your account and check on the status.

13. How Can I Cancel My Services with Aetna?

For individual health plans, you can call the 1-800 number on the back of your member ID card to cancel your services.

If your plan is through your employer, you'll need to visit your HR department to initiate the cancellation process.

And if you signed up through a third-party agent, you'll need to contact that agent to cancel your services.

Medicare Advantage (Part C or Part D) health plans require that you keep your chosen plan for the full calendar year, per the agreement. This means you can't cancel your coverage mid-policy year.

What are Aetna's Strengths?

Let's take a look at the advantages of using Aetna for your health care needs:

Long-standing History and Wide Range of Products

Aetna has been around for over 160 years.

They've grown and persevered through tough economic times and continue to make strides technologically. Their experience and network of providers is a strong boost for their company.

Plus, they have a range of healthcare products from health insurance to dental, vision, and disability coverage to help you at every stage of your life.

More Affordable Coverage Options Compared to Other Providers

Aetna also offers some of the most affordable coverage around. Their premiums are generally less expensive than their competitors.

As compared to Cigna

Aetna members paid a lower percentage (20.4%) [for their monthly premiums].

Various Supplemental Programs are Available

Another key benefit to Aetna is their supplemental programs.

When medical expenses crop up unexpectedly, you can sign up for one of the following programs to cover those unplanned-for costs:

- Aetna Fixed Benefits Plan

- Aetna Hospital Plan

- Dental and vision insurance

- Life and disability insurance

- Vital Savings by Aetna discount program

Coverage is Available Nationwide

Aetna's coverage is available nationwide in most cases. To see if your state is covered, visit this page.

If Aetna doesn't happen to provide service in your state, they'll connect you with their partner site known as eHealth so you're still in luck.

Check your state specific regulations on this page.

Now that you're familiar with all the positives associated with Aetna's service, let's talk about a few of the negatives.

What are Aetna's Weaknesses?

While Aetna's strengths are hard to beat, you should also be prepared to experience these downsides just in case:

Customers Complain About the Customer Service

As we saw from customer reviews in a previous section, Aetna's not well-ranked when it comes to customer service.

Many customers have complained that Aetna denies claims that should have been covered and takes an extremely long time to process claims.

Customers with denied claims received extremely high bills (some as high as $91,000!) as a result.

Aetna's denied claims rate triples Cigna's (1.5% as compared to .54%) as mentioned in that same Investopedia article.

While lower premiums are nice, higher claim costs could negate any savings you initially see. And this difference could add up to far more money in the long run.

1-Star Rating by Consumer Affairs

We also saw that 666 Consumer Affairs reviewers gave Aetna a 1 out of 5 stars rating.

The US Insurance Agents score was slightly higher at 3.7 out of 5 based on 230 reviews, but again, many of the reviews were highly unfavorable.

This is by far one of Aetna's biggest downfalls.

Does Not Offer Short Term Coverage to Cover Insurance Gaps

The last con when it comes to using Aetna is that they don't offer short term coverage to fill insurance gaps.

Aetna's Voluntary Plans are used to supplement current insurance, but they won't fill a gap should you need short term coverage.

Plus, those plans are only available through an employer so if you're dealing with a period of unemployment, these won't help you.

Now that we have the strengths and weaknesses of Aetna under our belt, let's take a look at some of the most frequently asked questions about their service.

Frequently Asked Questions about Aetna

Here are a few of the most common questions when it comes to Aetna.

What documentation do I need to submit to add or remove a family member from my card?

According to Aetna's site, you can add or delete family members during open enrollment periods.

New members can do this within 31 days of signing up.

You'll need to present proper documentation and have experienced one of the following events before being able to add or remove a family member:

- Marriage or divorce

- Death of a spouse (or dependent)

- The birth, proposed adoption, or adoption of a child

- Beginning or ending of employment by an employee's spouse

- Change in full-time or part-time status

- Unpaid leave of absence

Simply call the number on the back of your card or login to your account to initiate the process.

What is a COBRA policy and how does it apply to my plan?

COBRA policies kick in when you lose your coverage due to a termination of employment.

As long as your employer is subject to federal COBRA, you're eligible to continue your current group health insurance coverage for a temporary period of time.

To learn more about COBRA, you must contact your HR department upon termination.

Why is Aetna sending out a representative to check my medical history?

Aetna will review your medical history during the underwriting process.

This means you must submit your medical history within 30 days of signing up with Aetna.

In some cases, a 15-minute phone call or in-house visit from an Aetna representative may be requested.

Your enrollment status can be delayed if this is not handled on time.

Is it safe to provide my banking information to Aetna?

According to Aetna, your personal and confidential information is protected by:

- Limiting the use and disclosure of your information

- Using agreements with contractors to ensure that they don't use and disclose your information improperly

- "Having procedures in place to limit who can see your information"

To learn more about their privacy policy, check out this page.

How can I ensure that my payment was processed correctly?

When you use Aetna's Payment System, you can login to check if your payment was received.

When a payment is processed correctly, you will receive a confirmation number.

So if you do not have a confirmation number and your payment is not tagged as "Processing", you'll need to contact customer support at 1-866-350-7644.

Does Aetna charge higher for drugs that are available in the market?

Under Aetna's health insurance plan, "the amount you pay [for prescriptions] depends on the drug your doctor prescribes," according to their most recent plan brochure.

There are three tiers, or levels, that every drug falls under.

- Tier One prescriptions are the lowest cost

- Tier Two prescriptions have slightly higher costs than current market rates

- Tier Three prescriptions have the highest costs

If your prescription happens to fall in Tier Three, it's very likely that you'll be charged a higher rate than what's available on the market.

To find out how much you'll actually be charged, check out your Plan Design and Benefits summary.

The delayed approval from Aetna has caused my disease to spread. Will Aetna provide me compensation for the stress it has caused me and my family?

I have paid my premium but Aetna is saying that they have not received it. What do I do?

First, you'll need to see if the money was taken out of your bank account or charged to your credit card.

If this is the case, you should have a transaction number from your bank or credit card that you can give to Aetna's billing support team. They can be reached at 1-800-872-3862.

If the money did not leave your account after a few days, it is very likely that your premium payment was not processed.

In this event, you will need to re-submit your payment to Aetna.

How can I get an Aetna case manager to help me figure out my insurance bills?

Aetna offers case management services over the phone for customers dealing with critical illnesses. This is done through their Compassionate Care Program.

Aetna members (and their family) can receive support for:

- Planning for advanced care (such as Hospice)

- Coordinating between multiple doctors

- Benefits management

- Resources available in your community

To learn more about this program, simply call the member services number that's located on the back of your ID card.

What online pharmacies are part of Aetna's preferred providers list?

The following list contains the pharmacies that are Aetna's preferred partners. This means you'll pay the lowest possible price for prescriptions from these vendors.

To see which vendors offer online ordering, you must visit each website directly.

What coverage does Aetna give to patients with terminal illnesses?

According to their website, most Aetna plans include their terminal illness program, which covers "experimental treatments for people with cancer and other terminal illnesses."

For this to kick in, you must be enrolled in eligible clinical trials (Phase II or Phase III).

On top of that, Aetna also covers "Category B" investigational medical devices.

To learn more about this, you must speak with your doctor first to see if you are eligible for a clinical trial.

Who will Aetna pay in case of my accidental death?

As with any life insurance, the person (or persons) you select to be your beneficiary will receive cash payments following your accidental death.

Aetna's life insurance policies follow this general rule of thumb as well.

Some exclusions––such as driving under the influence––prevent certain accidental deaths from being covered, so payments are not always guaranteed.

Aetna is late in reimbursing my payment and I have accumulated a late fee on my credit card. Will I get a full coverage?

How can I find out which plan is the best for my health needs?

Finding the right health insurance for your needs is not as complicated as it seems.

First, you'll need to decide if a Bronze, Silver, or Gold plan is right for you.

In short, Bronze plans usually have lower monthly premiums in exchange for higher out-of-pocket costs.

If you're someone who doesn't see a doctor often, this plan might make sense for you.

On the other hand, Gold plans are going to cost more each month in premiums than a Bronze or Silver plan, but they'll also give you the lowest out-of-pocket costs.

For people who require frequent trips to the doctor, this may be an ideal option.

Once you decide on the level of your plan, you need to determine how much you can afford as far as monthly premiums go.

In addition, it's also essential to consider how much you can afford to pay in a deductible, should you need to fork one over.

Determining these factors will drastically help you cut down your available choices so you find the right one fast.

Review the different plan structures: HMO, PPOs, EPOs, etc. from there.

Depending on the type of plan you choose, you may have to stick with in-network doctors only or you may need a referral any time you see a specialist, even if they are in-network.

You can learn more about the key differences between each type of plan by visiting this site.

Should You Choose Aetna's Services?

After reading today's guide, you should have a better understanding of Aetna as a company and the services they offer.

Only you can determine if they're the right choice for you and your family.

Over 23 million Americans trust Aetna for their health and dental needs and they've been in business for the last 160 years, proving they can stand the test of time and adapt to meet the ever-changing needs of their consumers.

If you're interested in learning more, or if you'd like to speak directly with an Aetna representative, call 1-800-US-AETNA (1-800-872-3862).

What is an automatic decline list and how does it affect me?

Some insurance companies have what's known as an Automatic Decline List.

This means that anyone with one of the following conditions may be automatically denied from receiving coverage.

To see if your condition qualifies as an automatic decline, you must call an Aetna representative directly at 1-800-872-3862.

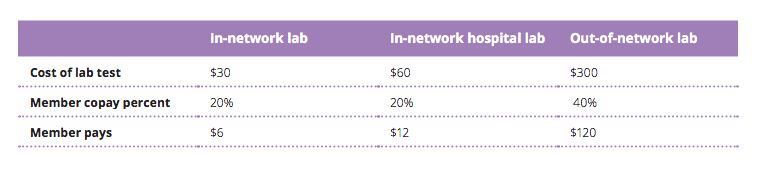

What do I do if Aetna's preferred lab does not offer the tests that I need?

If an Aetna preferred lab does not offer the tests you need, you can choose one that is out-of-network.

Keep in mind, this will increase the amount you pay for those tests.

Here's an example of what that looks like:

In this example, an out-of-network lab costs Aetna $300 as opposed to $60, which means, as a member, you would pay $120 out of pocket instead of $12.

So you should be able to get the tests you need outside of Aetna's preferred labs, but you will pay extra to do so. Fingers crossed that doesn't happen often (or ever).

Why has Aetna put a hold on my medication when my doctor has prescribed it?

Some drugs require authorization from Aetna even though your doctor prescribed it.

In some cases, it could be due to your doctor prescribing a high-cost option when a generic is available.

Aetna may also require additional authorization to ensure that:

- The dosing guidelines are not above the maximum allowed dose

- The prescription being filled is not a duplicate of an existing prescription from another doctor

If any of those criteria are present, Aetna will place a hold on your medication and it will not be approved for usage until your doctor reaches out to Aetna for further authorization.

You can learn more about this in Aetna's latest Pharmacy Drug Guide.

I have cancelled my insurance plan with Aetna and have requested for a reimbursement. How many days will it take Aetna to return my money?

How many days do I have before my claim expires?

Does my Aetna insurance cover me internationally or abroad?

Yes, you can seek medical care while out of your service area.

According to their site, "you can visit any facility or provider and be reimbursed all but the appropriate copay for covered services. Plus, you don't need authorization to do so.

Enjoy swimming with sharks or ziplining canyons on your next vacation without worry.

Why does Aetna want to send a nurse to my home?

Aetna offers free health assessments that can be done right in the comfort of your own home.

Essentially, a nurse would visit your house to:

- Perform a health exam

- Give you "tools to keep your health on track"

- Offer support and answer any questions you may have through a friendly, one-on-one consultation

To learn more about a home health visit, you can visit this page.