Filing an insurance claim after a vehicle accident can be daunting. You're left to wonder if you will be compensated for your loss but also how it will reflect on your premium cost next year.

Read on to learn more about how a fender-bender can affect your auto insurance policy, as well as other factors that you may not be aware could make it increase.

What Factors Contribute to Your Yearly Premium Rising?

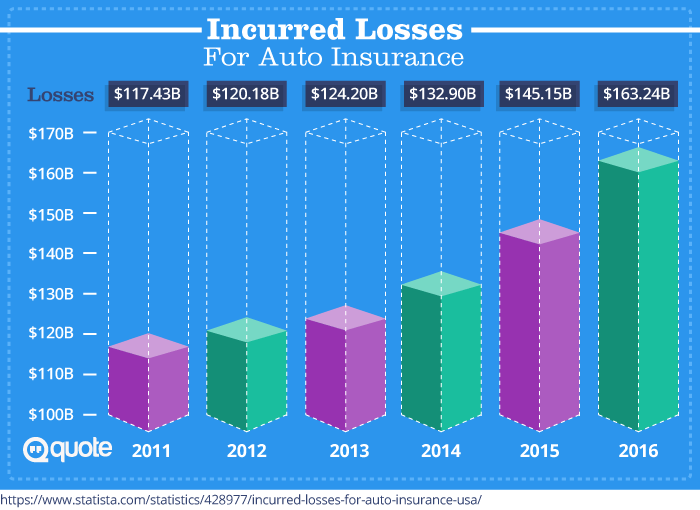

Every year, your auto insurance policy rate will increase slightly simply due to inflation and the state of the economy. What does this have to do with your cost? Well, in order for the providers to provide sufficient service to you in the event of mishaps, they have to cover the funds to repair your vehicle, pay for your losses and your medical-related expenses. Consider how these things hinge on the economy:

- The manual labor cost of repairing your car goes up drastically every year - as of 2016, there has been a 2.4% surge in the cost of motor vehicle bodywork repair

- The newer your car, the more it costs to repair - this is why newer car policies tend to be more expensive than ones on older vehicles

- Cost of living gradually increases year over year, so if you are injured and require compensation for salary loss during the time you cannot work, the compensation must also scale up

Consequently, as of 2016, there has been a 6% growth to the average insurance coverage rate across America due to inflation.

According to the statistics presented by the National Association of Insurance Commissioners (a U.S. organization that sets and regulate the standards of the insurance industry), a vehicle insurance claim of $2,000 can cause the annual premium to increase by 44% on average. A second case within the same year could hike up the fee by 99.4%.

As an example, if your current plan is $841 (the average cost of a policy as of 2017) and you submit an accident claim of $2,000, you can expect your rate to go up to $1211 next year (a $370 rise from your original plan). If you report another incident, your plan can come out to $1677 (a $836 hike from your original plan). However, when it comes to your own policy price, it heavily depends on several factors:

- Whether you are at fault for the crash, and the subsequent reimbursement to the other party

- Whether you or the other party has been injured in the incident

- Extent of the destruction to your vehicle

- Your driving history - including violations you have and have not informed your insurer of

It is important to note that premium surges differ by the type of case being submitted. Although the price surge typically kicks in only when you are at fault in a pile-up, that's not always the case. Usually, if someone hits your vehicle, their insurance should cover both their own and your injury and loss. However, in reality, not all companies comply to this guideline. This is because insurers know that if you report a collision whether you are at fault or not, you are statistically more probable to submit another incident in the future. As a result, you can even see your coverage rate go up after filing an incident for which you are not at fault.

Why Claims Affect Each State Differently

Aside from personal variables, each state's regulation concerning auto insurance can dictate how the cost varies.

Certain states have regulations banning insurers from using certain factors to determine the high-risk status of a driver, as they are considered to be prejudices against an individual. Therefore, companies can only use 3 factors to calculate whether an individual is a high-risk driver:

- Driving record

- Average annual driven miles

- History of driving experience

So once you report an incident in these states, the rate goes up drastically based on the change.

In states that are allowed to use any information to determine high-risk factor, they tend to have a much lesser impact. Some of the deciding factors are:

- Age

- Gender

- Relationship status

- Credit history

- Education level

- Job title

- Zip code

- Vehicle Horsepower

Different Effects of a Claim by State

Because of the different background factors and different scenarios in each incident, it is hard to fairly compare whether one state will have a harsher impact over another. To create a point of reference, this study conducted was based on one hypothetical case to compare how each state would respond to it. In this study, the individual is:

- Female

- Married

- 45 years old

- Employed full time

- Has excellent credit history

- Has no history of auto insurance coverage lapse

- Has absolutely no prior history of auto collisions

For each state, the study looked at how a $2,000 appeal from each one of these categories affect the coverage:

- Comprehensive

- Property damage

- Bodily injury

Overall Worst and Best States to Submit a Claim

Different types of claims have different impacts on insurance premiums. Among all the categories, bodily injury tends to be the most costly because they are reported only when someone is injured in the collision - whether it is you, your passengers, individuals from the other party, or even pedestrians. They are the most expensive as they always involve medical treatment costs and sometimes lawsuits and compensations. As a result, you can see the steepest raise to your costs after bodily injury cases.

The Worst 5 States to File

According to the statistics compiled by NAIC, these 5 states have shown to incur the highest coverage price fluctuation from filing a $2,000 case from any of the 3 categories:

- Tie. North Carolina (57.3%)

- Tie. Massachusetts (57.3%)

- Texas (59.9%)

- New Hampshire (60.3%)

- California (63.1%)

The Best 5 States to File

The lowest fluctuation from filing $2,000 from any of the 3 categories:

- Kentucky (30.6%)

- Montana (30.2%)

- Oklahoma (27.9%)

- Michigan (26.1%)

- Maryland (21.5%)

Worst and Best States to Submit a Bodily Injury and Property Damage Claim

According to the statistics of NAIC, average bodily injury compensation costs around $17,024 as of 2015. It is significantly higher than other categories (average $3,493 for property damage and $1,671 for comprehensive). Therefore, almost every state requires drivers to purchase a set minimum amount of bodily injury coverage to coverage the medical-related costs in a fender-bender. The only exception is New Hampshire. Even though slightly less severe than bodily injury, a first-time property damage can cause an increase of around 43.9%. A second time will result in an average rise of 105.8%.

Here are the worst 5 states to report a bodily injury appeal and their respective price hike from a $2,000 bodily injury claim:

- Massachusetts (62.3%)

- Texas (64.8%)

- North Carolina (65.9%)

- New Hampshire (65.9%)

- California (73.2%)

The best 5 from a $2,000 bodily injury claim:

- Kentucky (33.3%)

- Montana (32.8%)

- Oklahoma (30.1%)

- Michigan (28.3%)

- Maryland (22.6%)

Worst and Best States to Submit a Comprehensive Claim

Of the 3 types of appeals, comprehensive tend to be the least costly, averaging around $1,671 in 2015. It also has the lowest impact on the price hike. This is because of 2 reasons:

- Comprehensive only covers for damages and loss as a result of rare incidents that are beyond the driver's control (e.g. getting hit by an elk or a falling tree)

- Because these cases are not caused by the driver, the insurance providers cannot use them to label the individuals as a higher-risk drivers

Of the 50 states, these 5 places are the worst states to report a comprehensive case of $2,000:

- Iowa (6.8%)

- Wisconsin (6.9%)

- Minnesota (7.1%)

- Louisiana (9.7%)

- Nebraska (10.6%)

As for the rest of the country, most of them only show an inflation of less than 2% in the upcoming fee. In 8 states, there is no change at all.

What Your Insurance Company Doesn't Tell You

Each company has its own set of regulations and guidelines to determine price increases for policy holders. For some companies, they may not change your rates if:

- The request is only for a small amount of destruction and require very little repair

- You are not at fault for the collision

- This is your first accident

- You have great driving history

Unfortunately, not all companies are the same. Some companies will raise your rates even if:

- You are not at fault for the collision

- The appeal can be as little as $1

If your company is in the second category, don't worry just yet. These companies often offer accident forgiveness programs, where they will overlook the first incident as long as you have elected the option.

Companies that offer accident forgiveness programs:

- GEICO

- Allstate

- Liberty Mutual

- The Hartford

- Progressive

- Nationwide

- State Farm

How Does Accident Forgiveness Work?

Usually if you have a driving record without any collision history, the insurance company will allow you to subscribe to their forgiveness program. By paying slightly more for your policy (about 8 to 15% more than the same policy without the option), your provider will overlook your first mishap and allow your coverage plan to stay the same without any penalty. To make the program even more attractive, some companies will go as far as reducing your policy fee for each year you maintain a spotless record without any accidents or violation ticket history. If you are interested in this option, please note that each company has slightly different regulations:

- Some companies will initiate the forgiveness program immediately. This means that you can take advantage of this program as soon as your policy is active.

- Some companies will only allow this program to kick into active mode after you have been a collision-free driver under their policy for a certain amount of years.

- Some companies will allow 1 accident forgiveness within a certain amount of years for each policy.

- Some companies will allow 1 accident forgiveness for each member listed on the policy within a certain amount of years

- Some companies will allow unlimited submission of incidents if you pay for their premium policy services. However, too many will make the company kick you off their premium account holder list.

Before you subscribe to the program, make sure to check out all the details and fine print. Be sure that you understand what services are included with the program, and how you can take the most advantage out of your policy.

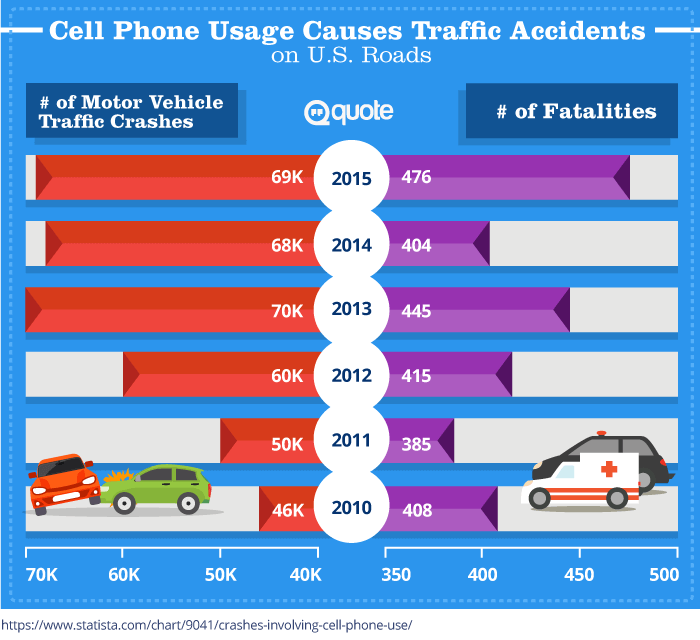

Watch Out for Traffic Violation Tickets

Another very important factor that can drastically change your annual policy fee is traffic violation tickets (i.e. talking on the phone or texting while driving, running a red light, speeding). You can expect your plan cost to go up by $100 to $150 after the first violation. The second ticket will likely incrase your rate by several hundred dollars. The third can send your rate up by $1000 a year.

Depending on the company, they may decide to drop you as a customer altogether or demand a hefty deposit before allowing you to keep your policy. Some accident forgiveness programs will overlook your first ticket as well.

What Can You Do If You Are Living In One of the Worst States to File?

The good news is that the premium increase is not permanent! After the first year of the raise, your rate will gradually drop each year that passes without incident. Within 3-5 years, your insurance policy cost should return to the pre-accident rate.

If you see that your rate has jumped significantly, you're able to soften the hit by offering to take a driving class to brush up your driving skills. After completing the course, your insurer will offer you a 10-15% discount for taking the initiative to be a safe driver. You can also see if you qualify for other discounts that will lower your premium. If you have been a long-term customer, you may want to call customer service and try to negotiate your rate. As a last resort, threatening to take your business elsewhere may prompt them to offer a lower rate just to keep you as a customer.

If all fails and you still do not like the price, you can always switch to another provider. Different providers treat prior cases differently. If they see that you have been a responsible driver for a long time before any incidence, they may overlook it and still offer you a great price just to make you one of their customers. The most important thing is not to lie about your driving record and collision history. All this information is recorded somewhere, and they will find out eventually. If your insurer finds out you've lied while processing a new claim, they have the right to deny your request and drop you as a customer without any compensation or refund of policy.

To File or Not to File Is the Question

Unfortunately, as a driver the odds are you will eventually be involved in an accident. What you should know is that filing a claim is not a necessity in certain situations. How do you know when to submit a claim and when you should pay out of pocket to avoid a premium increase?

You should always file when:

- You are involved in a pile-up where someone is injured

- Your vehicle is stolen

- The destruction of your vehicle is caused by random rare occurrences such as an elk ramming into your car, fire, or any natural disaster occurrences (i.e. flood, tornado, hail, earthquake)

- You are at fault in a collision

- When the fault is unclear, and you may need an insurer to represent you to clear up the situation

- When the other party does not have insurance and the damage on your vehicle costs more than your deductible to repair

Here are several situations when you may want to avoid filing:

- When you are the only party involved in a fender-bender that is caused by you (i.e. backing into a wall or a pole)

- When you are involved in a car crash where you are not at fault and your vehicle has suffered very little damage

In situations where you're unsure about whether to file, go to a repair shop and get a quick estimate on the repair. If the cost is less than your deductible, there is simply no point of submitting your case as you have to pay out of your own pocket for the repair anyway. If the repair does cost more than your deductible, you will have to weigh out several factors:

- Will your company raise your annual cost even though you are not at fault for the car crash?

- Does the repair cost more than the rise of your plan cost for the upcoming year?

- Is the damage only cosmetic, or does it affect how well the vehicle functions?

If the repair cost is less than the estimated price hike of your insurance plan, you may not want to submit a case for the sake of keeping your record clean. If the damage has caused mechanical problems, affecting how the vehicle runs, AND you can't afford to pay out of pocket immediately, then filing a claim is likely your best bet.

Conclusion

We hope that this article has helped you understand more about how your accident claims can affect your insurance premiums. If you have any personal experience and comments that you wish to share, leave us a comment below!