Whether you like it or not, we all need insurance.

Not having insurance could mean financial ruin in all sorts of scenarios.

Once you've come to terms with the fact that you're going to need car, home, life, and health insurance, your next job is to find the right insurance companies for those products.

You want to find an insurance company aligned with your needs and values.

Evaluating the hundreds of different companies out there can be time-consuming and exhausting.

And navigating the world of insurance is tricky.

Fortunately, you don't have to do it on your own.

That's right—we've done the research, so you don't have to.

We've taken the time to analyze 815 insurance companies for you to find out their differences, similarities, and trends.

When you've finished reading this, you'll have all the knowledge and information you need to choose the right insurance coverage for the right price.

Auto Insurance

If you drive a car, having auto insurance is the law, not an option.

Some kinds of car insurance are optional, and some are not

Liability insurance is a must. The mandatory car insurance everyone on the road must have is called liability insurance.

Liability insurance covers damage your vehicle causes to other people, their property, and other cars.

One out of five chooses the minimum. Our research supports the finding that 20% of all car insurance customers in the U.S. only carry the minimum amount required for their state.

For example, in Colorado, the minimum requirement is $25,000 in liability coverage for bodily injury per person, $30,000 in total bodily injury liability per accident, and $15,000 in property damage per accident.

When 20% of customers choose the minimum coverage in Colorado, it means they are leaving themselves vulnerable.

For example, if the driver gets in an accident and three people are injured, and their medical bills add up to $75,000, then the driver could be sued for the $50,000 not provided by their minimum amount of insurance.

Given that the average cost for a nonfatal disabling injury is $61,600, according to the National Safety Council, then just having the minimum coverage in Colorado would result in a $36,600 debt for one injured person.

Collision insurance is a good idea if you have a nice car. The first option you can add on to the basic liability package is collision insurance.

Collision insurance covers damage to your car caused by accidents with other cars or damage caused by hitting a tree or light post.

If your car is an old beater and it would be cheaper to replace it than repair it in the case of an accident, you don't need collision insurance.

For people who drive more expensive or valuable cars, getting insurance so it can be repaired in the case of an accident is a must.

Comprehensive insurance protects against theft or vandalism. All other types of damage to cars are covered when you choose to get comprehensive insurance.

Losses related to fire, weather damage, vandalism, flood damage, and having your car stolen are all covered by comprehensive insurance.

If you're driving a jalopy and it gets stolen, it might not be worthwhile to replace through comprehensive insurance, because your rates will go up and you will have to pay the deductible.

People who are driving a nice car will definitely want to protect it from these threats by adding comprehensive insurance to their policy.

There are a few other optional forms of coverage you might need. With most car insurance policies, you can also choose medical payments coverage, coverage for a rental car during repairs, and coverage for towing.

Uninsured motorist coverage kicks in if you were ever in an accident with a driver not carrying their own insurance.

Roadside assistance is another option good auto insurance policies offer.

Ask if you qualify for discounts and save

One of the big trends we noticed when we reviewed the insurance companies offering auto insurance was the long list of car insurance discounts for qualifying customers.

Some things are less risky than others, so customers pay less if they have them.

Multiple vehicles make the price go down. If your household has more than one vehicle, insuring them on the same policy gets you a discount for all of them.

Discounts for taking driver's education classes. When someone graduates from a driver's ed course, they've learned skills like defensive driving and road safety.

Having these skills means less risk for an accident, so there's a discount.

Good students get good rates. If a young person is on the policy, companies will give discounts if they have good grades.

Good students are usually good drivers too.

Safety and anti-theft devices lower premiums. Technology like collision avoidance alerts and antilock brakes reduce the risk of accidents.

Anti-theft devices also reduce the risk of a claim—since it's harder to steal a car with this feature, the risk is lower.

For both of these features, lower risk level means lower prices.

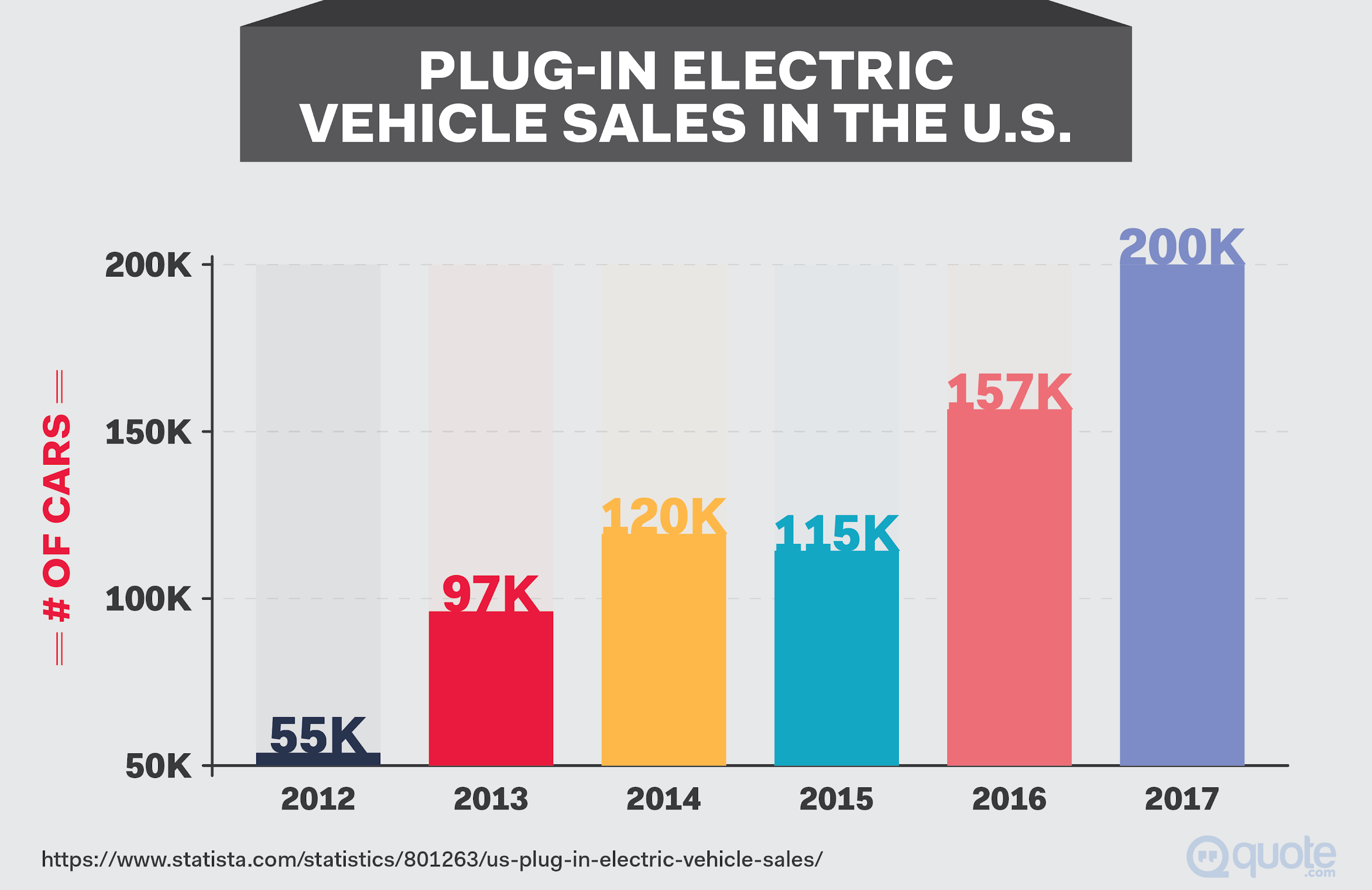

Going green costs less. There are also a couple of discounts given for making environmentally friendly choices.

Choosing paperless billing can get you a 1–2% discount.

Having a hybrid or electric car can also result in lowered premiums.

Compare car insurance companies to get the best rate

Once you've figured out the coverage you want and the discounts you qualify for, our research shows it's important to comparison shop before you choose your car insurance company.

We've observed pretty big differences in prices between different car insurance companies, so comparing could save you hundreds of dollars a year.

Compare apples to apples. The best way to compare auto insurance companies is to determine the coverage you want and get quotes for the exact same options from different companies.

Rank them from cheapest to most expensive and make your choice.

We've included the best of the best below.

The 5 best companies for car insurance

After researching every single company offering car insurance in the U.S., we can identify our picks for the five best companies.

We chose based on what companies had the best combination of high client satisfaction ratings, good reputations for customer service, and the lowest auto insurance pricing.

Geico tops the list, and not just because of their commercials. Geico car insurance has the best combination of outstanding customer service, low rates, and high levels of customer satisfaction.

The company is a household name thanks to its cavemen and gecko mascots.

With such a massive customer base, the company can afford to offer the best rates.

Your car insurance is in good hands with Allstate. Second place for car insurance companies goes to Allstate.

The company's customers love it for its customer service and prices.

Allstate has also been a leader in innovative car insurance features like accident forgiveness.

The first time you get in an accident your rates won't necessarily go up.

State Farm is there for auto insurance. State Farm tops the list of the Big Five U.S. auto insurance companies.

The largest car insurance provider in North America, with a total market share of 18.3%, is known for agents offering awesome customer service.

The amount of coverage you can get for a low price from State Farm is impressive.

Esurance offers online options. Unlike State Farm, which is known for its agents and offices, Esurance is an online car insurance company (you can also do business over the phone.)

Customer service is fantastic since support from friendly agents is available 24/7.

Having an online insurance company also reduces costs like office overhead and rent.

As a result, Esurance can offer top-notch prices.

Liberty Mutual has earned its great reputation. Closing off our top five auto insurers is Liberty Mutual.

It's an old, conservative insurance company priding itself on personal service, competitive pricing, and short wait times for claims.

Life Insurance

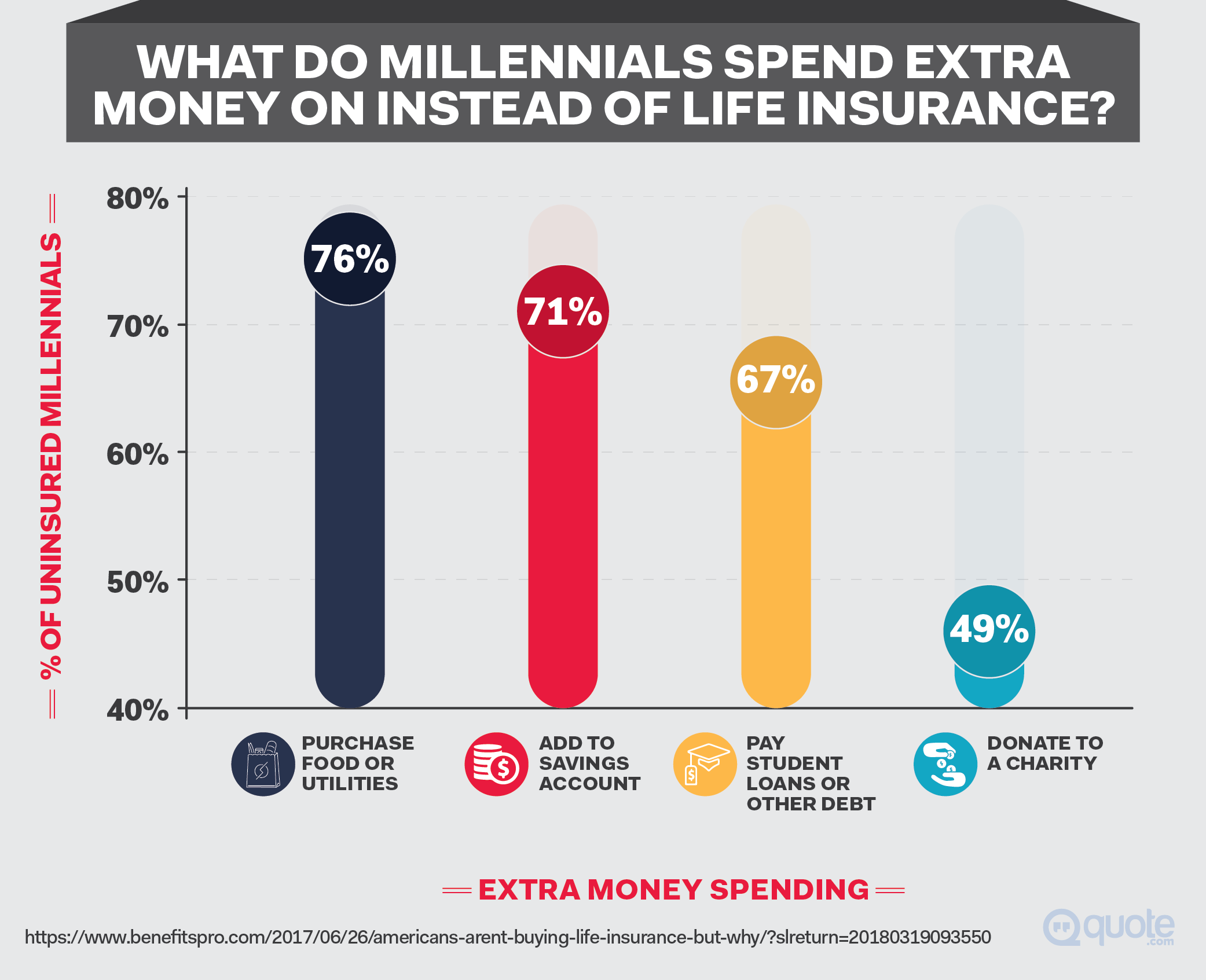

For some reason, a lot of people don't like to talk about life insurance.

Maybe they don't like thinking about what would happen to their family if they died.

Or perhaps they just don't understand how it works.

It is one of the more complicated insurance products.

We've researched all the life insurance companies out there, so you can learn about the differences between the various types of insurance and the trends to look out for.

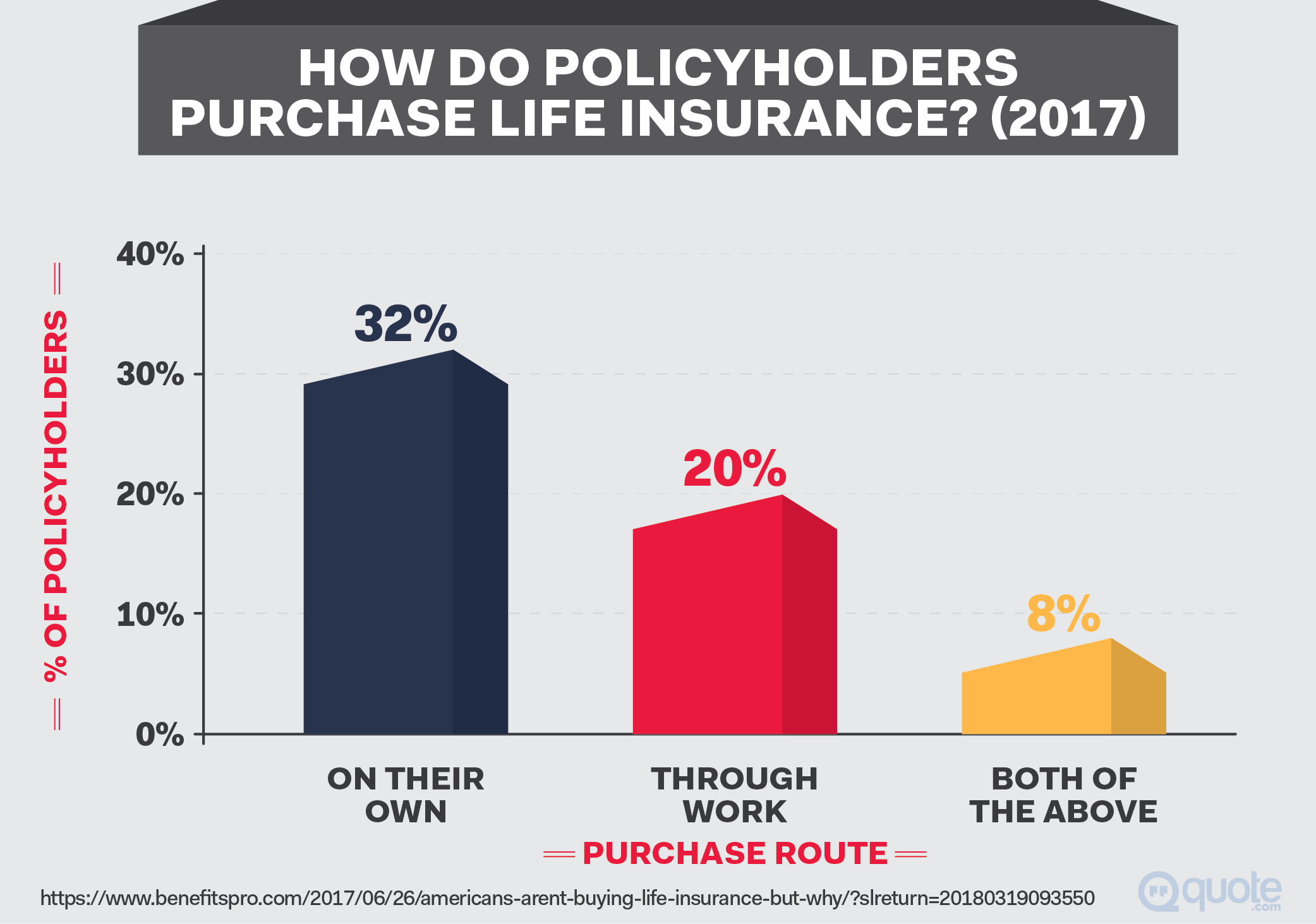

You need life insurance to protect the people who depend on you

If you have a spouse, children, or anyone else who depends on you and your income to support them, you need life insurance.

Our research on life insurance companies supported previous findings on people's likelihood for having life insurance.

Renters are 13% less likely than the average to have life insurance.

Single people are 8% less likely to have life insurance than the average.

When you get married your likelihood goes up to 3% over the average.

Parents are 5% more likely to have life coverage, and homeowners are 7% more likely.

Retired people are most likely to purchase life insurance, at 14% higher likelihood than the average.

As your net worth increases and people start depending on you, you'll be more in need of a life insurance product.

Life insurance isn't just a price put on your head. Life insurance is a strategic asset to help your family if you passed.

Covering funeral expenses, paying off debts and mortgages, and providing peace of mind during a difficult time are all benefits provided by a life insurance policy.

Make your personal calculation. Before you buy insurance, you should do some math.

Account for the amount of income you provide, who depends on you, outstanding debts, and final expenses.

Based on that calculation, you can determine how much coverage you need.

Your final decision will also be influenced by how much you can afford to pay in premiums.

Get to know the different types of life insurance available

Before you can make your choice for life insurance, it's important you have a good understanding of the main types available.

Term life is the most common, least expensive, and simplest

With a term life insurance policy, you choose a fixed time period to be insured.

Typically, terms are 10, 20, or 30 years.

Pick a term. If you think your children will be depending on you for the next 30 years, you should pick a 30-year term.

If you have a 20-year mortgage and want to protect your family's home (if you die and they lose your income), you'd pick a 20-year term.

The risk is assessed. The life insurance company calculates the premium you'll be charged based on the probability you will die within the term.

That means higher premiums for smokers or people with chronic health conditions.

Medical tests are commonly—but not always—required to determine risk. One trend we noticed when we reviewed all the companies selling life insurance is a growing number of policies available without a medical exam.

Permanent life insurance also includes a savings feature

Permanent life insurance can be like a tax-free savings account, where the money you put in doesn't get taxed until it's taken out.

It's also based on the probability of you dying. Unlike term insurance, there is always going to be a payout with permanent insurance, since everyone eventually dies and the policy never expires.

Most expensive option. Since there will always be a claim at the end of a permanent life policy, the premiums are much higher compared to term life.

Helpful for estate planning if you're wealthy. For wealthy individuals who plan to leave large estates to their dependents, permanent life insurance can offer tax privileges.

Whole life has an investment feature. The original type of permanent insurance is called whole life.

It has an investment component very much the same as bonds or CDs except it is backed by the insurance company.

Variable life is like a mutual fund. The kind of permanent insurance known as variable life acts like a mutual fund, with the cash value from the premium payments invested into multiple sub-investments.

Using life insurance as an investment is rarely the right reason. Ideally, life insurance should be purchased as a risk management tool, not as an investment.

Although permanent forms of life insurance like whole and variable life insurance do have an investment feature, life insurance policies provide low returns compared to pretty much all other investment options.

Here's some math to prove it. For example, a whole life insurance policy costing $9,370 a year in premiums would have a cash value of $181,630 after 20 years.

The premiums paid in over the 20 years would total $187,400—over $6,000 more than the cash value.

If the same person had bought term life insurance for $480 per year and invested the remaining $8,890 at an average return of 8%, they'd have $480,806 before tax.

Universal life is the least expensive permanent life insurance. The final type of permanent life insurance is called universal life, and it costs less and has more flexibility than the other forms of permanent life.

It provides relatively lower-cost coverage, like term life insurance, but includes an investment component, like with life insurance.

Keep up with other important life insurance trends

Another trend we've observed in the life insurance sector is for companies to offer options to extend a term life insurance policy or convert it to a permanent policy.

Renewing has advantages if your health has changed. If you choose a policy with the option to renew, you will pay a higher premium based on your increased age.

You won't necessarily be charged more for changes in health since most can be renewed without a medical exam.

Conversion lets you change a term policy to a permanent one. When the term is about to expire you can convert the temporary policy to one of the permanent options.

Death benefits can be accessed early for end-of-life care. One final trend in life insurance is to have an option for death benefits to be paid out before death in the case of a terminal illness.

Palliative care, end-of-life care, and hospice costs can all be covered by drawing from the death benefit early.

Our top five picks for life insurance

Based on our research on the entire life insurance sector, we've identified five companies that stand out from the crowd.

We chose the companies that provide the best services for particular needs.

We also considered customer service, premiums, and convenience.

Haven Life is great for those needing insurance but not wanting an exam. Haven Life strictly provides term life insurance with no permanent life options.

The online application process with no medical exam means zero hassle and quick approvals.

Banner Life is best for high-risk life insurance customers. Another trend we've noticed is more and more companies offering good insurance rates to people with high-risk factors.

Banner Life provides mostly term and universal life options.

You can get guaranteed up to age 95 (usually guarantees only go up to age 65 or 75).

People with chronic health conditions or smokers are charged higher premiums but Banner is generally more affordable than other companies' rates for these kinds of high-risk customers.

AIG is the world's largest life insurance company. With 88 million insurance customers worldwide and a 9.87% market share of the personal insurance industry, American Insurance Group (AIG) offers every option.

Best for healthy individuals. Unlike the top two picks, AIG is not known for approvinghigh-risk clients.

If you're in good health, AIG could be the right choice.

Prudential is cheaper than AIG. If you're strictly shopping for price, you can choose Prudential for lower premiums.

For a six-foot-tall, 37-year-old male, a $1,000,000 policy with a 20-year term would cost $214 a month from AIG.

The same policy could cost $103.05 a month with Prudential Life.

The company offers excellent rates especially for non-smokers and people who qualify for preferred rates.

The annual savings would be more than $1,300 a year and $26,000 over the life of the policy.

MetLife has another good no-medical-exam product. MetLife is one of the leading life insurance providers in the United States.

It provides all of the normal policy options, including term life, whole life, universal, variable, and survivor insurance.

MetLife also offers a term life insurance product with simplified options including no medical exam.

If you have an existing medical condition, faint at the sight of needles, or hate the idea of taking a blood test to prove your health, this is a good choice.

I went with a higher life insurance plan because I want to make sure my wife and kids can afford to stay in our home and maintain the business for a longer period of time without having to worry about paying the bills.

It's not just a salary that goes away with a loved one when they die—it's security and knowing you can pay the bills every month while you contemplate a new normal.

I want my family to know the last thing they will have to worry about is whether they can pay our monthly bills while dealing with losing a husband and father.

Home Insurance

Your house is your biggest asset and investment.

The people and belongings inside it are precious.

Our research reflected the finding that the average price of home insurance (in other words, the annual premiums people pay to insure their homes) in the U.S. is $1,083.

Everyone who owns a house should have home insurance. Home insurance covers you for liability in case accidents happen to people visiting your house.

It also covers your personal property like your furniture and other home contents.

Support during a worst-case scenario. In the event of a fire or other type of serious property damage (usually except floods), you'll be able to finance the repair or replacement of the building and contents through insurance.

Know the available home insurance coverages

When we looked at all the companies providing home insurance, we were able to identify some trends in the coverage packages made available to customers.

Most packages specify the kinds of threats being insured against. A home insurance package will indicate you are protected against fire, windstorms, and theft.

If your package doesn't specify those kinds of events you should make sure you're covered and consider a different policy if you're not.

Other types of coverage typically available with a home insurance policy are:

- property damage (damage to your home or property by insured causes)

- coverage for living expenses while damage is fixed

- personal liability coverage (if someone gets hurt on your property and it's your fault), and

- insurance for medical expenses (for treatments if people incur injuries on your property).

Make homeowners insurance more affordable with discounts

Like car insurance, there is a trend in home insurance to offer discounts to qualifying customers.

Bundle and save. If you go with the same company for car insurance and home insurance, you'll get a discount on the premiums you pay for both.

Locks and alarm systems pay for themselves. If your home is well-protected with deadbolt locks and a home security system, you'll get a discount every month on your premiums.

Raise the roof. Home insurance prices can be lowered if your house has a brand-new replacement roof.

Plumbing upgrades can lower rates. You can also get a reduction in your home insurance rates if you have copper or high-quality plastic (e.g. PVC) pipes for your plumbing.

Rental insurance protects your stuff

If you rent an apartment or house, rental insurance is highly recommended.

Even if you don't have a lot of personal belongings, there's a good chance some of the things you have, like TVs, stereos, computers, phones, and electronics, are valuable and important to you.

Coverage in and out of the home. If these things get stolen or damaged, rental insurance will reimburse their value (minus the deductible).

Most rental insurance also covers these contents if they are damaged or stolen outside of the home.

Get your things appraised and get in touch with an insurance company.

Make sure you have the receipts for higher value items like TVs since you'll have to prove you owned them if a claim is made.

If a company sells home insurance there's a good chance it offers a rental insurance option.

Our top five picks for home insurance

After reviewing all the companies providing home insurance, we've identified five with the best coverage options, prices, claims processing, and customer service.

Amica is best when it comes to price. We compared the different home insurance companies out there by getting quotes for a $315,000, 2,000 square foot home in a Midwest city with a $1,000 deductible.

Significant savings compared to the competition. Among all the companies we compared, Amica had the lowest monthly price for home insurance.

The premium we were quoted was $75.33.

The same policy with State Farm was quoted at $117.75.

Amica also tops the list for overall satisfaction ratings and has the highest possible rating for financial strength (A+) with the A.M. Best scoring system.

The company is also rated highest for policy offerings to meet customer's needs.

Progressive also has cheap rates. When we looked at the average annual rates charged by each home insurance company in the U.S., Progressive was the lowest.

Lowest annual average rate. Progressive's average annual rate for home insurance was $1,056.

State Farm's was $1,499.

Liberty Mutual had an average annual premium of $2,227—well over a thousand bucks more than Progressive!

Although things like discounts can impact your premium, the biggest influence will be the insurer you choose since they all use different calculations for their rates.

Erie Insurance has outstanding coverage. Erie Insurance is a Fortune 500 company and is the 10th largest home insurer in the country.

High rankings in the industry. The company has also been included near the top of many lists for financial performance and customer service.

Erie Insurance provides excellent home insurance coverage options.

For example, it offers coverage for ID theft and home businesses.

The Hartford specializes in home insurance for seniors. The home insurance product offered by The Hartford is known as the AARP Homeowners Insurance Program.

AARP stands for the "American Association of Retired Persons." The Hartford is the only home insurance endorsed by this big national organization for seniors.

Anyone can purchase the coverage, but special discount credits are available to retired seniors who sign up.

State Farm is best for agent support and customer service. State Farm has agents and offices all over the country and is known for its excellent customer service for homeowner insurance.

Speak with an agent. When you're shopping for your home insurance, talking to a real human being can be an advantage.

The company's huge market share and strong financial ratings also provide security.

Best for flood insurance. Flood insurance must be purchased separately from most home insurance policies.

Getting both home and flood insurance from State Farm can result in a discount.

Health Insurance

The final sector we looked at when we analyzed 815 insurance companies was health insurance.

The health insurance industry is experiencing lots of changes, so the trends are changing every day.

Health insurance coverage is no longer mandatory

Under the Affordable Care Act (i.e. Obamacare) getting health insurance became a requirement for all Americans, not an option.

Millions became insured. The mandate, and the new laws making health insurance more accessible resulted in the number of uninsured Americans getting cut in half.

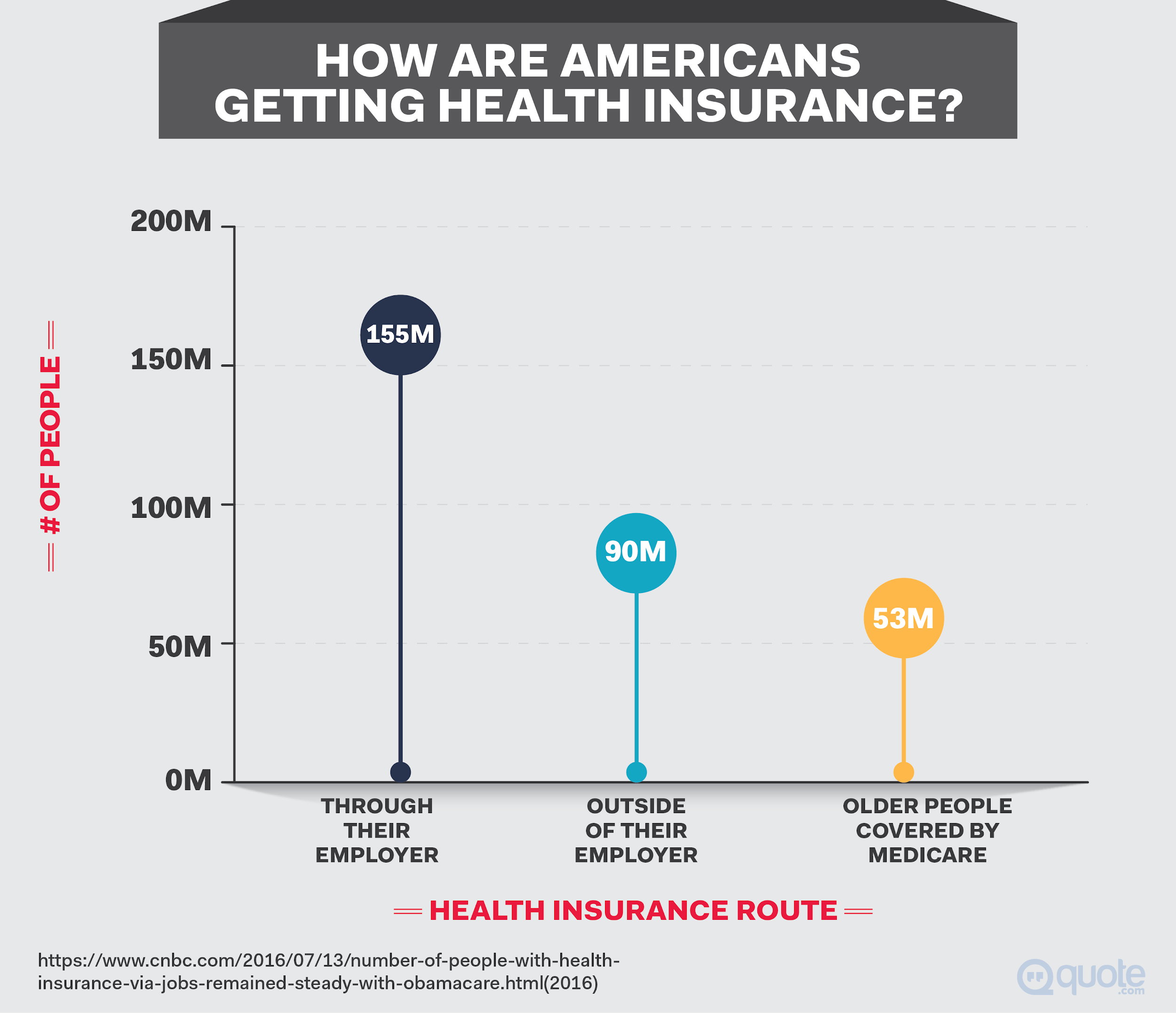

In 2016, 155 million Americans had health insurance through their employer, 90 million had insurance outside of their employer, and 53 million older people were covered by Medicare.

Although 91.2% of Americans had health insurance coverage, there were still 27 million uninsured.

In 2017, the law mandating all Americans to have health insurance was repealed.

Get health insurance anyway. Even though it's no longer the law, having health insurance for you and your family is extremely important.

You would not want the cost of care to stand in the way of your family getting the medical care it needs.

Medical bills in the U.S. are the single biggest cause of bankruptcy, accounting for over 25% of all cases.

Choose between the different types of plans

All medical plans will have features like out-of-pocket maximums customers can pay before the policy covers 100%.

There are a few different types of health plans you can choose from.

HMOs keep it in the network. Health Management Organization (HMO) health insurance plans only fund medical care provided within their own network.

Referrals to specialists must go through your primary care physician.

PPOs have more flexibility. A health insurance plan with a Preferred Provider Organization (PPO) doesn't require you to get referrals from your primary care physician to see a specialist.

If you do access health care within the network, you will pay less.

Tens of millions of users. More than 70 million Americans have signed up with HMOs and around 90 million have participated in PPOs.

POSs and EPOs are a mix of the two. Points of Service (POS) plans require you to use your physician for referrals, but out-of-network care is funded.

EPO (Exclusive Provider Organization) plans require you to get care within the network but you don't need primary care physician referral.

Our top five picks for health insurance

Blue Cross/Blue Shield has a wide variety of plans. With 37 locally and independently owned companies across the U.S., the company is able to meet individual needs really well.

Blue Cross/Blue Shield offers good prices and a wide range of discounts.

Humana had some of the lowest prices among the companies we analyzed. Humana also offers its customers access to wellness programs for improving their health.

Kaiser Permanente has lower than average premiums, especially for seniors. The insurance Kaiser Permanente provides is for its system of doctors and hospitals.

Aetna is also lower than average for costs. Aetna offers solid options for additional supplemental coverage like hospital and critical care coverage.

United Healthcare is high-priced but has an incredible online support system. Although our research found United Healthcare had higher prices than other companies, its online account manager feature is awesome.

You can use the app to order prescriptions, learn about and sign up for wellness programs, and contact a nurse for real-time advice.

Feel confident when you're choosing your insurance

Like it or not, everyone needs insurance.

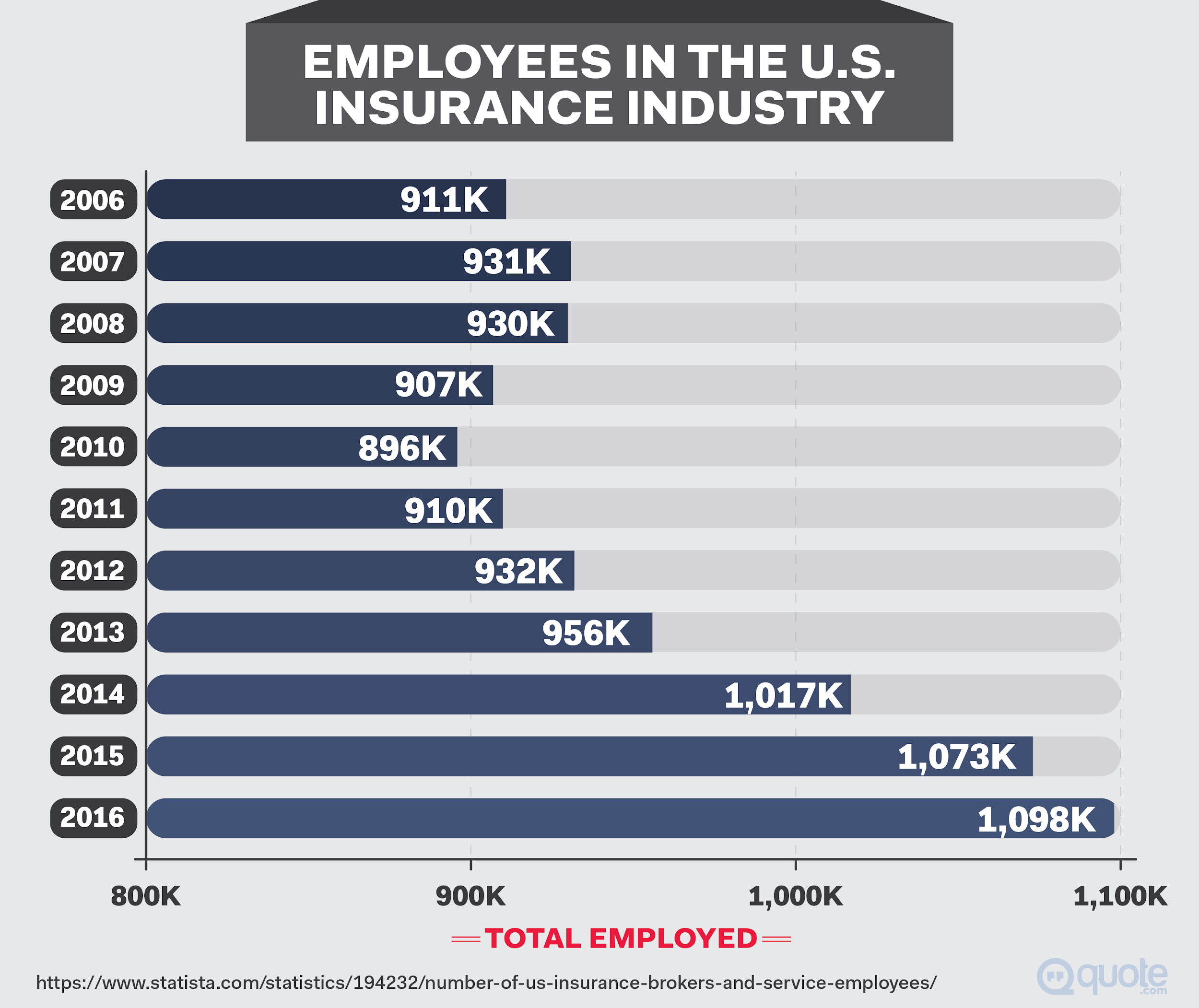

The U.S. insurance industry includes more than 800 companies.

We looked at them all and discovered the differences, similarities, and trends within the industry.

We wanted to give you a thorough overview of the best options available so you can compare rates and save thousands of dollars while getting the best coverage possible.

You now know everything you need to know when it comes to choosing homeowners insurance, life insurance, auto insurance, or health insurance.

Take what you've learned and figure out the coverages you need.

Then go to at least five insurance company websites and get an online quote from each one.

Compare the quotes you receive and make your decision.

Don't forget to factor in discounts for lowered risk or for bundling.

Your peace of mind will be increased knowing you and your family will be covered if anything happens.

We hope you never need to make an insurance claim, but if you do, at least you know you'll have the right coverage.

What has been your experience with insurance companies? What do you think of the industry as a whole?

Let us know in the comments below!