When buying insurance, we all have a choice. Purchase through an agent, or directly from an insurance company. If you purchase through an agent, you pay more. This is because you know they will act on your behalf in the case of a crisis or claim. They'll seek out the best products and prices from among the ones they sell. But would you pay more for an agent if you trusted a company that sold directly to you? A company that cuts out the middle man? A global survey of insurance customers revealed that during the recent financial crisis, financial companies were not trusted. However, people saw the insurance industry as trustworthy. Amica Insurance's mission statement is "To create peace of mind and build enduring relationships." The company would like to win your trust and inspire you to ditch the insurance agents. But is the potential sacrifice of personal service worth it?

Amica Mutual Insurance company operates according to a model known as direct insurance. This means they sell directly to clients rather than through an insurance agent. Amica is an acronym for Automobile Mutual Insurance Company of America. As a mutual company, the policyholders own Amica. There are no stock holders or investors. Policyholders share in the earnings in the form of dividends. Today their head office is in Lincoln, Rhode Island, and they have 44 offices across the United States.

A.T. Vigneron started the company in 1907 in Providence, Rhode Island. Amica Insurance company is the oldest insurer of automobiles in the U.S. Initially they offered insurance for cars, fire, and theft. Over a century later they have grown to a company worth billions of dollars. They offer a full suite of products. These include Home, Auto, and Life insurance. They also include Marine and Personal Excess and Umbrella insurance.

Amica Insurance is well known in the industry. The company claims that it achieves its financial strength via its ability to provide quality customer service. In fact, Amica Insurance Company would argue that the best thing about them is that you deal direct with the company. Customers can earn dividends that go against the costs of the policies.

Amica Home Insurance

Amica Mutual Home Insurance provides coverage to home owners, renters, and condo owners. Home insurance policies compensate for unforeseen losses due to fire, theft, smoke, and vandalism. The policy holder also has options for add-ons and flexible extended coverage. Coverage for credit card fraud is part of the standard package. Liability insurance for covered claims is portable to anywhere you are in the world.

The Homeowner Insurance Policy includes coverage for loss or damage claims due to fire, vandalism, theft, and smoke. It covers damage to out buildings like detached sheds. It covers the increased costs of living if you have to leave your house during repairs. It covers you if your home needs temporary repairs to protect it from further damage. If an unauthorized person uses your credit card you they reimburse you up to the limit of your policy. If claims are made against you or your family for bodily injuries or property damage the liability protects you worldwide. This includes any legal fees. You can also get an option that increases coverage up to 30% if the cost to repair your property exceeds the coverage limit. You can insure for the full replacement value of lost items regardless of depreciation. There is an option to cover items of value beyond the basic fire and theft coverage. Protection for earthquakes and floods is available, as is identity theft insurance. Amica lets you pick your own contractor for repairs, but will also refer you to one. With Amica's unique dividend insurance policies you pay a little more every month. At the end of your term, they refund some of what you have paid.

The rates for Amica home insurance are good. The company bases their rates on a variety of options and factors. This includes the value of the coverage you need. In order to get a price, you need to submit a request for a quote. An online quote test request for an urban home in Ohio with a value of $400,000 got a quote for $110 per month ($1,325 per year). This was if you picked the option of a higher deductible ($2,500).

The company gives discounts on your policy for alarm and detection systems, for auto pay and/or online. There are discounts for being free of claims, and for loyalty and the presence of more than one policy. For example, if you have both home and auto insurance with Amica the discount is 15%. Owning a newly built home also results in discounts on premiums.

The reviews for Amica Home Insurance company are nothing short of glowing. It ranked #1 on J.D. Power's 2016 Homeowners Insurance Survey with a 5 star rating. Although clients do not get to work through an agent, customer service reviews are positive. Customers appreciate being able to get information or file claims 24/7. Once you submit a claim reviews indicate they handle them promptly with the goal of fixing damages quickly. Their wide range of policies and discounts are also great.

Negative reviews include criticism that Amica is choosy with who they decide to cover. They exclude customers who they consider risky and only insure low-risk clients. Their home insurance doesn't include coverage for farms, mobile homes or older homes with no renovations.

Amica Auto Insurance company provides full coverage for vehicles, passengers, and liability. Personal injury protection is included. Coverage includes roadside assistance services, glass coverage (with no deductible for repair. They do not charge a deductible for lock replacement or replacement of a deployed airbag.

If you write off a car within a year of its purchase they'll replace at the full retail value.

Under the premium plan, over time you earn points for good driving that can go towards accident forgiveness. They lower insurance costs associated with an accident based on your good driving record. This includes waiving the surcharge for a car accident, or paying your deductible down or off.

Amica does not provide an auto insurance product that covers Ride Sharing (e.g. for Uber drivers).

Amica's online claim center provides an information-rich site. A customer can submit a claim and receive advice and get answers to important questions. It includes a link to access assistance around repairs if you need to a referral. It provides a link to roadside assistance services.

As with all policies the options you choose and the value of your insured vehicles determines the price. The higher the deductible you choose the lower the premiums you pay. Compared to the industry average, Amica's premiums are cheaper for most customers. However, they are not the cheapest. There is a 25% discount for multiple cars, and a 15% discount if you bundle auto with home.

The reviews for Amica Auto insurance are very positive. The price is good. After shopping around reviewers found they could save significant money by bundling their auto and other insurance policies with Amica). The customer service receives high ratings. You have the option to pay a little more up front and earn a dividend that saves you money. Some reviews like to the choosiness of Amica. Their refusal to insure anyone other than the lowest risk customers results in low premiums.

There are also some negative online reviews for Amica Auto insurance. Some comments indicated poor customer service experiences. Some didn't like unexpected rate increases. Shoddy handling of claims was another complaint. Some received a quote that was not honored later because they didn't accept it right away.

Amica's Life insurance options include Term Life and Whole Life insurance. You purchase Term Life insurance for a fixed period of time (10 years, 15 years, 20 years, etc.). Premiums and coverage stay the same over the span of the policy. You can choose the level of coverage you want (e.g. $1 million) and they calculate your payments. Whole Life insurance is a permanent policy that maintains the same premiums throughout your entire life. It builds cash value that you can withdraw or borrow from. A level benefit is available upon death.

Amica's Life insurance rates are good. An example they offer sites Term Life insurance for as low as $9.84 per month.

The reviews for Amica Life insurance are positive. For example on one review site, the average reviews were four out of five stars. Some reviewers said the customer service was the most positive aspect of their experience. Several reviews mention that they would recommend this product to their friends and relatives.

Amica Overall

Amica also provides Health insurance (including Employee Health insurance), and Disability insurance. They also provide long term care and retirement products. The reviews for their health insurance are positive. One says you can reduce health insurance premiums by using Amica's Wellness Checkup tool.

A customer gets a discount when they go claims free, for loyalty, when a policy includes multiple vehicles. You also get a discount for multiple policies. Discounts are occurring when you choose auto pay, paperless and pay in full payment options.

In terms of Amica's strengths, the middle person is not at all essential to excellent customer service. Positive customer service reviews suggest direct insurance is better than going through an agent. They have a very useful online claims tool. It lets you report a claim, track your claim, and access information, advice and roadside assistance. Their home repair assistance program lets you either pick your own contractor or get a referral. They have over 2,000 licensed contractors they can contact in an emergency situation. If you would prefer they will work directly with the contractors so you don't have to do anything. Finally, their dividends program is hard to beat. When the company does well everyone reaps the benefits in the form of lower bottom lines.

In terms of Amica's weaknesses, there is not a lot of flexibility in terms of payment options. Other than the option to pay in full for a discount there are no other formats. Reviews where they had a reasonable rate only to have them go up (sometimes double!) the next year is definitely a concern. And if you're a high-risk customer it sounds like you might not want to waste your time.

Amica's Personal Umbrella Insurance policy offers extra liability coverage that further protects your assets from financial loss. This includes legal costs. Amica offers a full range of umbrella coverage levels, starting at one million dollars.

There are three options for reporting a claim. First, there is an online reporting system. Second, you can contact 1-800-24-AMICA (800-242-6422) and choose the option to report a claim. Third, there is a mobile app that you can use to report your claim. All three reporting channels are open 24 hours a day.

The online, mobile app and telephone options are also used to report accidents or damage.

The most common complaint about Amica is when customers see increases in their premiums over time. The quote they get first brings them into the company, and then the next year they find that they jack up their premiums. For some this feels like a "bait and switch" tactic. The other complaint is that they do not insure cases where there is any risk involved.

As far as canceling your Amica insurance, you can cancel your policy at any time.

FAQS

Q: Do products/services offered by Amica differ from state to state?

A: They do since different states have different insurance rules. So in some states they may offer a coverage that is not offered in other states. The same goes for discounts. It just depends in which state the product/service is purchased.

Q: How much does Amica insurance go up after an accident and/or speeding ticket?

A: It just depends on the type of speeding ticket, how many miles you went over etc. Most states use a points system. For instance, in an accident with a $1,501 -$2,500 pay out for property damage, it would count as the ½ point. An accident that results in bodily injury or death and with a payout in excess of $2,500 would be 1 point.

Q: What does comprehensive insurance cover with Amica?

A: Acts of nature including fire, flood, theft, contact with animals, flying objects and glass repair

Q: Does my Amica insurance cover a rental car?

A: If you have full coverage and rent a car in the USA you don't need to purchase more coverage.

Q: Does my Amica car insurance cover me in Canada or anywhere outside the USA?

A: If you have an auto policy with Amica with full coverage. That includes liability, uninsured motorist, collision and anything other than collision coverage. That coverage would extend to any vehicles you rent within the US, its territories and Canada.

Q: Does Amica insurance use credit scores?

A: They do use credit scores in most states to determine your insurance bureau score. It will not affect your credit however as it shows up as a soft inquiry.

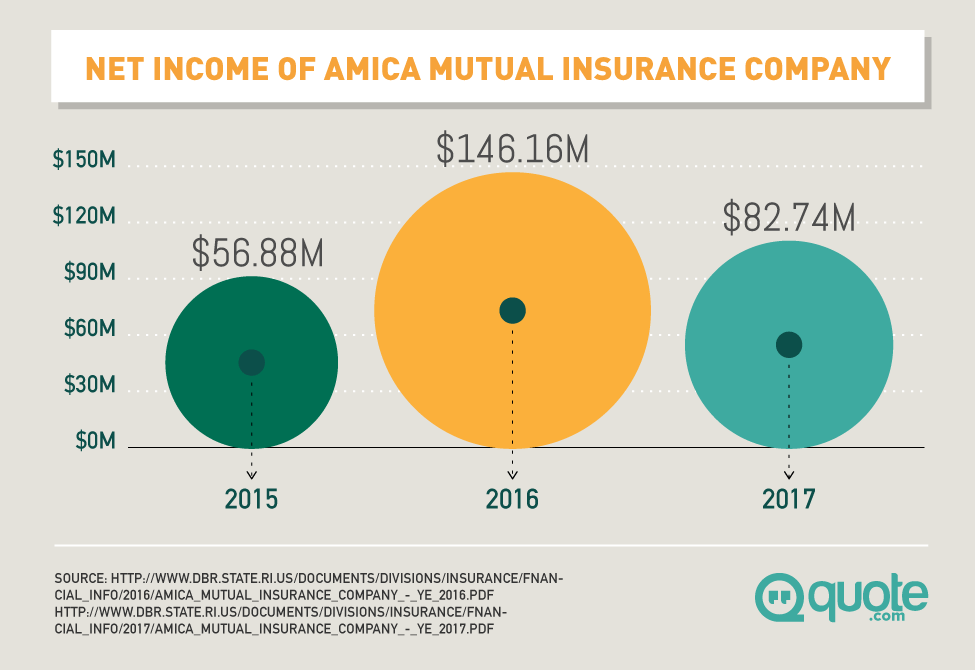

Q: What are Amica's financial strengths?

A: Amica is worth more than $5 billion in terms of its assets. It reports an annual surplus of over $2 billion. Rather than this profit going to share holders, it is goes back to policy holders.

Q: How long does it take for Amica insurance to pay for a claim?

A: They state that their goal is to pay claims within 24 hours. In emergencies, they can even transfer funds to your local bank online.

Q: Does Amica insurance have gap coverage?

A: In most states. However the vehicle would have had to be purchased within the last 30 days.

Q: Does Amica insurance have roadside assistance?

A: Towing and labour coverage includes roadside assistance. This covers the cost of roadside repairs and/or towing.

Q: What does my rental insurance with Amica cover?

A: Amica covers costs of renting a car in the case of an accident. Auto insurance also covers cars rented by the policy holder. There is also coverage for people who live in rental arrangements that protect their personal property.

Q: What are the deductibles on Amica insurance?

A: That depends on what you chose. The most common range between $500 and $1,000. However, some people have higher and other people have lower deductibles. It just depends on what you are OK with. In general the higher your deductible the lower the costs.

Q: Will adding a teenager to my policy will increase the cost?

A: Yes, your cost would increase by adding another driver.

Q: Will my rate go down if I make my payments on time?

A: Making payments on time will not count against your rates.

Q: Should I opt for automatic payments and renewal or shop around after my policy is done?

A: Several reviews have indicated that their premiums went up in their second year. So it's a good idea to find out about your next year's premiums and compare. Don't forget dividends you will receive when making your choice.

Q: Does Amica cover third party liability?

A: Yes.For example auto coverage includes damage done by a driver with no insurance.

Q: Can I add up my family member's car to my insurance plan?

A: If that family member resides in the same household as you, you can.

Q: Can I get my car repaired by my own mechanic or are there specific repair shops I should get my car fixed from?

A: You may choose your own contractor or facility, and present the estimate to Amica. Or a claim adjuster can suggest a facility through Amica's Repair Assistance Program.

Q: What happens when I pay throughout the year without filing any claims?

A: This ideal scenario would not affect your rates.

Q: What are the dividend policies offered by Amica?

A: In most states, Amica offers a dividend policy. This results in a lower total insurance cost for those who choose this option. They get to subtract their annual Amica dividend payment from the cost of their premium. A dividend insurance policy costs more because you have to pay up-front. But they invest that money over the course of the policy term. At the end, they give you a dividend which reduces the overall cost of the policy. Dividends cannot be guaranteed and can fluctuate from year to year. Nondividend policy holders enjoy lower payments.

The Verdict

Amica has proven that you do not need an Insurance Agent to experience top notch customer service. The phone and online channels for purchasing, reporting and claiming means that you get support when you need it. It's in your advantage to bundling your services. This helps with the fair price of their products.

Amica's track record for denying coverage for higher risk clients could be seen as good or bad. If you get approved for coverage it works in your favor that the company takes on less risk/loss.

But what's probably most impressive is that as a mutual company, Amica's profits go to the policy holders. This reduces the cost. An insurance company operating for the benefit of its customers is a super idea. The mutual insurance company stands in stark contrast to the typical insurance company model. Amica wins our trust on this level – if you're thinking of going with them remember who they benefit!