You've probably heard one or two crazy driving accident stories in your lifetime:

Turkeys flying and crashing through a windshield.

A moose drunk on rotten apples charges at oncoming traffic.

Baseball-size hail totaling the roof of the vehicle.

Sinkholes swallowing up a bunch of parked cars in a split second.

A 200kg Australian fur seal decides to pick a random unlucky car as his newest perch.

As entertaining as some of these might be, you may wonder what happens if you are caught in such a freak accident. Would your insurance cover the damage? What is the procedure for dealing with such accident on the spot? And how should you go about filing a claim in such circumstances? This article is here to answer your concerns regarding auto damage as a result of random animal accidents and natural disaster events.

Will My Insurance Cover Damages from Animal and Natural Disaster Related Accidents?

Obviously animals and weather do not have insurance. Even though it may entirely be their fault for damaging your automobile, you cannot put the blame on the "other" party. In cases of animal-related collision, many people assume that their collision policy will cover the loss and repair. Even though the accident IS a collision, collision coverage only covers reparations from collision that involves in 2 or more automobiles or crashing into an inanimate object. In other words, if you collide with an animal, only comprehensive insurancewill help you get reimbursed for the loss and repair.

What is a Comprehensive Auto Policy?

If you are unfamiliar with coverage terms, here is a quick explanation of the 3 types of insurance offered by providers:

- Liability: Legally must-have for all drivers except those in New Hampshire. It pays for damages to another person's property or automobile in an accident where you are at fault.

- Collision: Although your state may not demand that you have collision protection, it is often required if it is leased or paid in installments. In any accidents, whether you are at fault or not, it covers the cost of collision-specific repair to your own vehicle.

- Comprehensive

Sometimes referred as other-than-collision coverage (OTC), it covers non-collision-related expenses. The most common claims are associated with:

- Vandalism

- Weather and natural disasters-related destruction

- Fire

- Theft

- Animal collisions and damages

- Falling objects such as trees, coconuts, and even airplane waste fluids

- Sinkholes and floods

- Civil disturbance occurrences such as riots and drive-by shooting

- Windshield damage

Is It Mandatory?

Although it is not mandatory by state's regulation, it may be a requirement if you are leasing or paying for it on installments. If you do not comply with the agreement, your auto lender or lease holder do have the right to void the contract and take back the automobile as you have not followed through with your end of the deal to secure sufficient financial protection on the automobile.

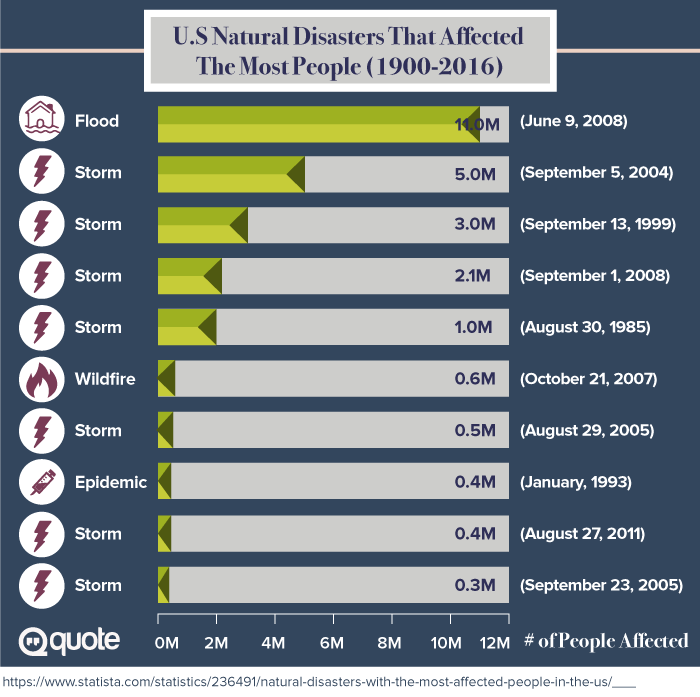

On the other hand, even if you own your car out right, that are still benefits of having this option. According to a survey in 2016, about 70% of the United States insurance policy holders have bought OTC coverage along with their liability policy. In general, it is an add-on option purchased by brand new or expensive auto owners. Because in cases where the automobile is totaled, the owner will be reimbursed the full price of the automobile market value. But what about owners of older or economic cars? Depending on where you live, it may be a great coverage to have. For example, if you live in an area where certain natural disasters are common occurrences such as floods, hail storms, and tornados; or you live in rural country areas where certain large creatures roam in the surroundings such as elks, deer, moose, and bears, you are much more likely to experience automobile destruction that is not related to collisions. When you constantly have to pay out-of-pocket for repairs, the costs can add up to more than the annual premium. In extreme cases where your automobile suffer a total loss under such circumstances, you will not be reimbursed for any money unless you have OTC coverage.

Cost of Comprehensive Premium

Just like any auto insurance applications, the premium rate depends on factors such as the model, age, mileage, your credit and driving history. One important deciding factor you should not overlook when it comes to premium is that where you reside plays a large role in deciding how much you have to pay. For example, certain states have a higher rate because they have a greater tendency to suffer from various natural disasters such as floods and tornados. In a thorough study done in 2014, the average annual premium in the United States is about $143 with Oregon having the lowest premium of $90 and Kansas with the highest at $238 per year.

| State | Comprehensive Annual Premium | State | Comprehensive Annual Premium |

|---|---|---|---|

| Alabama | $151.40 | Missouri | $175.7 |

| Alaska | $140.15 | Montana | $210.49 |

| Arizona | $185.63 | Nebraska | $223.03 |

| Arkansas | $193.34 | Nevada | $117.2 |

| California | $98.73 | New Hampshire | $106.62 |

| Colorado | $167.94 | New Jersey | $126.26 |

| Connecticut | $130.8 | New Mexico | $167.69 |

| Delaware | $116.49 | New York | $165.07 |

| D.C. | $233.65 | North Carolina | $130.37 |

| Florida | $111.71 | North Dakota | $233.06 |

| Georgia | $154.05 | Ohio | $117.58 |

| Hawaii | $97.99 | Oklahoma | $219.85 |

| Idaho | $114.07 | Oregon | $90.79 |

| Illinois | $124.89 | Pennsylvania | $138.27 |

| Indiana | $117.25 | Rhode Island | $125.17 |

| Iowa | $178.45 | South Carolina | $175.19 |

| Kansas | $238.67 | South Dakota | $242.27 |

| Kentucky | $133.55 | Tennessee | $144.6 |

| Louisiana | $211.9 | Texas | $192.33 |

| Maine | $97.35 | Utah | $109.56 |

| Maryland | $149.7 | Vermont | $120.18 |

| Massachusetts | $132.64 | Virginia | $134.5 |

| Michigan | $149.11 | Washington | $104.87 |

| Minnesota | $180.47 | West Virginia | $200.1 |

| Mississippi | $201.01 | Wisconsin | $132.64 |

| United States Average | $143.45 |

Should I Buy Comprehensive?

Before contacting your agent, ask yourself these several questions and do some calculation to figure out whether you should purchase a policy or not:

-

Is this your only vehicle, and you depend on it as your daily ride to work and other essential daily activities?

If this is your only way to get to work, you should definitely get the protection as it helps out with the repair cost and make sure you can get back on the road as soon as possible without affecting your life. In cases where your automobile is totaled, you can quickly be reimbursed and get a new car for your essential needs.

-

How old is your car and what is its current market value?

If it is quite old where the providers will pay you very little money in the event of it being totaled, you may want to skip the coverage. This is especially true if you are using your current old automobile as a beater and you are planning to drive it into the ground before selling it to the junk yard. However, if your auto is relatively new and expensive to fix, buying the optional coverage will be a smart investment move.

To make it even simpler, OTC coverage is for you if:

- You lease

- You are paying it on installment and have not finished paying for the whole sum

- You took out a car loan on your automobile for various reasons

- Your area is known for high frequency of vandalism and/or theft

- Your area is known for severe natural disaster problems (e.g. hail, tornados, tsunamis, floods, etc.).

- Your area is known for having an abundant amount of wildlife roaming in your neighborhood or highways

- You cannot afford to fix the damage or replacement

You probably don't need it if your automobile is old and not worth a lot based on the market value (you can quickly check the price on the Kelley Blue Book website). If the payout is less than the annual comprehensive premium, it is an easy choice to just skip the add-on option and save the money.

What You Should Be Aware Of When Purchasing a Comprehensive Policy

- Not all policies from each provider are the same. Make sure that your company offer the coverage you actually need.

- Like other coverage, you are required pay your deductible before you insurer starts paying for the rest of the repair. So before you start a claiming process, you may want to bring your automobile to a repair shop for a quote to decide whether it is worth it to make a claim. If the estimated job is less than your deductible, you may as well pay for it out of your pocket.

- Most insurers will waive your deductible if your windshield repair is only for a crack or pit hole smaller than a dollar coin. Anything bigger will require the whole glass to be replaced, and you will need to pay your deductible in such circumstance.

- Some providers require that you buy both collision and comprehensive as a package; whereas other companies will allow you to buy one without the other so that you do not need to pay extra for something you do not need.

- If it is totaled in the accident, you're the policy will only pay you the estimated fair market value of the auto.

- If you have a loan or lease, you may want to consider getting a gap coverage. This add-on option will pay the difference between your how much you owe and the car's cash value.

How to Keep Your Premium Low

There are several ways to minimize your premium cost depending on your scenario. The following tips may help you squash your annual rate to the bare minimum:

- If you cannot afford to fix major repairs and/or replacement, yet you live in an area where running into beasts and other situations that require OTC protection is a very rare occurrence, you may opt to choose a higher deductible. The usual deductibles are on average $500. However, if you choose to increase it to $800 or even $1,000, you can see the rate significantly decrease. This way, there is always an assurance that if you do total your auto, your insurer will take care of you.

- Shop around for local deals. Sometimes local insurers will give you a better quote because they understand the common OTC claims in your area. Having said that, make sure the provider is reputable and has a good financial standing. Even if the premium is low, when it comes to reimbursing your claim, if they cannot pay you, it makes the policy equally useless.

- If you live in certain states that have relief funding for natural disaster loss, you may use that in combination with the comprehensive coverage. This way, you can choose a lower quality insurance package and still receive the benefits.

Will Making a OTC Claim Increase My Premium?

Compared to the other two types of policies, this type of coverage does not reflect upon you as a high-risk driver as these accidents are more to do with the freak of nature run of the luck occurrences. Therefore, even though one expensive claim can increase your rate, it is likely to increase by around 2 percent. If you are wondering what is the typical average claim loss, it came to about $1,585 on average in 2016. As mentioned earlier, some companies are even willing to overlook the deductible if your windshield issue is minor (you are required by law to fix a windshield dent or crack that is on the driver side as it obstructs the view making it dangerous to drive on the road). So if the repair is more than your deductible, it is definitely worth it for you to claim the accident and keep your automobile rated at a higher market value.

What You Should Do When You Hit an Animal

It has been estimated that about 1.25 million collisions occur annually in the United States due to animal collisions. Of the total number, auto-deer collision seems to be the most prevalent occurrence. But in most driving education packages, the protocol for dealing with these situations is rarely mentioned. So to prepare yourself, here are the steps of what you should do if you do hit a large animal on the road:

- Move your automobile to a safe location. The best procedure is to pull over to the side of the road and turn on your hazard lights to warn oncoming traffic to steer clear away from you. If you must exit your car, avoid standing on the road and in the way of any oncoming traffic. If you have and flare alerts or emergency cones, lay them on the road to warn other drivers of your location and the creature on the ground.

- If you have any passengers, make sure everyone is safe and unharmed.

- Avoid getting too close to the animal if it is still alive. Even if it acts wounded, it can be unpredictable. A panicky, injured animal is the most dangerous as they can lash out with their hooves, legs, and antlers as a survival instinct to harm you. If you are unsure, do not attempt to check yourself. Some can play dead and attack when you least expect. It is best to let the authorities handle the situation.

- Call the police. Let them know of the situation and if the animal is obstructing the traffic and generating a danger to other drivers on the road. Note that if the collision causes any human injuries and/or property damages, you may need to fill out an official report. Do not be afraid as this report serves as a useful proof when you file your claim.

- Try your best to document the incident with your smartphone and/or camera. Be certain that you are safe before taking videos and/or photos of the road condition, the animal related to the incident, your surroundings, the damages, and any injuries you and your passengers have sustained in the process. If you are unsure where you are, or you have difficulty describing the exact location where the accident occurred, simply take a screenshot of your GPS location. If you have any distance tracking Apps, you should save a record as it can help prove that you were not speeding at the time of the accident. If there are any witnesses, record a voice clip of their explanation of what they saw with your smartphone recording function. Do not forget to ask for their contact information. When police officers arrive, note their badge number, their names, and their contact information. If possible, get a copy of the report if it is available. All this information can help make your claim process much more straightforward and quick.

- Contact your agent or file a claim online as soon as possible. The sooner you report the accident, the sooner your agent can process your claim and go ahead with the restoration. Make sure you have this information with you before you being the process:

- Your policy number

- The brand, model, year, and license plate number

- Location of the accident

- Even though your auto may not look severely smashed in, do not assume that it is safe to drive. Look for leaking fluids on the ground, loose parts, parts dangling from underneath, slashed or flat tires, broken headlights and/or taillights, a loose front bumper, and/or a hood that will not latch. If it makes any odd sounds or you are unsure of the destruction, call a tow and avoid any further damage by running the engine.

Other Tips You Should Know About Animal Collision:

- Deer auto accidents are most common in October, November, and December with November being the peak as it is the mating seasons for deer.

- Dawn and dusk are the most common hours of deer coming out to feed. Also, the glare and low visibility make it more difficult for the driver to see them. Coincidentally, these are the time when most people are trying to get to work and getting off work.

- Expect to see more deer if you spot one beside the road. Slow down. If there is no oncoming traffic, you may also want to flash your high beam lights several times to alert them to your location.

- Try your best not to swerve if you think that you will be running over a deer - simply slow down. If you swerve, you are at a higher chance to hit another car, a tree, or a road block. It also makes it harder for the deer to predict your movement and get out of the way.

- Set your headlights to high-beam mode in rural areas if there is no oncoming traffic or if you have difficulty seeing.

- If a deer standing in the middle of the road, do not get out of your vehicle. You may get hit by other fellow drivers on the road. Simply slow down and flash your lights will do the trick.

- Unlike the common myth belief, do not speed up when you realize you cannot avoid hitting a large creature like a moose (some people believe that it will simply roll off the top of your vehicle and land somewhere behind). If you are a fan of the show Mythbusters, you may already have seen the rubber moose collision experiment. They have found that speeding can actually lead to more severe injuries which can include the antler puncturing through the windshield and right into the driver and passengers' torso. Slowing down is the best policy.

Interesting Question: Can You Harvest a Fresh Roadkill?

If you are one of the people who believe that eating fresh roadkill is both ethical and sensible, you need to contact your local DMV concerning the issue. In certain states such as Texas, Tennessee, California, and Washington, it is illegal to harvest or collect a carcass in any way after it has been killed in an auto accident. This is to prevent poachers using it as a loophole to illegally hunt for animals during off season. However, for other states such as West Virginia, it is legal for you to harvest the carcass as long as you report the accident within 12 hours. There are other states such as Wyoming and Vermont that do require you to have a game warden to examine the carcass and tag the animal as roadkill before you can harvest the meat. So to avoid unnecessary legal trouble, it is best to first consult with your local DMV or law enforcement officers before collecting the carcass.

Hail: Cosmetic Dilemma

Hail is a tricky issue. Even though the damage is almost always cosmetic, you never know what can of worms you will open. For minor hail blemishes, most people would choose to live with the ugly minor dents and opt out on repair. But when hail rain down in size of golf balls or even baseball sizes, people may decide to claim. In these cases, people may be surprised to find that their insurers see the dents to be severe enough to label your auto as "totaled". Under such circumstance, your state will allow the company to declare it as a total loss and marked with a salvage title.

How Do Providers Calculate the "Totaled" Formula?

In general, automobiles are regarded as "totaled" when the repair cost is higher than the car's actual cash value (It is often referred to as ACV which stands for the value of your auto based on comparing the market value of the same automobile in mint condition and the wear and tear condition of yours). However, in some cases such as flood and hail where it is not practical to fix a car due to the extensive cosmetic blemishes, the carrier may deem an automobile "totaled" even if the repair cost is less than the ACV. In these circumstances, the state laws and the company guidelines become the determining factor on whether a vehicle is regarded as totaled. For insurers, the "damage ratio" (also known as "total loss ratio") is the deciding factor. This ratio is calculated by dividing the cost of repair by the ACV.

Total Loss Ratio = Repair Cost / ACV

This percentage is then compared to the company and/or state law minimum ratio limits to qualify for the salvage title (this limit is known as the total loss threshold or commonly known as TLT). For certain states that have a firm regulation to TLT, the total loss ratio must exceed the TLT in order to qualify for the salvage title.

These states have the following TLT threshold mandated by law:

| TLT Threshold Mandated By These State's Law | |||

|---|---|---|---|

| Arkansas 70% | Louisiana 75% | New Hampshire 75% | Tennessee 75% |

| Colorado 100% | Maryland 75% | New York 75% | Texas 100% |

| Florida 80% | Michigan 75% | North Carolina 75% | Virginia 75% |

| Indiana 70% | Minnesota 70% | North Dakota 75% | West Virginia 75% |

| Iowa 50% | Missouri 80% | Oklahoma 60% | Wisconsin 70% |

| Kansas 75% | Nebraska 75% | Oregon 80% | Wyoming 75% |

| Kentucky 75% | Nevada 65% | South Carolina 75% | |

For other states that have more flexible regulations, the carrier will decide based on their Total Loss Formula (TLF):

Cost of Repair + Salvage Value > Actual Cash Value

If the restoration cost and the salvage car value added to be greater than the ACV value, the car can be then declared as a total loss.

Can You Still Drive the Hail-totaled Vehicle?

If you intend to keep the "totaled" automobile despite the salvage title and the severe cosmetic blemishes, you can ask your provider to buy it for its salvage value. For example, if you auto was worth $20,000 before the incident and your company places the salvage price at $8,000, they will send you a check for the difference minus your deductible. Depending on your state regulation, your auto may require an inspection to prove that it is safe to drive before you can get back on the road. Please note that a salvage title car is difficult to insure for future crash and OTC coverage because its value is particularly difficult to determine.

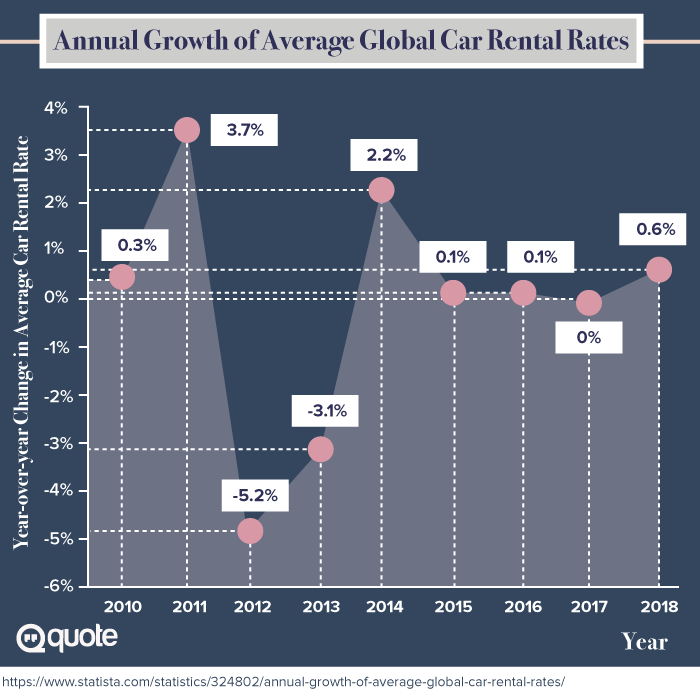

Always Purchase Comprehensive for Rental Cars

If you are on vacation, comprehensive coverage is a must-have. For any nicks and dings on the rental, the rental company has the right to fine you for all the wear and tear. It is sad, but it is a common practice for many car rental companies to swing onto renters without OTC protection. To increasing number of unfortunate vacationers, this can become quite an astonishing fee as these repair costs can run into thousands if not tens of thousands. In extreme cases where severe hail storm strikes while you are driving, the company can charge you for the totaled loss. If you do not have coverage, you will have to pay the whole fee out of your pocket. So to avoid being dragged through the phone tags, arguments, and even lawsuits, obtaining a comprehensive policy can help you concentrate on having fun.

How to Claim for Damage from Natural Disaster-Related Accidents

You may wonder what happens if your automobile gets flushed away from the flood or flies away like the Wizard of Oz scenario. No, you do not need to hunt down your vehicle before you can file a claim. But how do you file a claim when you have no evidence? These tips will help you assess the situation much easier:

-

Do not worry if you hit sometime during evacuation to safety.

If you are trying to run for cover during a tsunami or tornado episode and you hit something along the way, you are covered by the optional collision part of your policy.

-

Make temporary repairs to your vehicle to avoid further damage.

Emergency situations may call for inventive temporary fix. If you have a broken window or hole in the roof, taping a garbage bag or some tarp can prevent the problem from becoming worse. Make sure that these fixes are only temporary and not permanent. If you have to buy anything for the job, keep the receipts, as the insurers will reimburse you for the expense as well.

-

Be patient.

There are many people who are in the same boat as you are and they are all reaching out to their insurers at the same time. Even though many big name companies such as Progressive, State Farm, and Allstate have 24/7 emergency teams to handle high call volume after a major natural disaster, they are still swamped with processing all these information. Even though you should always file your claim as soon as possible, providers understand that when a major disaster strikes, people are busy trying to find shelter, water, and food. And with phone and internet communication being a problem, many people just cannot file a claim within the usual 24 to 48-hour rule. In this cases, insurers often offer special hotlines and longer grace period of the claiming process.

-

Gather as much evidence as you can.

Take pictures and videos of the damage if your car is available. If you cannot locate it due to the natural disaster event (e.g. your car floated away during a flood, swallowed into a sinkhole, or get blown away by a tornado), do not worry. Take pictures and videos of the location at which it was parked when the incident occurred. If there are any witness, take down their contact information. By chance, if you have left your smart devices in the auto, you may be able to track it down by accessing the GPS information. Your cellphone provider may assist you on this problem. Once you try your best to gather all evidence, just file the claim and do your best to accurately report what happened at the time and where it was originally parked at the time before its disappearance. During these emergency situations, they will likely to regard it as being totaled and reimburse you for your loss according to your policy. At the same time, they will report the title as salvage title". So even if someone finds it in the future and decides to claim it as their own or attempts to sell it on the market, you will not be responsible for what happens in the future.

-

Do not attempt to start your automobile if it has suffered from water damage.

Doing so can cause the engine to suffer more spoilage. If you must, you can check these signs that you should not run the engine:

- All the seats are wet

- The paper air filter under the hood is wet

- Your vehicle will never be the same again. Even after it has been properly dried and repaired, any electronic parts that are dampened and/or submerged will never work the same again. If the flood is from salt water, you can expect the worst as the salt will rust up all metal parts.

- If you are not insured and attempt to keep your automobile, you will need to take it to a professional auto body shop to dry out the whole vehicle. Do not attempt to do this on your own with your home hair dryer or space heaters. The worst idea is to use any gas heaters as it may cause an explosion when placed too close to the gasoline in the tank. And even after all the interior surface may seem dry, the deeper inner portions may still be wet. Over the time, this can progress into a severe mold problem. The professionals have industrial high-powered fans for such jobs.

Conclusion

We hope we have answered many of your questions and concerns regarding animal collision and natural disaster related damage coverage and claims. If you have any personal stories and tips on being a smarter driver and claimer, please leave us a comment to share with other fellow readers! And if you feel that our infographic is something that is educational to others, don't hesitate to share it on your social media of choice!