With a name like Auto-Owners, it would be easy to assume the company specialized in nothing but car insurance. However, Auto-Owners offers home, life, and other insurance products in conjunction with their auto insurance policies. When shopping for insurance, it's important for you to understand what coverage is provided and what type you need, lest you pay for a policy that doesn't have any utility for you. Take a look at this review of Auto-Owners insurance and see what the company has to offer.

Founding and History

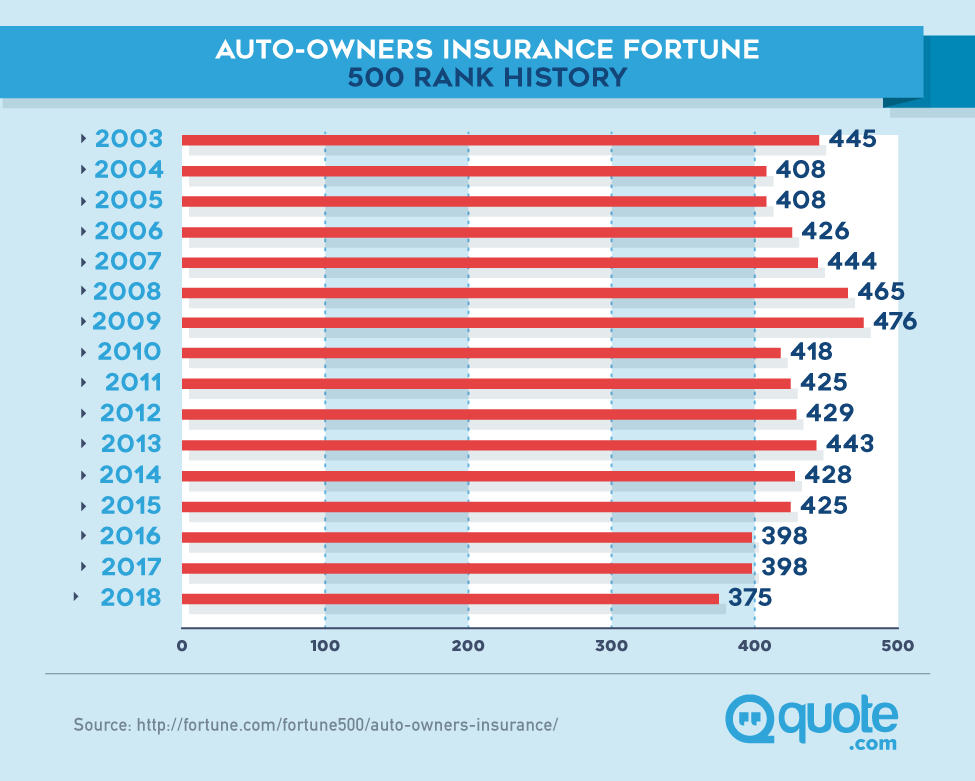

If you haven't heard of Auto-Owners Insurance before, you aren't alone. The company started in Mount Pleasant, Michigan back in 1916 before moving to Lansing, Michigan in 1917. It took the company 18 years to leave the state. Today, Auto-Owners Insurance serves 26 states with roughly 6,200 agencies. With revenue exceeding $6 billion in 2016, Auto-Owners turns a tidy profit these days.

Auto-Owners Products and Services

Auto-Owners might sound like the name of a car insurance company (and that is one of the services it offers), but there are also other forms of insurance you should remember.

Car Insurance

Auto-Owners provides a variety of types of coverage for your automobile including collision, comprehensive, uninsured motorist, rental car insurance, and much more. Insurance isn't limited strictly to cars, either; the company also provides coverage for all-terrain vehicles, antique vehicles, utility trailers, motorcycles, and more.

Home Insurance

Auto-Owners Insurance covers homes, condominiums, mobile homes, farms, rental homes, and renters from damage. This coverage applies to the most common types of damage to homes: storms, fire, etc. However, there is optional coverage available that will protect your property against earthquakes, floods, sump pump malfunctions, and a host of other potential threats.

Life Insurance

If you don't already have life insurance, it's better to invest in it sooner than later. The older you get, the more expensive life insurance becomes—particularly if your health is degrading. Life insurance and related coverage provide your family with the necessary funds should something happen to you for a funeral and pay any outstanding debts.

Other Products

Aside from these main three products, Auto-Owners provides a few other types of insurance including business insurance. This insurance helps protects against lawsuits and other threats to your business. It also provides optional coverage for damages caused to your business by earthquakes, floods, and other natural disasters.

What is its best service?

Despite this wide range of products, there's no doubt that the car insurance is the strongest offering Auto-Owners has. There are a number of reasons for this, including the fact the company has been in business since 1916. The insurance coverage ranges from standard collision insurance to uninsured motorist liability and everything in between and can be found in more than 26 states. Let's take a closer look.

A Breakdown of Auto-Owners Car Insurance

The auto insurance industry is massive, but that's to be expected when something is required by law. Auto-Owners provides coverage for almost any incident you can imagine:

- Additional Expense

- Bodily injury liability

- Collision

- Comprehensive

- Full glass

- Loan/lease gap

- Medical payments

- Non-owned automobile

- Personal Auto Plus

- Personal injury protection

- Pet medical coverage

- Physical damage plus

- Property damage liability

- Rental car

- Road trouble service

- Underinsured motorist liability

- Uninsured motorist liability

- Uninsured motorist property damage

Each one of those bullet points is a type of coverage, but what does it all mean?

Additional expense coverage is defined as insurance that provides financial support for increased expenses after a given claim was made. For example, if you routinely pay $200 per month for gas, but an accident damages your fuel intake system and you begin paying $300, that difference would be considered additional expense.

Bodily injury liability

coverage pays for the medical costs of the other party in an accident if you are found legally responsible. It may also help provide legal counsel if you are taken to court.

Collision

Coverage is exactly what it sounds like: protection from impacts against another vehicle or object.

Comprehensive

Coverage provides a broader range of protection that collision. It protects against damages caused by events other than an impact; for example, vandalism, fire, or flood.

Full glass

Coverage provides replacement windows, windshield, and other glass pieces within your car that aren't covered under basic liability insurance.

Loan/lease gap

Coverage can be useful, particularly if you drive an older vehicle because it covers you if the value of the vehicle is less than the amount you owe at the time of the accident. If you have loan/lease gap insurance, you don't have to pay that amount out of pocket.

Medical payments

Coverage help to pay the medical and funeral costs of the insured after an accident, regardless of who is at fault.

Non-owned automobile

Coverage applies specifically to businesses. If an automobile used in connection with the business is involved in an accident, this type of coverage will pay for damages. However, it does not protect the employee personally.

Personal Auto Plus

is a type of coverage that tends to vary from company to company. Think of it like a platter of coverage options. With Auto-Owners, the Personal Auto Plus package contains the following:

- Trip Interruption Coverage

- Cellular Phone or 2-Way Communication Device Coverage

- Increased Transportation Cost Coverage

- Non-Owned Trailer Physical Damage Coverage

- Supplementary Payments Coverage

- Identity Theft Expense Coverage

- Personal Property Coverage

- Automobile Stereo, Video & Media Coverage

- Rental Automobile Gap Coverage

- Loss of Use by Theft Coverage

- Re-Key Coverage

- Deductible Amendatory

Personal injury protection

Covers you in the event you're injured in an accident and can help with medical costs, lost wages, and other damages.

Pet medical

Coverage helps pay the veterinary costs if your pet is injured in an accident.

Physical Damage Plus,

Like Personal Auto Plus, is a collection of coverage types all rolled into one that protect your vehicle.

Property damage liability

Helps pay for damages to another person's property if you are responsible for the accident.

Rental car

Coverage is insurance for a rental car while you aren't driving your own vehicle.

>Road trouble service

Coverage is a type of coverage that provides support in the event of automotive troubles on the road. This covers towing, flat tires, dead batteries, emergency fluid service, and lock-out service.

Underinsured motorist liability

Coverage protects you if you're in an accident with a driver that doesn't have enough liability insurance to pay for the damages to your vehicle. This coverage pays that gap.

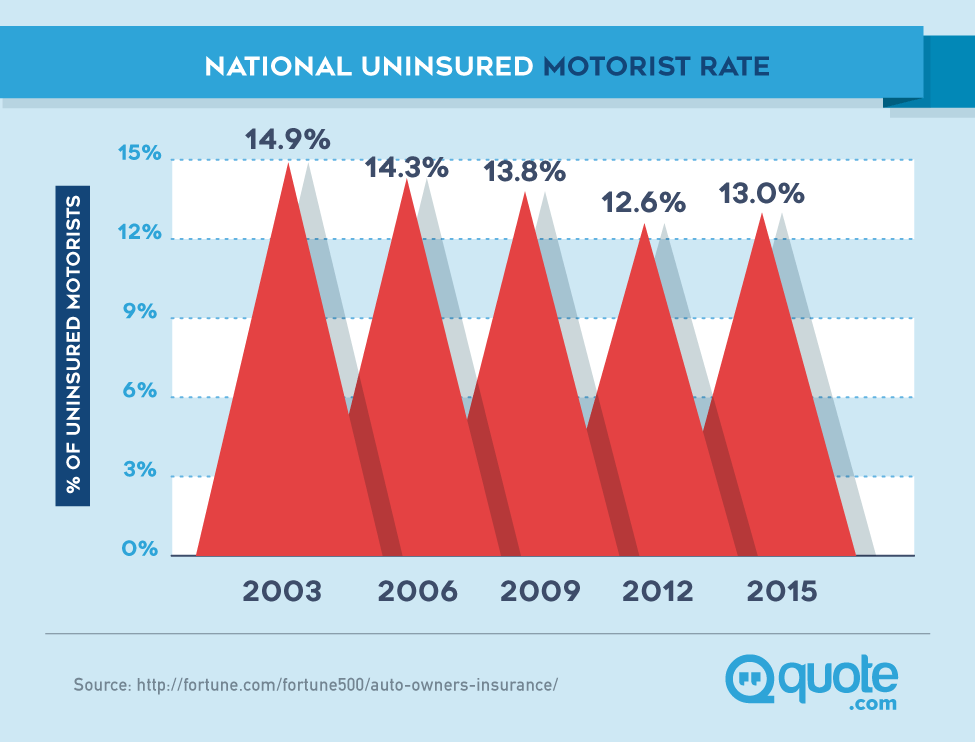

Uninsured motorist liability

Coverage protects you if you're involved in an accident and the offending party has no liability insurance. While it is technically illegal to operate a motor vehicle without insurance, it happens often enough that this type of coverage is a necessity.

Uninsured motorist property damage

Coverage functions like uninsured motorist liability coverage, except that it protects your personal property; for example, if a driver with no insurance runs into your mailbox.

Additional Coverage

Auto-Owners also provides tow coverage and gap coverage.

Tow coverage

Is provided through the company's Road Trouble Service package. This provides towing service 24-hours per day in the event you break down. If you have a flat tire, dead battery, run out of oil, or lock yourself out, this coverage will help you out. The best part is that no payment is needed when utilizing this service unless the balance exceeds your coverage amount.

Gap coverage

Helps cover the difference between the value of your vehicle and your policy coverage amount. If you total your car and its cash value is more than the amount of your auto coverage, you would have to pay the difference out of pocket. Gap coverage protects you financially from this burden.

What is accident forgiveness?

Auto-Owners provides accident forgiveness. If you aren't sure what that means, it's easy: your first at-fault accident won't cause your insurance rates to increase, provided your driving record is otherwise clean. There are times when this won't always apply, such as in catastrophic accidents, but it is a useful endorsement to have that can save a significant sum on insurance rates.

What is new car replacement?

New car replacement is a type of optional coverage that will completely replace your car if it meets certain criteria. The vehicle usually needs to be less than a year old and below a certain mileage count. Auto-Owners does not offer new car replacement, but it does offer gap insurance. This will help you pay the difference between what is left on your loan and the physical value of the car if it is totaled.

Premium Estimates

Auto-Owners doesn't allow you to get an estimated quote online; you have to contact your local agent to find out what your premiums would be.

While your monthly premiums will depend on a variety of factors that include your driving record, age, and gender, the quoted premiums from Auto-Owners lean toward the costlier side. Sample quotes placed the average premium higher than those of comparable insurance companies.

Our estimates put the cost of insurance for a 27-37-year-old male with no accidents and no other issues at around $114 per month, while a female 60 years or older with no accidents might see rates of $85 per month.

Auto Insurance Reviews

Here is what other customers had to say about Auto-Owners auto insurance policies.

"My grandson had an accident (not his fault). We are insured by Auto-Owners. His car was totaled. Within a little more than a week he received a check for the value of his vehicle before the accident. Although at first, the claims examiner offered a lower amount I re-negotiated the amount to be more favorable. I do believe that only once I confronted my agent because I expected service which I felt I was being neglected. If I pay my agent the premium I expect them to go to bat for me with the company. I do not feel that I should have to deal directly with the company, otherwise, why have an agent."

- Lory (Consumer Affairs)

"We've been with them for over thirty years. They have been on top of everything that we have experienced when filing claims and adjusting our policy. They cover our private vehicles as well as our business vehicles and equipment. We are so pleased with their service that we also have our business insurance and home insurance with them."

- Rosa (Consumer Affairs)

Auto Insurance Discounts

Afraid your premiums might be too high? Auto-Owners Insurance offers a number of discounts to help keep costs low. Some of these are the sort of discounts you'd expect, while others might surprise you. Here's the list of available discounts.

- Company car discount

- Mature drivers discount

- Safe drivers discount

- Discounts for safe driving

- Multiple vehicles discount

- Safety feature discounts

- Green discount

- Multi-Policy discounts

- Student discounts

- Group/franchise discounts

- Paid in full discount

Keep in mind that not all discounts are available in all locations. The availability of these discounts will depend on the state.

Where Auto-Owners Excels

While no company does everything right all the time, there are certain areas where they excel.

- Auto-Owners provides the Personal Automobile Plus package.

- Auto-Owners has solid feedback from customers when it comes to claim payments.

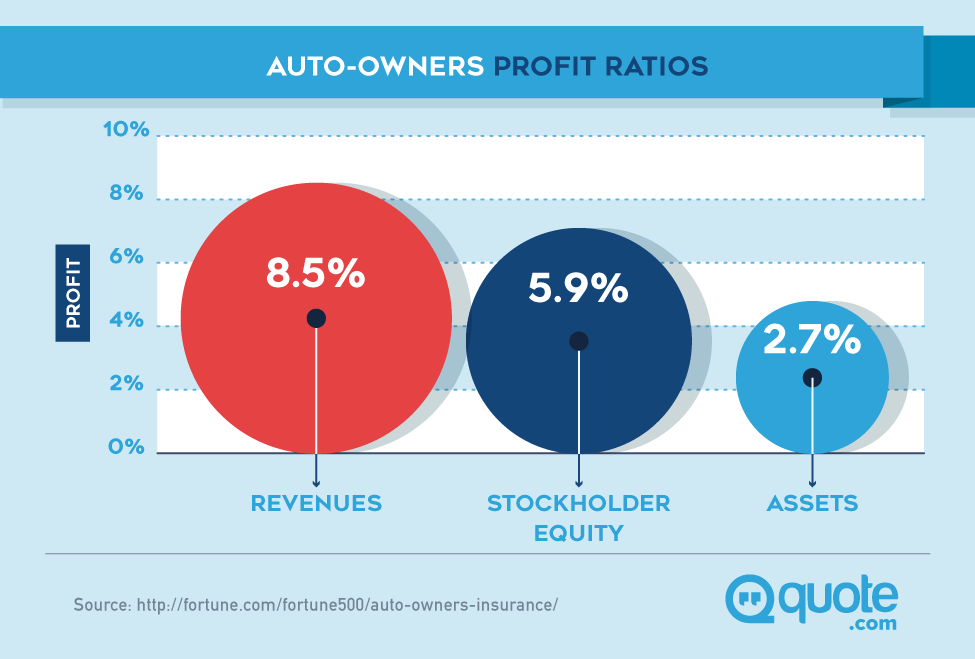

- Auto-Owners has strong financial stability, ensuring that claims can be paid out.

Where Auto-Owners Can Improve

While we don't like to say a company fails, there are always areas that can be improved upon.

- Auto-Owners is not nationwide; the company only operates in 26 out of 50 states.

- Auto-Owners has no online quote calculator. In order to get a quote, you'll have to call an agent—an often time consuming process.

Auto-Owners' Umbrella Policy

Umbrella insurance is a form of additional liability insurance. In many cases, it helps protect against major claims against you as well as lawsuits. If you're brought to court and lose when hundreds of thousands of dollars are on the line, your entire financial future might be affected.

Compared to the umbrella policies of other company's, Auto-Owners' stand-alone policy is incredibly broad and has more coverage. The only types of damage not covered under the umbrella policy apply to rented boats, rented snowmobiles and ATVs, racing go-karts, a furnished company car with no PAP, and auto liability even though someone does not drive. The short nature of that list is a testament to the strength of Auto-Owners' umbrella policy.

Many umbrella policies are simply excess damage policies in disguise, but Auto-Owners' is a true umbrella.

How to File an Auto-Owners Insurance Claim

Filing a claim should never be hard, and Auto-Owners makes it easier than ever. In the event of an accident, the first thing you should do is gather the necessary information. You'll need the name of the other party as well as the tag number of the other vehicle, as well as the contact information of any witnesses to the accident. Take care not to discuss the case with anyone except the investigating officer, as this can open you to further liability.

Once you have all of the necessary information, contact your local Auto-Owners agent. That agent will then set the claim in motion and handle the necessary paperwork to ensure you receive your benefits in a timely manner. This is known as the "No Problem" Claim Service; after you've been through something traumatic, the last thing you want to do is worry whether your agent cares. In the event that you can't reach your agent, there is an emergency number that can be reached from 4:30 PM to 8:00 AM Eastern Time from Monday to Friday. The service is available for free by calling 1-888-252-4626.

You can also log-in to the website to track the progress of your claim, view your claim history, and easily access all relevant contact information to your case. From the Customer Center, you can view any of your policies, on any device, and pay your bills.

Reporting an Accident

The "No Problem" Claim Service handles the reporting for you. Once you've contacted your agent about the accident, he or she will take over and get in touch with the main office to set your claim in motion.

Auto-Owners Customer Reviews

Take a look and see what other customers have to say about Auto-Owners.

"I have had Auto-Owners for several years now and they have been awesome! Yes, I have even had a couple claims and they have not canceled me because of it. They are great with claims service and attention to their insured. Highly recommended. They are rated A++ by AM Best Co (this is the highest rank you can get) and have won the JD Power award for 5 years running for their auto claims service. They are good and this proves it!"

- LaurieMartin, May 15, 2013 (Viewpoints.com)

"4 months and still waiting for to be paid on home owners claim. Adjuster goes weeks without returning calls. Their pricing seemed really good obviously they can keep their rates low by not paying anything out."

- Michchuck, September 1, 2010 (Viewpoints.com)

Most Common Customer Complaints

The majority of complaints centered on two topics: customer service and claims. A large number of customers stated that the company refused to honor certain policies or claimed that types of damage were not covered. For example, one customer stated their Auto-Owners home policy wouldn't cover damage caused by hail. Almost all of the negative reviews commented on the attitude of the representatives; customers were displeased with how they were treated.

How to Cancel Your Auto-Owners Insurance

While you can email Auto-Owners with questions regarding your policies, billing disputes, and other topics, you cannot make policy changes online. In order to change your policy or cancel your policy, you'll need to speak with your agent directly. Contact them at their office during business hours to start the process should you choose to cancel. You can cancel when your account is up to date and current.

FAQS

These are the most common questions we've encountered regarding Auto-Owners Insurance.

Do products/services offered by Auto-owners differ from state to state?

Auto-Owners' products and rates will vary depending on your state. Not all products and services are available in all states served.

How much does Auto-owners insurance go up after an accident and/or speeding ticket?

In general, a single speeding ticket won't increase your rates — you'll need multiple tickets or be classified as a 'high risk' driver for that to happen. If you have a discount that is dependent on a clean driving record, your rates will increase as a ticket will cause you to lose that discount.

However, accidents are a different matter. If you're involved in an accident but are not at fault, your rates will likely remain the same. If you are at fault, however, rates can increase significantly, sometimes by as much as $1,000 or more per year.

What does comprehensive insurance cover with Auto-owners' auto insurance?

The idea that comprehensive insurance covers everything is a myth. What it does cover, however, is damage to your car not resulting from a collision. This can include everything from theft, fire, and even rockslides.

Does my Auto-Owners insurance cover a rental car?

Auto-Owners offers rental car coverage as part of its insurance policies. However, whether your policy includes this or not is dependent on the individual policy and if that coverage is available in your state.

What does my rental insurance with Auto-owners cover?

Auto-Owners' rental insurance provides rented automobile replacement as well as rented automobile gap coverage. This provides protection against total loss of a rented automobile, as well as coverage in the event the rental company decides to sell the vehicle without making repairs.

Does my Auto-owners car insurance cover me in Canada or anywhere outside the USA?

It's a good rule of thumb to assume that, unless otherwise stated, your car insurance does not provide international coverage.

Does Auto-owners Insurance use credit scores?

Auto-Owners will check your credit score while building a financial profile of you, but this check does not affect your credit score.

What are Auto-owners' financial strengths?

Auto-Owners has high financial strength ratings from nearly every rating agency. The company has sufficient financial backing to pay out in the event multiple claims are made at once.

How long does it take for Auto-owners Insurance to pay for a claim?

Auto-Owners customers have reported the company generally pays its claims quickly. You should also note that each state has a set time period after which the claim must be accepted or denied, and if accepted, there is an additional time period during which it must be paid.

Does Auto-owners insurance have gap coverage?

Auto-Owners' loan/lease gap insurance is one of their most popular products.

Does Auto-owners insurance have roadside assistance?

Auto-Owners offers 24 hour Road Trouble Service coverage.

What are the deductibles on Auto-owners Insurance?

The deductible will be based on your individual policy. Higher premiums usually equal lower deductibles and vice-versa.

Will adding a teenager to my policy will increase the cost?

Adding another person to your policy, particularly a driver considered to be more high-risk will result in increased costs.

What are the options to lower my deductible?

The easiest way to lower your deductible is to set a higher premium payment. You should find a balance between the deductible and the premium that you can easily afford without compromising your coverage.

Will my rate go down if I make my payments on time?

Your insurance rate will not be affected by on-time payments; however, failure to pay on time can result in cancellation of your policy.

Should I opt for automatic payments and renewal or shop around after my policy is done?

If a discount is offered for making automatic payments, it can be beneficial to sign up. As for automatic renewal, when you know your renewal date is approaching you should take the time to evaluate your present needs. If your policy provides too much coverage, shop around to find out if another company can offer you lower rates.

Does Auto-owners cover third party liability?

Auto-Owners is composed of a parent company and multiple subsidiaries, but provides its own insurance coverage.

Can I add up my family member's car to my insurance plan?

You can add any licensed driver to your policy as a driver. However, unless you are living in the same household, you cannot add their vehicle to your policy.

Can I get my car repaired by my own mechanic or are there specific repair shops I should get my car fixed from?

You can have your car repaired by any accredited, licensed mechanic.

What happens when I pay throughout the year without filing any claims?

In most cases, nothing. However, if you've been considered a high-risk driver in the past, you may be eligible to have your rates re-evaluated.

What are the dividend policies offered by Auto-owners?

While Auto-Owners offers dividend policies, these are only found via their life insurance policies—not auto insurance.

Does Auto-owners insurance cover motorcycles?

Yes, Auto-Owners covers motorcycles.

I am an elder. What are the benefits and additional discounts for signing up with Auto-Owners?

Auto-Owners offers a mature driver discount that older drivers are eligible for. If you are willing to complete a safe driving course, you may be eligible for substantial discounts on your premiums.

Thinking of Going with Auto-Owners Insurance? Our Verdict

Auto-Owners Insurance has been in business for a long time, and that means the company has had plenty of time to establish a reputation and build experience. For the most part, that reputation is good — with high financial strength ratings, a broad range of coverage, and widespread availability, Auto-Owners is a reliable insurance company. On the other hand, it can be difficult to obtain the information you need. Quotes aren't available online, and much of the information surrounding the company is hidden on their website. Full explanations of some of the policies and discounts must be obtained through an agent, and in the modern day of information availability, that raises a few concerns.

Premium rates lean toward the higher end on average, but that can result in lower deductibles and a sense of security. Take the time to evaluate all that Auto-Owners has to offer and then decide whether that lines up with your present needs before making a decision.