Whether it's for your home or your vehicle, you're always going to need some form of insurance.

You need to make sure that your belongings are safe and that you're also protected from liability.

The problem is that some insurance companies make it difficult with poor customer service and long waits on the phone before you can actually speak to a person.

Some companies are only quick to answer the phone when you need a quote and you'll notice they'll do everything to help you sign up.

But then once you've signed up and paid them, you'll start to experience being put on hold forever to get an answer, whether you're trying to file a claim, or just need some information about your account.

That's the last thing you need to deal with when you just want to get some insurance.

Thankfully, United Auto Insurance is one company with a history of providing excellent customer service.

Its online reviews show a stellar record.

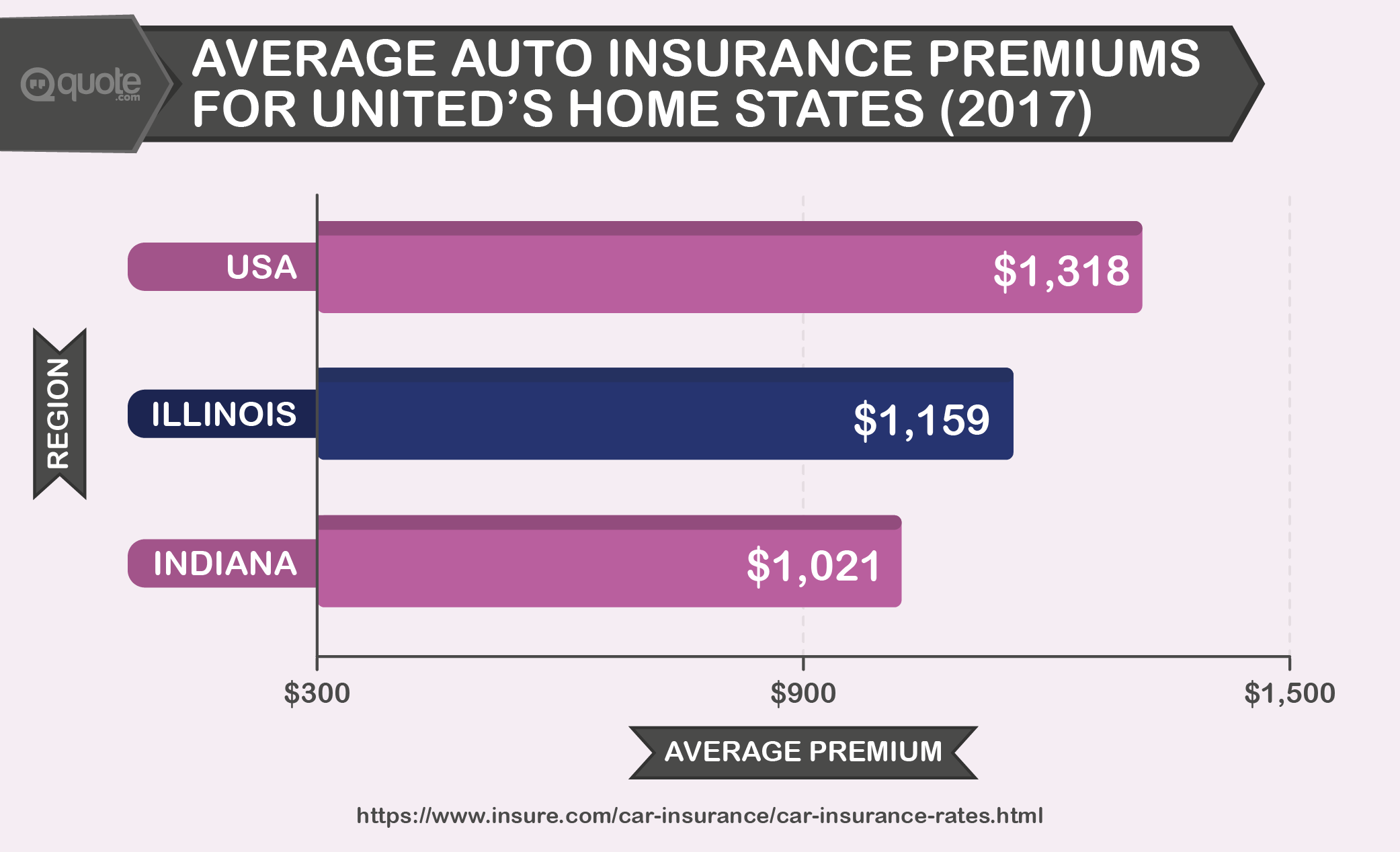

And it also claims to offer some of the lowest prices in the industry.

In this in-depth review, I'm going to help you decide whether United Auto Insurance might be a good choice for you.

But first, it's time to know a bit more about this insurance company.

United

Learn more about this Chicago-based auto insurance company

United Auto Insurance has been providing customers top quality insurance at the lowest possible prices for more than 50 years.

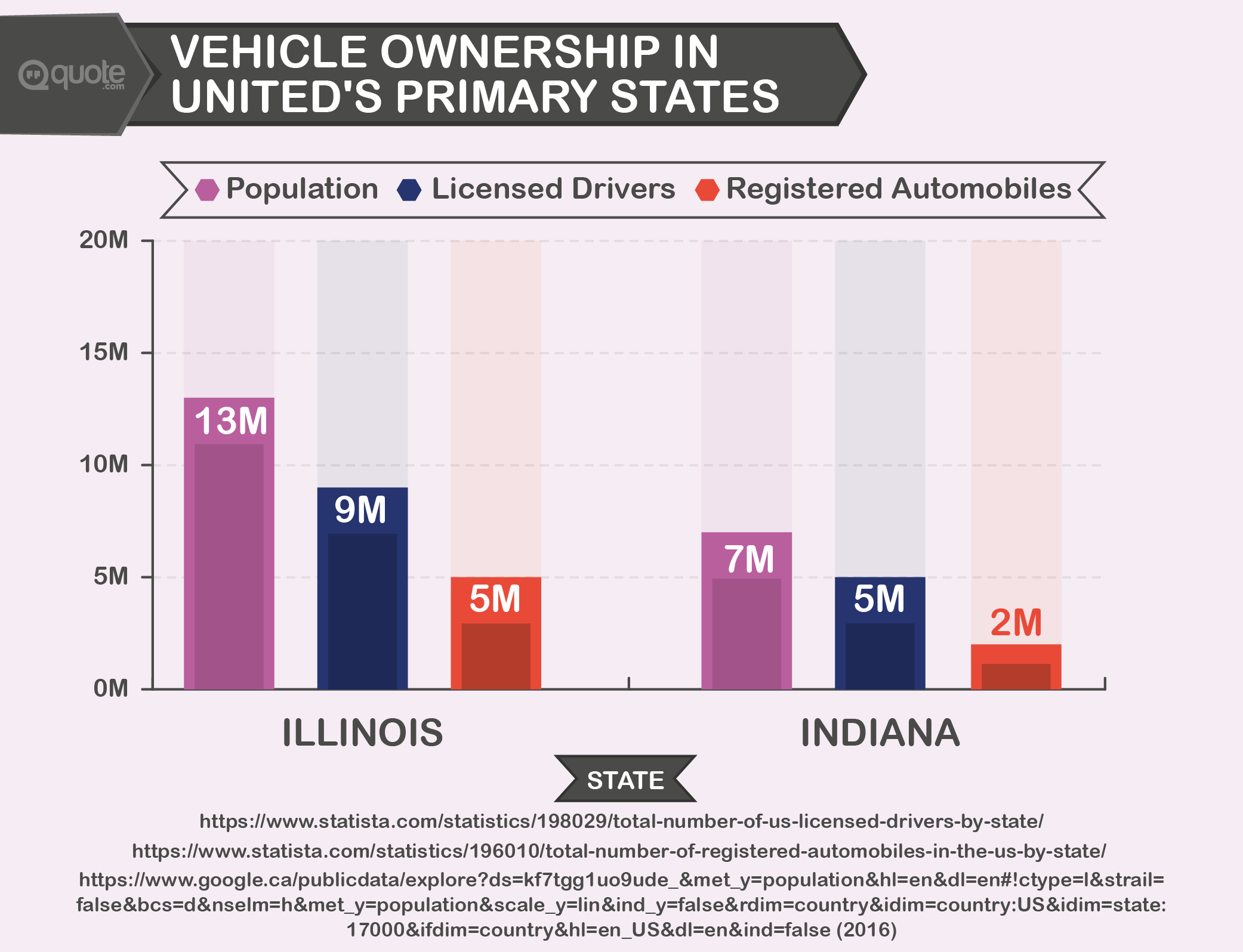

The company primarily serves clients living in the Chicago, Illinois, and Indiana areas.

It can customize a monthly payment plan to fit your budget, whatever that may be.

You can pay by check, debit card, or credit card right over the phone and you have an option to speak to someone in English, Spanish, or Polish.

United's specialty is last minute coverage.

Its computerized rating system allows its agents to offer you the lowest possible rates plus instant coverage right over the phone.

Having no prior insurance is also not a problem. And United will find you the lowest rate even if you've had tickets before.

United offers coverage for all drivers, and that includes teens and young adults too.

I would say United is definitely worth checking out.

After all, a single phone call might save you hundreds of dollars per year on your insurance.

And with just a click, quote, and print, you can get insured in minutes!

Products and Services

See what United Auto Insurance can offer you

United offers the following types of insurance:

Auto. Get top quality auto insurance at the lowest possible prices.

SR-22. Get your SR-22 certificate the same day you apply.

Motorcycle. Get full coverage, liability, and guest passenger insurance.

All motorcycles can be covered, including high performance bikes and Harley Davidsons.

Homeowners & Renters. Make sure your property and the belongings in it are safe.

Commercial. If you have business vehicles on the road, then you need commercial auto insurance!

Auto

United offers all of the common types of auto insurance

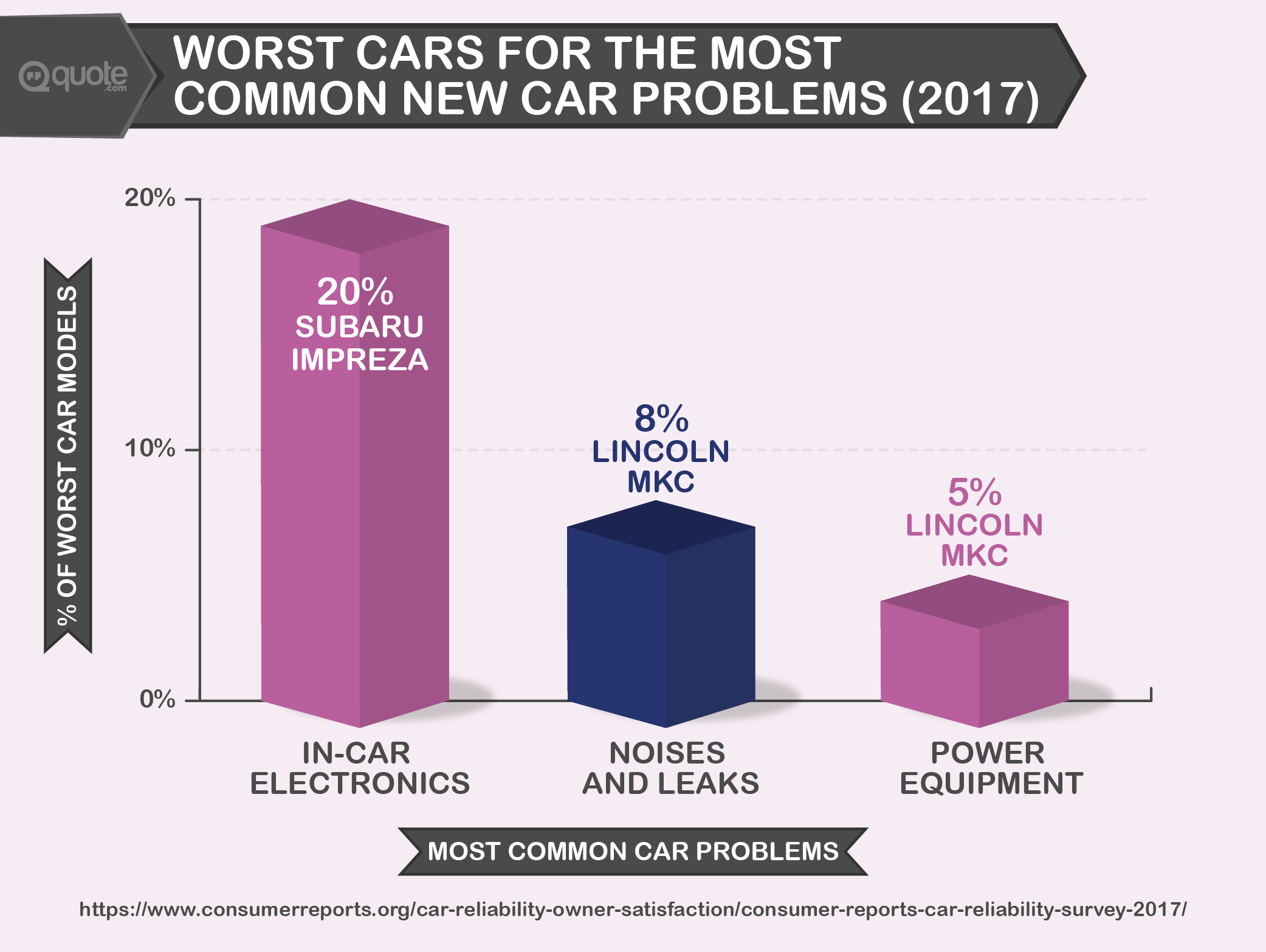

If you have a car, United can get you the insurance coverage you need.

Whether you have a vehicle for personal or business use, it's got you covered.

United covers leased vehicles and even tow trucks.

Plus it offers the option for increased liability limits.

You might also be entitled to the following discounts:

Multi-car discount. If you insure two vehicles or more on one insurance policy, you'll get a discount.

The amount of your discount will vary based on your particular situation.

Renewal discount. If you maintain your coverage for a specified period of time without any lapses, you'll earn a discount as well.

United automatically begins applying your discount once you qualify.

Safe driver discount. If you have kept a clean driving record for a specific period of time, you're entitled to a discount.

Why shouldn't you get rewarded for being a safe driver?

This type of discount will also vary depending on a number of factors. You can call United today for more specific information.

SR-22

What is SR-22 insurance and why would you need it?

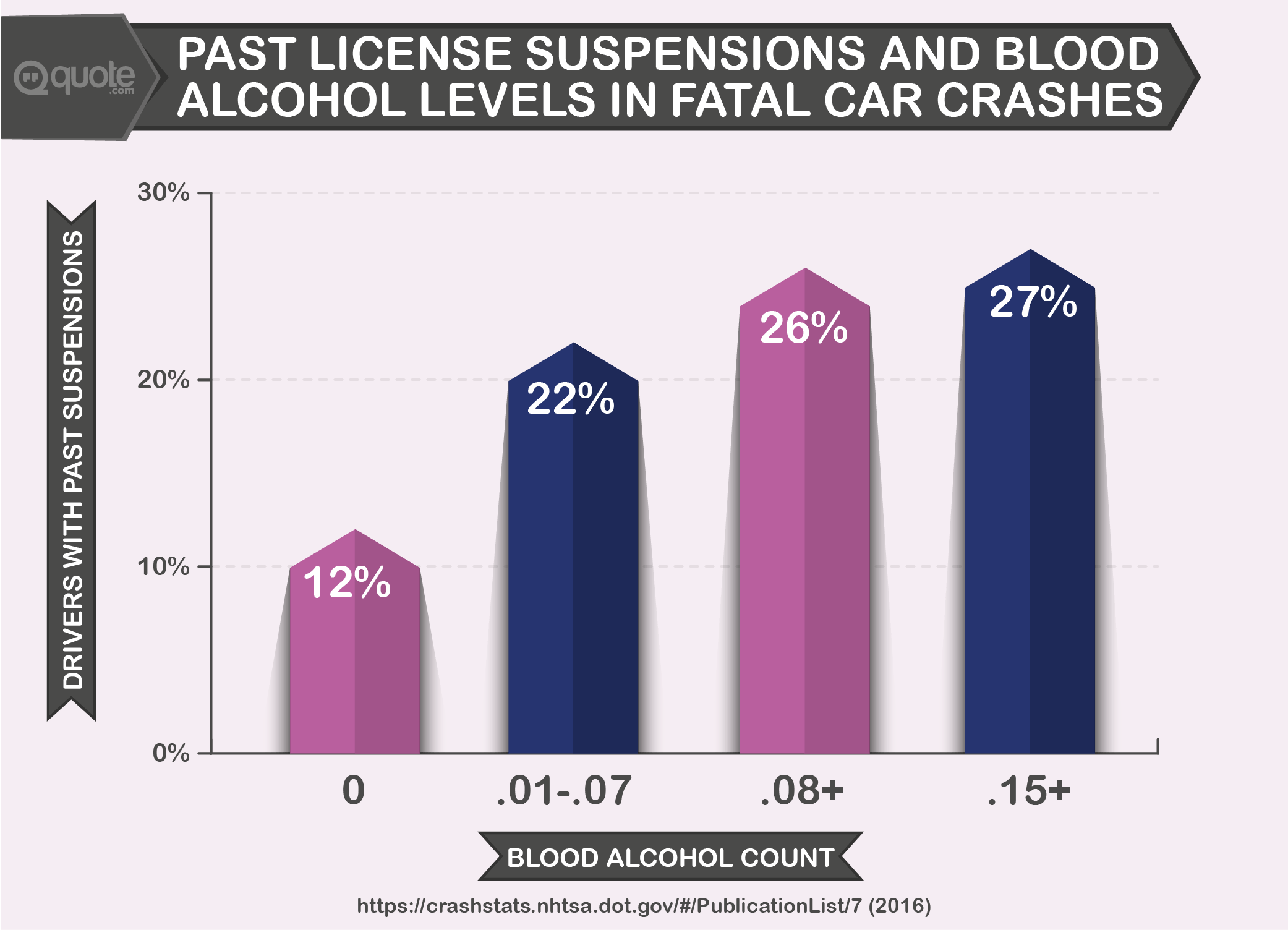

You require SR-22 insurance if you're a driver who's had their license suspended.

It's a certificate of financial responsibility that gets filed with the Illinois Secretary of State's office.

It notifies the State that you have a minimum of liability insurance and have met the State's insurance requirements.

This might be because of a number of reasons.

Some of them include:

- DUI/DWI convictions.

- Driving without insurance.

- Expired license plates.

- Multiple traffic offenses.

- A high amount of points on your driving record.

Do any of these apply to you?

Your driver's license can get suspended if you don't file for an SR-22 by a specific date.

United can provide instant SR-22 coverage and proof of insurance.

It can also electronically file your SR-22 paperwork directly with the Illinois Secretary of State to save you the hassle.

However, you should be aware that it can take as long as 30 days for the State to process it.

The SR-22 filing process can be confusing, but United is known to be helpful in answering any questions you might have.

United Auto Insurance doesn't charge any additional cost for filing an SR-22 either.

You just need to purchase liability or full coverage insurance and United's staff will handle the rest.

The cost will depend on your age, type of vehicle, driving record, and other insurance factors.

The State of Illinois generally requires SR-22s for at least three years.

After this period, your SR-22 status will get removed.

Then it's important to revisit your insurance policy and make sure you continue to stay covered.

United Auto Insurance can help keep your driver status intact and in good standing during and after your SR-22 period.

One important thing to note is to be sure you keep both your SR-22 certificate and your insurance policy together with you at all times while driving.

Motorcycles

You're passionate about your motorcycle. Make sure both you and your bike are taken care of

United Auto Insurance understands that if you ride a motorcycle, it's probably your pride and joy.

Whether you're a long time motorcycle enthusiast or just buying your first bike, United can make sure you have protection.

It can make sure you get the right coverage.

What that is, depends on your individual needs.

But it may include protection of theft or fire, covering your accessories, or providing optional roadside assistance.

United lets you get out on the open road with peace of mind that your bike has coverage.

You can choose the motorcycle insurance that's right for you:

Liability. This includes bodily injury, property damage, uninsured motorist, and guest passenger.

Full coverage. This includes everything liability covers. Plus accessories, comprehensive, and collision.

Excursion diversion. If you crash your bike more than 100 miles from home, this type of insurance helps pay for food, lodging, transportation, and towing.

Optional. You can also get optional rental insurance and roadside assistance through United.

United covers all makes and models of motorcycles.

Including Harley-Davidson, Kawasaki, Honda, Suzuki, and more.

It can also cover scooters and mopeds on this type of policy.

Coverage varies state by state. But expect United will do its best to find the right motorcycle insurance for you.

Homeowner & Renter

Make sure your residence and belongings get kept safe

United Auto Insurance provides homeowners and renters insurance.

It doesn't matter if you live in a small apartment downtown or a 2-storey home in the suburbs, it can help keep your contents safe.

Homeowner insurance. This protects your house and belongings.

It can even protect you from lawsuits if accidents happen on your property.

Renters insurance. Even if you don't own the place you live in, your stuff is still important.

Make sure you have insurance for all of that stuff you've accumulated over the years.

United can ensure everything from your jewelry to your flat screen TV.

All it takes is completing the quote form on United Auto Insurance's website to get a policy customized to fit your needs.

Commercial

Don't put your livelihood and business at risk because you lack the right insurance

Commercial insurance is necessary if you use your car for business purposes.

That could be service, sales, or delivery calls, or even running work-related errands like trips to the post office or bank.

Normally, commuting to and from work isn't considered business use, but pretty much anything else you use your car for during work is.

A smart business-owner understands why commercial auto insurance is essential.

It helps protect your business vehicles from a number of risks.

United Auto Insurance can help no matter what type of vehicle you drive for business.

Pickups, trailers, box trucks, and regular cars are all covered.

United offers insurance to all kinds of different businesses:

- Taxis

- Limousines

- Couriers

- Delivery companies

- Caterers

- Tradesmen

- Roofers

- Electricians

- Plumbers

- And more!

Roadside Assistance

United Auto Insurance's motor club provides 24/7 roadside assistance

United has thousands of garages and service stations under contract to help protect you.

With United's 24-hour roadside assistance, you don't need to worry about getting left stranded anywhere in the continental United States.

You might need roadside assistance for any number of reasons:

- A flat tire

- Dead battery

- Running out of gas

- A tow or jumpstart

- You lock yourself out

When you're having a bad day on the road, it doesn't need to be any worse.

That's why roadside assistance is nice to quickly get help with just a simple phone call.

United Auto Insurance's roadside assistance includes the following:

Emergency road services. Members of the roadside assistance plan can get jump starts, tire changes, delivery of gasoline, and mechanical assistance.

Emergency towing service. If your car won't start, you can get your car towed to the garage of your choice. 24 hours a day, 7 days a week.

There are some limits on towing coverage though, so make sure to read your service agreement.

Emergency lockout service. If you accidentally lock your keys inside your vehicle, you can call United's 24-hour hotline to get a locksmith to help.

Toll-free emergency service lines. United Auto's motor club has a toll-free 24-hour emergency road service number.

It's always there for you to call if something happens to your vehicle while you're on the road.

Auto accident towing. If you get in an accident with another vehicle, you're entitled to a towing service.

Signing up

Learn how to sign up with United Auto Insurance

Signing up with United Auto Insurance is pretty straightforward.

You can call United or use its online form to get a quote.

The website is designed to be the fastest way to obtain a free quote.

You start by just entering your zip code then there's a four-step process that follows.

Overall it's a minimum amount of information. Just enough to ensure your quote will be accurate.

This includes things like your address, the make and model of your car, and other essential details.

You're not under any obligation to buy from United when you request a quote.

But if you decide that United Auto Insurance is your best choice, you'll be just a couple minutes away from having coverage.

You can print yourself a copy of your policy immediately after getting your quote and purchasing your insurance.

Strengths and Weaknesses

See what sets United Auto Insurance apart from other companies

United Auto Insurance has some rave reviews online.

Some of the things people love about the company are:

Great service. On Google Reviews, the company has a rating of 4.4 out of 5.0 stars with over 400 reviews.

People rave about how professional and helpful UAI's customer service is.

On the Better Business Bureau website, UAI has a 5/5 review and a BBB rating of A+.

100% of customer complaints have been resolved or closed.

So when it comes to customer service, I think United Auto likely offers the best that an insurance company has to offer within Illinois and Indiana.

Language options. If you happen to be more comfortable speaking Polish, United Auto Insurance could be an excellent choice for you.

I can't think of any other auto insurance companies that provide this option.

Although admittedly that will help only a small section of people. And its service in both English and Spanish are pretty standard for most other insurance companies.

However, there are also a few drawbacks related to United. These include:

Limited area. The biggest downside to United is that it only provides insurance within two states.

Its roadside assistance program will cover you in case of breakdown across the entire continental United States.

But everything else it offers is only good for people who live in Indiana or Illinois.

Few discounts. UAI also doesn't offer a huge amount of discounts.

Discounts include the basics like multi-car, renewal, and safe driver.

But none of its other plans seem to offer any other specific discounts.

Lacking info. The website also doesn't provide any specific details of what the insurance options cover.

At least not until you actually request a quote.

This makes it difficult to compare rates and offerings with the competition.

FAQ

Frequently asked questions about United Auto Insurance

Any business owner or tradesperson is required to sign this form when they apply for a personal auto policy.

Overall

United Auto Insurance has excellent customer service, but it isn't available nationwide

You don't want to deal with bad customer service when trying to get an insurance quote.

You just want to get your vehicle or home insured so that you know you have coverage if anything untoward happens.

United Auto Insurance has online quoting available, and claims tooffer the lowest possible prices.

United can provide you with an SR-22 certificate to get you back on the road if you have a suspended driver's license.

The biggest drawback is that its service isn't available nationwide.

The website also doesn't say how much coverage the plans include.

So you're really left in the dark until you've requested a quote.

In terms of discounts, United only offers the bare minimum.

But for some people, customer service is a significant factor in deciding which insurance company to go with.

If that's the same case for you and you live in Indiana or Illinois, then it wouldn't hurt to get a quote from United Auto Insurance.

What's the best customer service experience you've ever had?

Let us know in the comments below!