Driving may seem like a simple fact of life.

When you're younger, you look on wistfully as others around you do it, and then get to a certain age where you can finally do it for yourself.

Before you know it, getting in your car and driving to work or school and back home again is just a part of the routine of life. Sometimes, we might even forget just how many cars are out on the road today.

In the U.S., 95 percent of households own a car, and over half have two or more vehicles.

That may not seem surprising, but consider there are just over 320 million people in the U.S. (of any age), and over 210 million of them are drivers with more than 252 million cars between them.

That means there are enough vehicles in the U.S. alone to circle the Earth at least 26 times.

As anyone who's ever bought a car (or maintained one) will tell you, cars aren't cheap. At least, not for most of us, and over the years, the auto industry has had its fair share of ups and downs.

Despite some of these fluctuations, the 1980s and early 2000s turned out to be the most popular times for buying new cars over the last 50 years.

With almost 18 million car sales in 1985 and nearly 19 million in 2002, these booming years are contrasted sharply with the recession of 2006, which turned out to be the worst year for the auto industry to date with only 9 million cars sold. Considering all of the cars that are already here, it may be surprising to learn that purchasing new vehicles is actually on the up.

In 2016, car buying rose to more than 17,550,000 new consumer vehicles (including motorcycles) – an increase over what was already considered to be a record-breaking year in 2015.

Of those 17.5 million vehicles, over 10 million were trucks and SUVs (another increase over 2015), so you may find compact parking spaces open more often these days.

Even millennials, who critics speculated for years weren't willing to buy new cars, surpassed their Generation X counterparts in 2014 when it came to buying new vehicles.

But don't let any of that fool you into thinking everyone you know is driving a hot new set of wheels.

Of the 260 million cars on the road, the average age of our faithful motorized companion is just over 11 years old. And thank goodness. Considering that, on average, Americans pay at least $33,000 for each new car they buy, our persistent hope is that if we treat them well, they'll stand the test of time.

The Top 7 Ways You're Wasting Money on Your Car Right Now

Considering most of us drive cars that aren't brand new, and those cars that are new today won't be new forever, understanding the cost of maintaining your car is just as important as the effort you put into buying it in the first place.

To help, we researched the seven most common (and costly) car ownership mistakes that could be costing you hundreds or thousands of dollars a year.

Instead of losing more time or money, we've compiled the best available research from auto industry and personal finance experts to help you navigate around these unnecessarily expensive roadblocks.

Remember those times when you were in love with your car and the possibilities of enjoying the open road instead of fearing how much a repair might end up costing you?

It's time to take back control, restore the love you have for your car, and put money back in your pocket, so that you don't have to spend time worrying about avoidable auto expenses.

Read on to see some of the surprising, but common, ways you might be overpaying for your car today.

1 1 Does Your Car Really Need Premium Gas?

Wait, wait, wait – before you even think about taking your car to the gas station to fill up your tank, we have to ask:

What grade, or octane, of gas are you using?

The follow-up question:

Does your car really need it?

One of the first steps to saving money on your car is checking the owner's manual (or going online if you don't have it) and determining exactly which grade of gas your car needs. You can even use this guide of cars that require premium grade gas to help.

If it doesn't need premium, stop using it. Most engines are smart enough that lower-octane fuel won't hurt them in the long run.

Americans waste over $2 billion annually on paying for premium gasoline their cars don't need.

It's possible you have been overpaying at every single fill-up. While premium sounds fancy, and we want to pamper our cars when possible, most cars sold in the U.S. are manufactured to use regular unleaded gas.

It's typically sold in grades: unleaded or regular with an octane rating of 87; plus with an octane rating of 89; and premium with an octane rating of 91 to 93.

On average, you could be spending anywhere from 20 to 50 cents more per gallon for premium gas.

Check this online calculator to see exactly how much you could be saving.

With 70 percent of cars on the road today requiring regular gas, you could be spending over $100 a year for no benefit to your car's performance. Purchasing premium gas when your car doesn't require it is just one way to watch your money go up in smoke – or exhaust fumes.

What To Do: Use the appropriate gas grade for your car type. If your car only needs regular unleaded, don't splurge on premium.

Potential Savings: Over $100 a year

2 2 Not Understanding The Cost Of Repairs At The Dealership

The second way to save money with your car is understanding the cost of repairs at the dealership versus an independent mechanic.

It's happened to the best of us.

Your car needs a repair, you need to get back on the road, and you sign every piece of paper your mechanic hands you.

Are you sure you even remember what work you authorized?

Our cars are essential to our daily routines, and it makes sense you'd want to restore your car to functionality as quickly as possible, but at what cost?

You should be comparing prices between the dealer and mechanic before you ever drop your car off because you could be overpaying for both labor and parts.

Labor costs alone could make the difference in a repair – anywhere from $30 to $50 or more an hour when using the dealership versus an independent mechanic.

If your next repair takes five hours to complete, this could mean spending up to $250 or more just for the technician to work on your car.

There's also the element of parts.

Dealerships, with loyalty to their brand, may only offer original equipment manufacturer (OEM) parts. While these may be mandatory in some repairs, you could potentially see savings on the parts with a multibrand mechanic.

Wherever you go for repairs, ask about using OEM parts or an alternative that can help save you some cash. In some cases, between parts and labor, you could be saving 15 percent or more just by looking outside the swanky dealership for your repair.

What to Do: Ask questions about the costs of a repair, and don't be afraid to compare quotes from dealerships and independent mechanics.

Potential Savings: 15 percent or more on certain repairs

3 3 Neglecting To Do Your Research Via Customer Feedback On Service Centers

When you make the decision to utilize an independent mechanic over the dealership, you still have to be smart about where you take your car.

In a world of smartphones, the car owner with apps is king or queen.

After a shop quotes you for a repair, make sure you still pull out your phone and take a look at what other individuals who have experienced working with this service center or independent shop say.

This is an easy way to save on repeat repairs and avoid bad service.

On popular social platforms, like Facebook, Google, and Yelp, users often post reviews and share their experiences working with businesses. These can provide you with a comprehensive look at the good, bad, and ugly of working with a particular service provider.

You should also ask if they're AES (National Institute for Automotive Service Excellence) certified to ensure they've met a certain standard of quality.

You should also take a written estimate before you leave your car for service, regardless of the shop's reputation.

More unscrupulous mechanics can do many things to inflate the cost of your bill, turning that $30 oil change into a set of $300 services.

Undercover studies and crooked mechanics that have come clean share you're most likely to see your bill inflate in a couple of key areas with less reputable mechanics: overquoting the time required to complete the service; recommending flushes of different fluids (brake, coolant, steering) outside of recommended intervals; difficult-to-access parts not actually replaced; and inventing a more costly repair off of a simple sensor reset or reconnection.

To avoid these types of scams, check your state's consumer complaints website to see what others are saying about a shop you're thinking about using for your repairs.

Doing research on the repairs and, more importantly, the reputation of your mechanic is worth whatever megabytes hit your cellular data package may take.

What To Do: Research where you're bringing your car ahead of time to see how other car owners have been treated.

Potential Savings: $10 to over $100 on each repair, depending on the repair needed and truthfulness of your mechanic.

4 4 Wasting Over $400 Per Year Driving On Flat Tires

Are your tires appropriately inflated right now? Or do you even know the right pounds per square inch (PSI) your front and rear tires require to be properly inflated?

You need to know.

If not, you could be wasting over $400 a year, based on an average of 12,000 miles driven per year, thanks to underinflated tires.

Talk about putting pressure on your finances! The popular Discovery Channel show “MythBusters” even put this to the test and confirmed the “myth,” finding tires underinflated were burning over 1 percent more fuel than appropriately inflated tires.

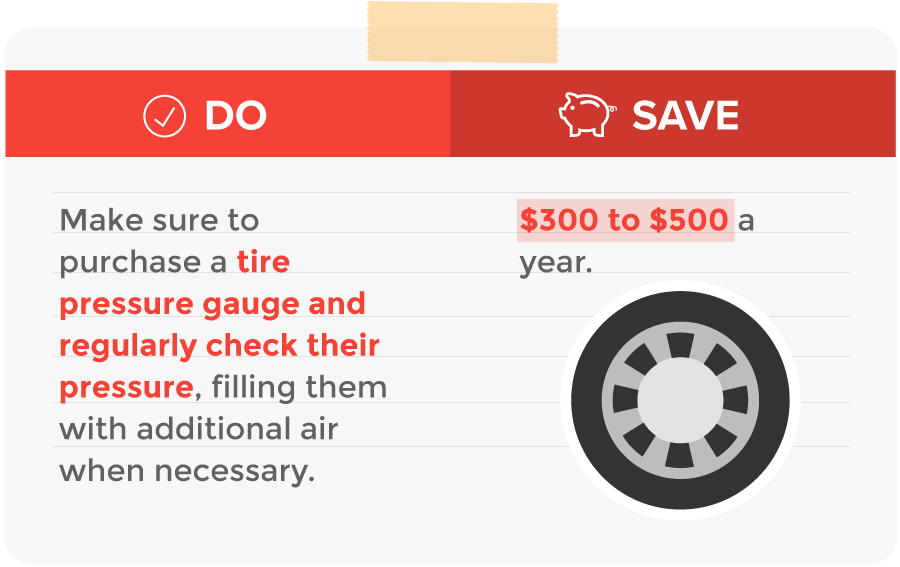

With digital tire pressure gauges costing well below $300 to $500 in potential savings per year (plenty are available for $10 or less in most major retailers), we recommend checking your tires regularly to help avoid that deflated feeling when you look at your bank account.

Don't contribute to the 5 million gallons of fuel wasted per day, or 2 billion gallons per year, due to underinflated tires.

The correct pressure levels for your front and rear tires, which should be different, are listed within your owner's manual. Your car manufacturer should also be able to provide you with the right number if necessary.

What To Do: Make sure to purchase a tire pressure gauge and regularly check their pressure, filling tires with additional air when necessary.

Potential Savings: $300 to $500 a year

5 5 Failing To Check Engine Light Warnings

You may not like seeing it pop up, but we can't stress this point enough – do not ignore the “check engine” light.

Over 220 million vehicles in North America and almost every car sold after 1996 are equipped with the “check engine” light. While this could be as simple as a loose gas cap, you won't know until you have the car examined by a mechanic.

This is a good opportunity to get more acquainted with your car and what it's trying to tell you so that you don't have to rush out to a mechanic when that little light comes on.

Purchase an inexpensive code reader from your local auto parts store that can connect to your car's computer and read the codes, or signals, the car is throwing.

However, these are only the first breadcrumbs in a trail to uncovering your problem.

Your “check engine” light doesn't necessarily mean your entire engine is failing. It could be the oxygen sensor, which costs less than $200, but could result in a 40 percent drop in your car's fuel efficiency if left unrepaired.

This would mean you'd only be getting 60 cents on the dollar for every gallon of gas purchased.

Spark plugs are another common part that could require replacing if the “check engine” light warning is active.

Spark plugs can cost less than $10 and could be an easy do-it-yourself fix depending upon your comfortability with repairs (or following instructions).

If they're not working properly and are left untreated, they could damage your car's catalytic converter, leading to a repair over $1,000. Leaving a “check engine” light unchecked could be an incredibly costly mistake.

What To Do: Have your car inspected within 1-2 days once the “check engine” light comes on.

Potential Savings: Depending on the nature of the issue, you could save $100 to over $1,000.

6 6 Not Getting Your Car Serviced On A Regular Basis

The last thing you want is to take your car to the dealership or to your mechanic to get routine service that doesn't fit with your daily or weekly routine.

However, forgetting to follow-up on regular services, recommended on a specific schedule for each car by its manufacturer, puts you in the position of paying more – multiple times more – than the preventative cost.

Make sure you read through your owner's manual, so you're familiar with standard maintenance services like oil changes, tire rotations, timing belts, and brake pads. Each of these is a minor cost when performed regularly, but can cost far more if neglected.

Oil changes, frequently advertised for $30, would cost you $120 a year – replacing your entire engine could be a $4,000 expense. Since the oil serves to keep your engine clean and lubricated, it's important to do this at the prescribed intervals to avoid a massive unexpected expense.

Another often-neglected component are tires. Rotating tires doesn't sound like something fun to spend money on, but by rotating them, you're distributing the wear more evenly across the tires.

Left unrotated, your car will need a new set of tires well before their time. This takes a $50 service up to a cost of $350 or more to replace all of your tires.

What To Do: Follow your owner's manual and complete the recommended services at the appropriate intervals.

Potential Savings: $10 to over $100, depending upon the nature of the issues that go unchecked.

7 7 Overpaying On Car Insurance

Over the last five years, research estimates that Americans have overpaid for car insurance by over $100 billion collectively.

What does that mean for you?

A lot of money.

Additional research has suggested that taking the time to shop around for your auto insurance can save you an average of almost $400 a year or more.

Nearly three-quarters of the U.S. population has been with their current auto insurance provider for four years or more.

This means leaving your policy on auto-renew and not looking at ways to save could be costing you hundreds of dollars. Who wouldn't want an extra $400 to use for something other than an insurance premium?

In total, Americans have overpaid over $100 billion in car insurance over the last five years.

While your rates are naturally going to fluctuate year to year regardless of your provider, taking the time to research your options before renewing your premium could save you big bucks. A J.D. Power study found that fewer drivers in the U.S. shopped around for car insurance in 2016, but of those who did and changed their insurer, the average savings were $356

Think about what you could with that money.

It's also important to understand the kind of coverage you're paying for. We all want to save and make sure we're covered in the event of an accident, but pay attention to the fine details of your auto insurance premium – you could be overinsured and not even realize it.

Know your state's minimum coverage laws and compare that to your elected property damage and liability coverages.

You may find you're covered substantially more than you're required and that you're paying extra for it.

Depending on how old your car is, or its estimated value, financial analysts even recommend reconsidering (and dropping) comprehensive coverage in some cases to help you save.

Use our online tool to get quotes from the leading providers of auto insurance.

At Quote.com, we want to show you how much you could be saving to help put money back in your pocket and take the worry out of car insurance. Use our free online tool today to learn more.

It's a Dangerous Gamble Riding Uninsured

There's also the unfortunate gamble some make on the road – carrying no insurance. Not only is this dangerous, but it is also illegal is almost every state. Even in the states where it is legal, you must have sufficient capital to cover potential damage and injury to a car or person if you are involved in an accident. While the number of uninsured motorists has gone down over time, sitting at just over 12 percent, or about 1 in 8 drivers as of 2012, it isn't a cheaper solution to costly premiums.

In California, for example, being in an accident without insurance could lead to a four-year suspension of your license. How would you go about getting to work or school if you had a four-year ban on driving yourself? You could also have insurance companies suing for your other assets to cover the cost of an uninsured motorist policy the other driver carries.

It's far, far less expensive to carry insurance than run the risk of not having it and being caught. In the U.S., more than 12 percent of drivers do so illegally while uninsured, leading to claims totaling over $2.6 billion in recent years. You can also pay high fines if caught driving without insurance. In New York, it's a minimum $1,500 fine for your first offense.

Use our online tool to get quotes from the leading providers of auto insurance. You won't know exactly how much you could be saving on your auto insurance or how much unnecessary coverage you may be paying for already until you check. While it may feel like you're unable to afford insurance and would rather run the risk of getting caught, an affordable policy is closer than you think.

What To Do: Ask for a detailed outline of your coverage from an existing provider and compare that to your state's requirements and the Kelley Blue Book value of your car. Once you have a sense of what you need, use our tool to find the best car insurance rates.

Potential Savings: You would save on potential fines for driving without coverage, which can cost hundreds to thousands of dollars. If there's an accident, your personal possessions could be a target for insurance companies to reclaim their expenses. It has cost the public over $2.6 billion in recent years to deal with uninsured drivers.

Saving Money On Your Car Doesn't Have To Be Difficult

Saving money on your car doesn't have to be difficult.

We've outlined seven simple steps that can save you hundreds of dollars every year and don't require a degree in automotive engineering.

From using the correct grade of gas at the pump, keeping an eye on your tire pressure, keeping up with routine maintenance, and listening to what your car is trying to tell you, you can avoid costly mistakes (and repairs) over time.

And because you can't do everything yourself, we even outlined steps to help you decide between using the dealership or a reliable independent mechanic.

Most importantly, you shouldn't be overpaying for any service – and that includes automotive insurance. Using Quote.com, you have the resources at your fingertips to find the right coverage at the right price.

At Quote.com, we want to show you how much you could be saving to help put money back in your pocket and take the worry out of car insurance.

Your opportunity to save is entirely unique to you.

Use our online quote tool to get an idea of your individual savings.