Car insurance is very similar to car shopping: sometimes it can be hard to tell whether you’re paying a fair price, or getting ripped off. Sure, the price may seem like a good deal, but how can you really tell? After all, it’s not like you’re an insurance expert.

If you’ve ever felt this way, the good news is that you’re not alone. For most of us, shopping around for car insurance is not high on our list of priorities. In fact, it’s actually more of a pain to deal with than something we look forward to. It can also be confusing and overwhelming at times, too.

Luckily, you’ll never have to feel this way again after today’s article. We’ll be outlining our best tips to save you money on your car insurance. You’ll feel like an auto insurance pro, minus all of the fancy training.

Let the Savings Roll In

If you’re ready to start saving money immediately, there are a few steps you can take:

Get Defensive

Some states are kind enough to offer a special defensive driving discount as long as you’re willing to spend 5–6 hours sitting through a course.

According to the Department of Motor Vehicles (or DMV), a defensive driving course covers the following topics:

- Defensive driving techniques

- Traffic laws

- Drug and alcohol awareness

- Driving in adverse weather

As you can see, these informative topics will help keep you safe when you’re on the road, which means you’re “statistically less likely to engage in risky driving behaviors and get into car accidents,” as pointed out by DMV.

You may be wondering what your “reward” is for all of this hard work. Well, some auto insurance providers will give you a discount that may be as high as 10% in savings. This may seem small, but it will certainly add up each month and over time.

Visit this link from DMV to see if your state carries a defensive driving course that’s eligible for an insurance discount. Check with your insurance provider to see what your incentives for taking a defensive driving course actually are.

Be Proactive

In addition to driving defensively, you also need to be proactive behind the wheel. Yeah, we told you to “get defensive” and now we’re telling you to be proactive, which is kind of the opposite, right?

So what gives?

Well, most auto insurance companies aren’t too keen on announcing every discount that they offer so you’ll need to proactively hunt for the ones that you’re eligible for.

Here are the most common discounts to look for according to Market Watch:

Annual Mileage - If you’re currently clocking in less than 12,000 miles per year, your insurance company may have an average of 11% to give back to you in return. This could save you roughly $84 per year, as mentioned in MW. Remember, every little bit counts!

Short Commutes & Days Per Week driving - If your commute is between 5–15 miles, you could see an average of 4% in savings each year.

Similarly, if you don’t commute every day, you’ll also see an additional 4% savings in your pocket.

Autopay - Insurance companies love when you pay on time. And one way that benefits both you and your provider is by switching to an autopay system where you authorize your car insurance payments to be debited from your account automatically each month.

This means you’ll be paying your premium in full at the same time every month like clockwork. If you opt for this method of payment, you’ll earn an average of 4% in discounts, which is pretty good considering you would be paying that amount (pre-discount) anyway.

Bundling - Whether you bundle your home insurance, life insurance, or both, you’ll save money by doing so. When combined, homeowners who also bundled their life insurance and auto coverage saw an average of 10% in savings (approximately 6% for homeownership discount and 4% for life insurance discount). Some providers will even offer savings as high as 20% for bundling.

College Discounts - No, you can’t technically flash your college I.D. for discounts, but some insurance providers will offer you a discount for graduating and receiving either a bachelor’s, master’s, or Ph.D. The savings are small at 4%, but they’ll be much more helpful going towards your student loans instead of your car insurance.

Student Discounts - Have a teen on your car insurance policy? Well, if they have good grades, you may be eligible to save money for it.

The few policies that do offer this discount only require students to earn a “B” average or above. So if your teen falls in this smarty-pants category, check to see if you can save some money with your provider ASAP.

- Don't Miss Out On Your Savings. Download Your PDF Now. -

Car Ownership - If you own your car (versus leasing it), you may be entitled to a 4% discount.

Early Renewal & Loyalty Discounts - When you find the right car insurance provider and you decide to stick with them for another year or more, be sure to ask about their advance renewal discount. This discount is awarded to those who renew at least 7–10 days ahead of schedule, and can near close to 8%, according to Market Watch.

You may also be eligible for loyalty discounts if you’ve stayed with your provider for 36–60 months. Although the savings are a bit smaller at 6%, it’s still worth investigating. And if you find that your provider doesn’t reward this kind of loyalty, it may be time to use our handy quote feature to shop around for a new provider that appreciates your business.

Multiple Cars on Your Policy Could Save You Money

In addition to bundling discounts, many policies offer competitive discounts for having all of your vehicles on one policy.

So instead of spending your time shopping around for individual car insurance policies for each person in your family, try to find one policy that includes everyone and saves you money by using our handy quote feature.

Go Green

Again, this won’t save you enough money to retire early on your own private island, but opting for paperless statements could save you anywhere from 1–2%, and doesn’t require much work on your part.

Similarly, if you drive a “green” or hybrid car, you could also reap some extra savings each year.

Does Your Car Have an Alarm?

Certain anti-theft features will lessen your car insurance payments a bit. Here’s how it works: Your insurance company assumes less liability if these anti-theft features are in place, which means you’ll earn a small bonus for reducing their risks.

Now, on the flipside, adding too many high-end accessories (speakers, rims… you get the point) could increase how much you pay for car insurance each month since you’ll be increasing the amount of risk your insurance company takes on to keep these upgrades covered.

Your best bet is to keep your car in its original form and only opt to upgrade when it comes to features like anti-theft alarms or safety features like backup cameras.

Safe Driver Discounts

Staying accident and ticket free should always be your number one priority when driving, and if you successfully do this, your insurance company may give you a small discount for being so cautious.

Ask for a safe driver discount from your provider today if you fall within the accident and ticket free category. Keep in mind, you’ll need to have this perfect track record for at least 5–7 years to be considered.

Safe Car Discounts

Driving a safer car will also reduce how much you pay for car insurance.

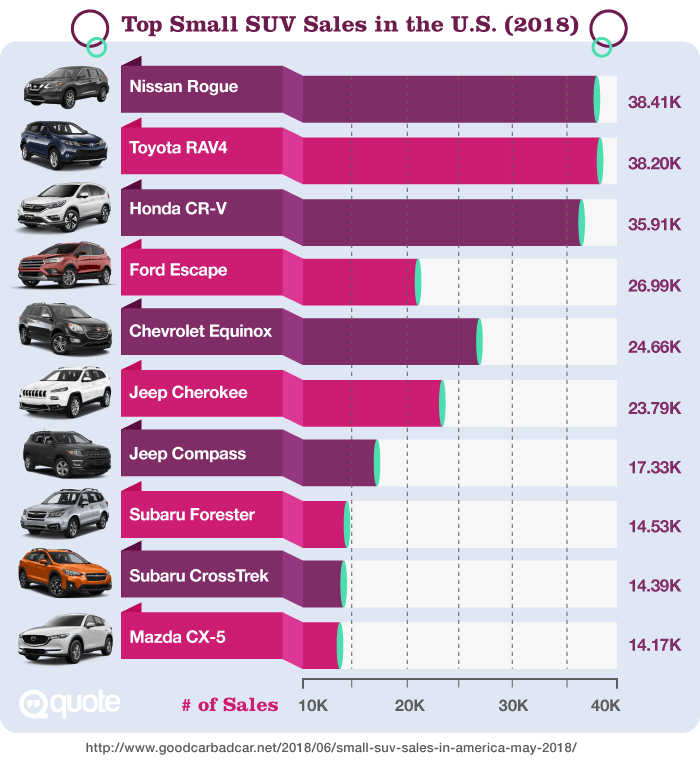

Small SUVs and minivans are seen as much safer options than sports cars and large SUVs. Since you’ll be paying more for a vehicle considered “less safe”, stick to the first two types or a four-door sedan as these will cost you the least to insure.

Looking For Car Insurance Quotes? Here’s How To Find The Best.

Advanced Level Savings

For the most part, the discounts we’ve just mentioned are fairly easy to obtain. Aside from the 5–6-hour defensive driving course, the rest only require a simple, inquisitive phone call to your insurance provider.

However, if you’re ready to take saving money on your car insurance to the next level, you’ll want to consider the following strategies in addition to the ones we’ve already listed here.

Higher Deductibles, Lower Payments

If reducing your monthly payments is a top priority for you, you’ll want to consider increasing your deductible.

Essentially, this is the amount you’d pay should your car need any bodywork repairs done.

To reap these benefits, you’ll need to switch your low $500 deductible for a higher $1,000 one. When you do this, you’ll end up saving a good chunk of change each month in your premiums.

Keep in mind, if you’re an accident-prone type, this is not your best strategy since you’ll be stuck forking over at least $1,000 for each major car repair you have done.

Car Insurance Savings Are At Your Fingertips. Download Your Free Checklist Now

Increase Your Insurance Score

Similar to a credit score, insurance providers give you an insurance rating (score) based on:

- Your driving history (tickets, accidents, etc.)

- Age and gender (young males [18-25] are likely to pay much higher rates than a 45-year-old woman)

- Where you live (some states such as Florida are much more accident prone so your insurance is going to be slightly higher than the national average)

- Type of car you drive (newer cars will cost more to insure than older ones)

To be clear, this is not the same as your credit score. However, your credit score is used — along with the bulleted items we just mentioned — to determine how risky you are to insure.

So if you have stellar credit and a poor driving record, don’t expect to reap too much in savings. Yet, if you have a near-perfect credit score and driving record, you should enjoy healthy savings each month.

Compare Rates to Save Even More Money

Lastly, one of the best things you can do to save money on your car insurance is to shop around for competitive quotes. Ideally, you’ll want to find plans that offer the same amount of coverage for a slightly lower rate than what the other competitors are offering.

You also want to find plans that offer the discounts we mentioned so you know you’re really getting the lowest rate possible.

Now, if this last step sounds daunting, don’t fret. You can easily shop around for competitive rates using our free Quote feature. Simply plug in your ZIP code, answer a few easy questions, and within minutes, you’ll have a competitive quote from some of the top car insurance providers out there.

And the best part is: you can do all of this without having to leave your house (or get out of your pajamas!).

As you can see, if you’re not taking advantage of these discounts for your car insurance premiums, you may be overpaying every month. Keep your credit score and driving record in tip-top shape so you’re not forced to pay more. Opting for a higher deductible is also another surefire way to save money.

Get free quotes from top insurance companies.

And when you do, ask them about all of the discounts we’ve mentioned.