Nationwide Insurance is the official sponsor of the National Hockey League's Columbus Blue Jackets.

The NHL hockey team from Ohio plays in the Nationwide Arena.

Liberty Mutual Insurance is the official sponsor of the United States Soccer Federation.

That includes the US men's and women's national soccer teams.

Two different insurance companies, supporting two different sports.

We're going to let them face-off here to see which one scores when it comes to auto insurance.

Types of Insurance

Both Nationwide and Liberty Mutual are best known for their auto insurance.

But they both offer a full range of insurance products.

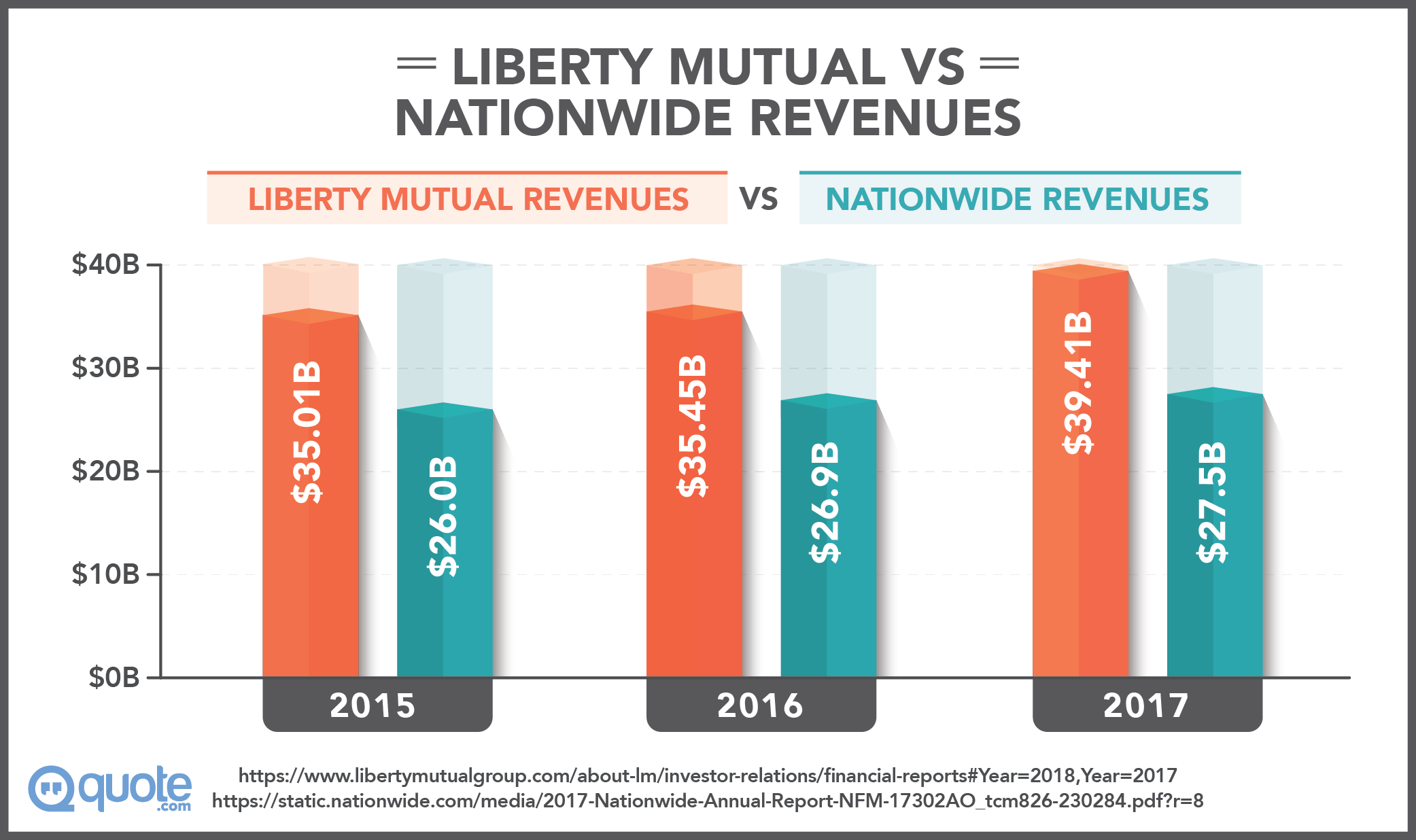

Liberty Mutual is impressive as the 8th largest insurance company in the US.

They have revenues of $38.5 billion and employ 45,000 people.

The company offers insurance for property, vehicles, and for life, family, and health.

Their property insurance includes homeowners insurance, renter's coverage, insurance for condos, and an insurance policy for landlords, mobile home, and flood.

Liberty Mutual's auto and vehicle insurance include policies for cars, motorcycles, boats and watercraft, antique and classic cars, ATVs and off-road vehicles, and recreational vehicles.

They also provide life insurance, identity theft, and a pet insurance policy.

Nationwide is a company that has a lot going for it.

The company offers vehicle insurance for cars, RVs, boats, and other forms of transportation.

They have property insurance that covers homes, apartments, and condos as well as their contents.

This includes an insurance policy for renters.

Nationwide provides life insurance coverage as well as small business insurance.

Their specialty insurance includes personal umbrella, travel, wedding, dental, and farm insurance.

Auto Insurance

Liberty Mutual and Nationwide are both in the top eight car insurance companies in the U.S. when it comes to market share.

Their auto insurance policies have several different features.

Liberty Mutual's car insurance has some features that come with every policy.

The standard features are bodily injury liability, property damage liability, and coverage for medical payments.

You have the option to add collision coverage, comprehensive coverage, accident forgiveness, new car replacement, better car replacement, and rental car reimbursement.

Nationwide's vehicle insurance includes liability, collision and comprehensive coverage for losses due to theft, vandalism or natural disasters.

They also have a lot of optional extras that include roadside assistance, personal injury protection, uninsured motorist coverage, rental reimbursement, and classic car insurance.

Rates

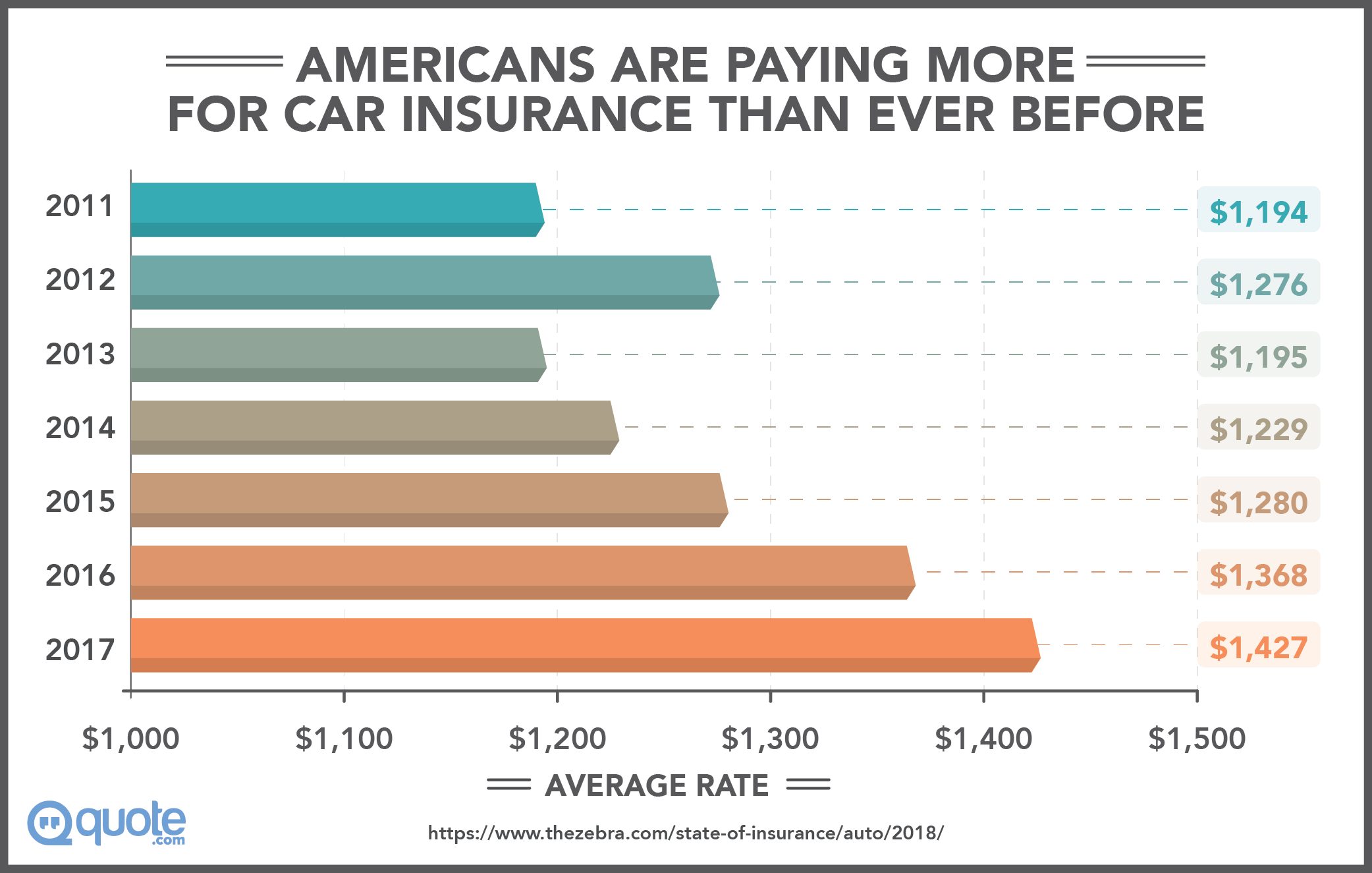

No matter who you are getting your car insurance from, there are milestones that are going to make your rate go up or down.

Nationwide sets its car insurance rates through several factors.

These include your driving record, your age, the kind of car you drive, and where you live.

Your credit score also impacts the rate you get.

Rates also change from state to state.

In Virginia Nationwide's average annual car insurance premiums were $1,064.

That ranked it the third cheapest in the state.

In Georgia, Nationwide's average car insurance premiums are $1,308.

That's the 8th cheapest car insurance available in the state.

But in California Nationwide's average annual premium is $1,137.

That's the cheapest car insurance you can get in the Golden State.

Liberty Mutual's rates are based on age, gender, marital status, the kind of car you drive, your driving record, your credit score, and the state you live in.

Their average rate for male drivers is $2,407 for teens.

For 20 to 30-year-olds, it's $2,337.

The average rate is $1,745 for males 30 to 40 years old.

If you're over 50, your average rate is $1,373.

For females, those rates average around $400 less.

Discounts

Liberty Mutual has several discounts that let you save.

Bundle discounts are available if you get other insurance products from Liberty Mutual.

If you also get your home insurance from them you can bundle them together and get a discount on both.

There is a discount if you sign up multiple cars for auto insurance policies with Liberty Mutual.

If your vehicle has safety features like anti theft security or anti lock brakes, you get a discount.

You also get discounts for some more advanced safety features.

These include adaptive cruise control, lane change warnings, and collision preparation technology.

If you drive a hybrid your concern for the environment is rewarded with a discount.

There are also some interesting discounts for personal situations.

If you're newly married, graduated, retired or moved, you can get a discount.

If you have a young driver on your policy, there are discounts that reward teens for responsible driving.

They also get rewarded for being good students.

You get a discount for adding or changing a vehicle on your policy.

If you opt for automated payment you also get a discount.

Nationwide also offers a lot of discounts.

You get a multi-policy discount if you bundle other products like life insurance or home insurance.

They have a family plan discount if other people in your family insure their cars with Nationwide.

If you have 5 years of accident-free driving, you get a discount.

If you sign up for paperless documents and pay your bills online, your premiums are reduced.

They have partnerships with professional organizations and alumni associations to provide discounts to members.

There's also an interesting option called the SmartRide discount.

This is where they give you a device that monitors your driving.

You instantly get a 5% discount for signing up.

If your driving data shows you're a good, safe driver you can get up to another 40% in discounts. Nationwide also has a feature called the Vanishing Deductible.

For every year of safe driving, you get $100 off your deductible, up to $500.

Say for example you have a $500 deductible and you go 3 years accident-free. If you do make a claim your deductible would just be $200.

Benefits and Features

Both companies have different benefits and features.

Liberty Mutual is owned by the policyholders.

That means the customers also get to have input on the insurance products and services.

That's probably why Liberty Mutual's car insurance includes roadside assistance.

There is a 12-month guarantee that your rates won't be raised.

Accident forgiveness rewards drivers who have been accident-free for five years.

Their rates won't be increased.

And if you get your car repaired at an approved car repair shop it is guaranteed for as long as you have the car.

Nationwide is also owned by its policyholders.

The company also has some strong benefits.

As mentioned, the Vanishing Deductible means that your deductible goes down by $100 every year you go without an accident (up to $500).

They also have a program called the On Your Side Review.

This is where an agent sits down with you one-on-one and looks for the best available coverage for you and your budget.

They also have really good hiring policies.

Their Equal Opportunity policy protects people's gender and sexual identity.

This has resulted in great relationships between Nationwide and the LGBT community.

Payment Options

Each company has several payment options.

Nationwide lets you pay online in a few ways.

You can register for automatic payments known as Easy Pay.

Your payment is withdrawn from your bank account.

You can pay electronically through your bank's website.

Or you can sign up for recurring credit card or bank card payments. You can set up an online account with Nationwide and pay through there.

You can also pay online through a portal that doesn't even require you to login to an account. You can pay by phone or even by texting PAY to a specific number.

Or if you're old fashioned you can still pay your bill via snail mail.

If you pay in full there are no fees but if you go for an installment plan you are charged an installment fee.

With Liberty Mutual, you can set up an account to manage your payments and claims.

But like Nationwide you can also pay through their online portal without logging in.

You can set up automatic payments through your credit card or bank account.

Or you can do electronic funds transfer through your bank's website.

There is also an automated phone service for payments.

You can even set up a payroll deduction where your insurance bill comes right off your paycheck.

And of course, paying through the mail is always an option.

Getting a Quote

You can get free car insurance quotes from both companies.

Nationwide's website gives you the chance to submit your information online.

Then they'll immediately give you a quote.

You also have the option to save your quote in case you are shopping around.

If you call Nationwide they have actual agents working at the call center who can give you a quote.

If you're more comfortable meeting in person you can find an office and talk to an agent one-on-one for a quote.

Liberty Mutual also has a call center with licensed professionals.

You can get a free online quote through their website.

Once you get your quote you can save it if you're comparing other quotes.

Or you can go straight through to purchase the insurance via the website.

You can also use the website to locate an office near you if you prefer to get your quote in person from an agent.

Best Company for Different Needs

Liberty Mutual has higher basic rates than other car insurance companies.

But they offer a lot of discounts.

If you're a driver with a good driving record you will get a discount.

Even if you get into an accident you can qualify for Accident Forgiveness and your rate won't go up.

If you don't have a good record you might want to look elsewhere.

Liberty Mutual won a recent court case against a company that had a higher risk than they reported.

They're not the right insurer for higher-risk customers.

If you don't qualify for any of their discounts you could likely find a better rate.

If you prefer to manage your insurance through an app Nationwide is a good choice.

Their agents and support staff are sometimes hard to connect with.

But the app is one of the best in the industry.

It's easy to navigate and you can use it for everything from finding an office to recoding insurance info after an accident.

They also have a really good website.

You can manage your policies there as well as pay your bills. You can report and track claims through the website.

Areas Each Company Serves

Insurance rules vary from state to state.

Every state also has different living and driving conditions.

That's why there are different prices and products available in each state for any insurance company.

Oddly enough, even though their name is "Nationwide" the company doesn't actually provide insurance in every state.

You can't get any kind of Nationwide insurance in Florida, Louisiana, New Jersey, and Massachusetts.

Liberty Mutual provides car insurance to every state.

However, they don't sell home insurance to houses in Florida.

Customer Service Reviews

The reviews for Liberty Mutual's customer service are generally good.

Customers have said that they like how Liberty Mutual will match lower quotes from other companies.

The customer service representatives are easy to get in touch with and answer all their questions.

The website and claims portal are easy to use. Customer service reps give advice for lowering premiums.

Their tips include taking defensive driving courses and getting umbrella coverage.

When accidents happen customers are given a rental for as long as it takes to get the car fixed.

Although most reviews are positive, there are some who complain their agent was poor in customer service.

Their customer satisfaction ratings are average or better.

Nationwide is supposed to be "on your side" but the reviews for their customer service suggest that's not always the case.

Customers complain that the agents don't return their calls.

They are told when they leave a message that they will get a reply within one business day.

But they don't hear back for over two days even when they leave a second message.

Others have found that the agents don't go to bat for them.

They don't look deeply into claims. This makes customers feel they are not looking out for them.

But with a 95% customer satisfaction rate, Nationwide's customer service can't be that bad.

That includes nine out of ten customers who say they would recommend Nationwide to a friend or family after making a claim.

There are some more positive reviews about customer service.

Customers are pleased with how the agents answer all of their questions and give them all the information they ask for.

Customer Reviews

Nationwide has a very high A+ rating with the Better Business Bureau.

But there are still some complaints from customers. Many of them are about problems connecting with agents or getting called back.

But there are also complaints of rates getting increased unexpectedly.

Denial of coverage and the need to take legal actions are also reported.

Liberty Mutual also has customer reviews reporting unexpected rate increases.

There are complaints about delays in processing claims.

Some talk about problems with claim settlements and the denial of claims.

Recommendation

Liberty Mutual is the insurance company that sponsors the US national soccer teams.

Nationwide sponsors the building where the Columbus Blue Jackets NHL hockey team plays.

But don't make your car insurance decision based on whether you like hockey or soccer better.

Make it on your own needs. If you are a good driver you can qualify for a lot of discounts go with Liberty Mutual.

If you're a customer who prefers to manage your insurance yourself using the website and app, Nationwide is a better choice for you.